Is there Meat in the Quantum-Crypto Collision?

Over the years, quantum computing has become a recurrent theme within the crypto sector. One that has a negative connotation in its potential to break the cryptography that secures blockchain networks and digital wallets. In such a scenario, we would see total collapse of the crypto ecosystem, as stolen funds and broken consensus mechanisms would transform a trustless ecosystem into a zero-trust one.

By the same token, a true quantum computing breakthrough would invalidate our entire digital infrastructure, toppling its entire spectrum: from basic HTTPS/TLS web security and secure email via PGP to VPNs, SSH connections, banking and financial systems, cloud security and password managers.

In other words, a quantum computer system with the ability to crack crypto would have much wider ramifications. It could theoretically lead to an internet-wide privacy extinction event. With stakes so high, let’s examine if one should be concerned.

How Exactly Would Quantum Computing Annihilate Public-Key Cryptography?

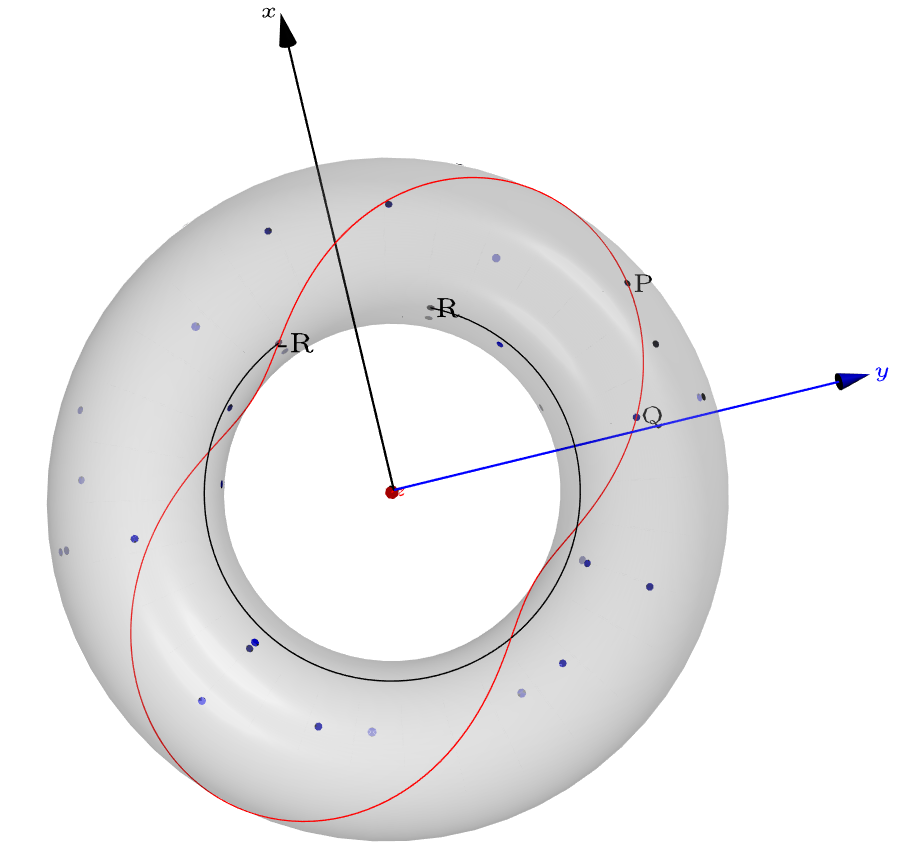

The entire blockchain ecosystem relies on ECC – Elliptic Curve Cryptography. Instead of using the difficulty of large numbers like RSA cryptography, ECC relies on the “hardness” of the Elliptic Curve Discrete Logarithm Problem (ECDLP).

It’s a lot to take in, but I’ll try break it down as simply as possible. The ECDLP is best understood as a mathematical journey:

- With the private key being a random 256-bit integer, the public key (Pa) is generated by multiplying the base point (G) of the curve by the private key (Na), delivering Pa = Na ⋅ G as a one-way function.

- The public key (Pa) is obviously made public as the resulting point on the curve, from the scalar multiplication of the base point G by the 256-bit integer – private key (Na). Likewise, the G is a publicly known point on the elliptic curve.

While it is easy to calculate the public key as Pa = Na ⋅ G, by repeatedly adding the base point G to itself Na times (called scalar multiplication) it is computationally unfeasible to find the 256-bit private key Na. That’s because elliptic curves are defined over finite fields, in which there is no predictable pattern.

Elliptic curve over finite fields visualized. Image credit: kelalaka153 via GitHub

Elliptic curve over finite fields visualized. Image credit: kelalaka153 via GitHub

In other words, there is no clear way to reverse the mathematical equation to crack the private key.

Therefore, the journey forward – calculating the public key from the private key is straightforward, while the journey backward is astronomically difficult.

