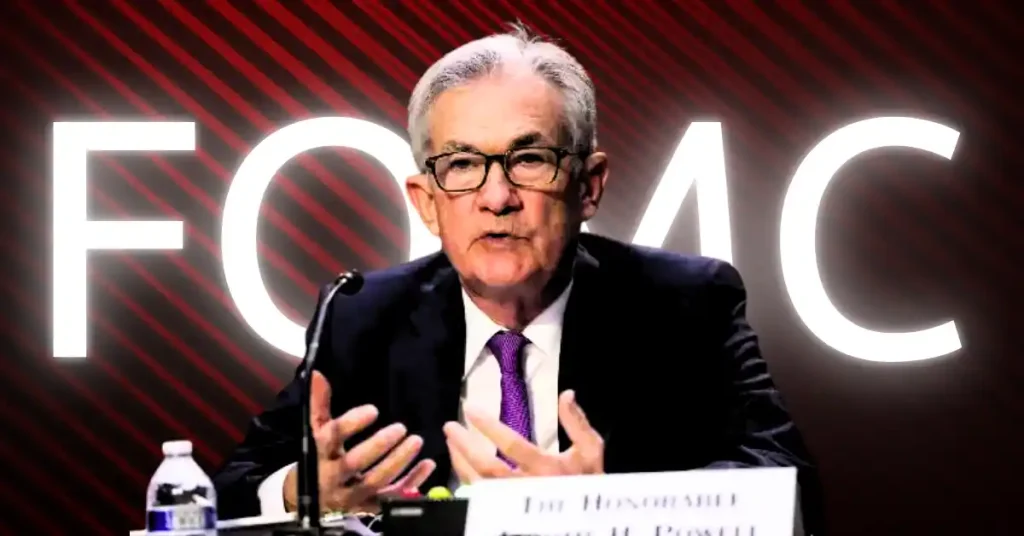

FOMC Decision in Focus as Investors Brace for Policy Shift

The post FOMC Decision in Focus as Investors Brace for Policy Shift appeared first on Coinpedia Fintech News

Bitcoin is trading near $90,549 as investors grow confident that the Federal Reserve will cut interest rates at the upcoming FOMC Meeting Date and Time. Market-based predictions continue to strengthen, with Polymarket placing the odds of a 25-basis-point cut at 94%, while the CME FedWatch Tool indicates an 87.4% probability ahead of the FOMC rate decision date.

Supporting this expectation, Standard Chartered has joined JPMorgan, Morgan Stanley, and Nomura in forecasting a rate cut, following weeks of mixed U.S. economic signals.

Major Banks Align Ahead of the FOMC Decision

According to Reuters, Standard Chartered revised its outlook after reviewing recent economic data that remains unclear, partly influenced by disruptions caused by the U.S. government shutdown. The bank believes a modest “insurance cut” could help manage slowing growth. While confidence is measured, Standard Chartered sees a rate cut as slightly more likely than a pause at the upcoming FOMC Decision.

With this shift, Standard Chartered aligns with JPMorgan, Morgan Stanley, and Nomura, creating a strong consensus among major financial institutions ahead of the FOMC rate decision date.

Nomura expects a narrow vote. The firm notes that some Fed officials may resist a rate cut, while at least one policymaker could support a larger 50-basis-point reduction. Looking further ahead, Nomura also projects additional rate cuts in 2026 if leadership at the Federal Reserve changes. Kevin Hassett, a senior economic adviser, is considered a leading candidate should a new Fed chair be appointed.

- Also Read :

- [Live] Crypto Market News Today: Latest Updates on December 9, 2025

- ,

FOMC Meeting Date and Time: What Markets Are Watching

Investors are closely monitoring the FOMC Meeting on December 9–10, when the Federal Reserve is expected to announce its latest FOMC Decision. A 25-basis-point cut could influence risk assets, including Bitcoin and Ethereum, as traders position for a shift in monetary policy.

What Does the FOMC Decision Mean for Crypto Investors?

If approved, this move would mark the third rate cut of 2025. Market participants are focused not only on the outcome but also on signals for the policy path beyond the current FOMC rate decision date. Fed officials are expected to avoid firm guidance and keep future actions data-dependent.

Crypto analysts say the Federal Reserve’s softer policy tone has already eased financial conditions. The Fed ended quantitative tightening earlier this month and recently injected $13.5 billion in liquidity through overnight repo operations. Analyst André Chalegre notes that these conditions often support institutional interest in Bitcoin, though the impact of rate cuts on prices is not always immediate.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

The next FOMC meeting is scheduled for December 9-10, 2025, where the Federal Reserve will announce its latest interest rate decision.

Major banks and market tools indicate a high probability of a 25-basis-point rate cut at the upcoming December FOMC meeting, based on recent economic signals.

A Fed rate cut typically eases financial conditions, which can boost institutional interest in risk assets like Bitcoin, though the price impact isn’t always immediate.

Current market predictions show very high odds, with some platforms indicating an 87-94% probability of a 25-basis-point cut at the December FOMC meeting.

You May Also Like

3 Paradoxes of Altcoin Season in September

Dogecoin Whale Wallets Add $300M in August — Meme Coin Frenzy Builds With MAGACOIN FINANCE Buzz