A would-be attacker is forced to try a massive number of possibilities in an exponential search, which is virtually impossible with the existing computing power of classic computers.

This one-way journey is impervious to all classical computers, but it has a fatal theoretical weakness as it belongs to a class of problems that Shor’s Algorithm can solve.

Shor’s algorithm doesn’t just brute-force the private key, but cleverly transforms the problem of finding the private key into a problem of finding the ‘period’ of a related function.

Using Quantum Fourier Transform (QFT), a quantum computer could execute this period-finding step with exponential speedup. The time needed to reverse the equation and break the private key could be reduced from billions of years to hours or days.

Therefore, the arrival of large-scale quantum computers would annihilate the security of ECC and the systems that depend on it, which is the entire blockchain ecosystem.

Extraordinary Requirements for Quantum Computing to Perform

It is still unclear if it is possible to achieve the monumental task of delivering a large-scale fault-tolerant computer. What does that mean exactly?

Unlike digital bits in classic computing, quantum computing relies on qubits – quantum bits. Qubits possess the ability to exponentially expand computational space as they process information in a manner that almost defies the laws of physics.

Unlike a standard computer bit that is limited to being either a zero or a one, a qubit can exist as both simultaneously, much like a spinning coin is technically both heads and tails at once. This unique ability allows a group of qubits to hold every possible combination of data at the same time. So, when a quantum computer performs an action, it isn’t just solving one problem linearly. It is effectively running calculations on every possible outcome simultaneously.

This is the core of the quantum computing hype. However, the same quantum phenomena that give qubits this advantage, also makes them extraordinarily fragile. Even the slightest disturbance can turn quantum computing into illegible noise.

Solving this is no simple feat.

Several scientists studying how to stabilise qubits have already been demoralised. Case in point, physicist Nikita Gourianov from Oxford University wrote an article for Financial Times in late August 2022, noting that:

“The current devices are so error-prone that any information one tries to process with them will almost instantly degenerate into noise. The problem only grows worse if the computer is scaled up (ie, the number of “qubits” increased).”

The implication is that common figures we hear about quantum computers, such as Caltech’s 6100-qubit array, as the latest record, are far from meaningful for practical use. Another implication is that these figures are then used to funnel VC money, keeping these efforts and companies afloat.

The Present State of the Quantum Roadmap

Van Eck’s quantum computing exchange traded fund (ETF) – UCITS – gained 19% value over the last 6 months and now comprises ~$437 million worth of funds. This may give the impression that investors are gaining exposure to the rise of the sector as early adopters. However, it is fair to say that the field itself is still in the beginning of the beginning stage.

“Trying to hold an atom while moving is like trying to not let the glass of water tip over. Trying to also keep the atom in a state of superposition is like being careful to not run so fast that water splashes over,”

Hannah Manetsch, Caltech graduate as one of the contributors in trapping 6,100 neutral-atom qubits.

Given that both quantity and quality of qubits is paramount to achieve viable fault-tolerant systems, it is safe to say that the QEC milestone is yet to be reached. And it appears that the neutral-atom approach is one of the more fruitful ways in that direction.

The leader in the field, IBM, set 2026 as the year in which a computer would demonstrate quantum advantage over classic computing, while 2029 is set for the first fault-tolerant system with 200 logical qubits. This should not be understood as the finish line but more of a technical milestone for error correction.

A theoretical requirement to break ECC-256 is estimated within the 2,000 – 2,500 logical qubits range. Again, this means that even 2029 would mark the beginning of the beginning, as IBM’s system would be 10x removed from the baseline requirement.

Beyond 2033, however, when IBM deploys Blue Jay with around 2,000 logical qubits, is the timeline where standard ECC-256 encryption could enter the danger zone.

Vitalik Buterin, the co-founder of Ethereum (ETH), noted at the recent Devconnect conference in Buenos Aires that “Elliptic curves are going to die” due to the quantum computing threat. He reasons that the danger zone could be four years away.

Even in that scenario, there are multiple ways in which blockchains can become quantum-resistant, whether it is lattice-based CRYSTALS-Dilithium algorithm, hash-based SPHINCS+ or code-based FALCON.

You don’t need to know exactly how these work – just that it appears that lattice-based algorithms have the most traction, while hash-based ones are the “nuclear option” given they would drastically slow down blockchain networks.

The Bottom Line

There is no doubt that quantum computing advances have been made. Yet, the quantum uncertainty is so great, no pun intended, that it is unclear if stable qubits are feasible on a meaningful, blockchain-threatening scale.

At the same time, it is possible that some lab somewhere will deliver a new physical approach to solving the quantum computing conundrum. But even in that ideal scenario, the breakthrough would be apparent, and the scaling would still take years.

Consequently, the “quantum apocalypse” is unlikely to manifest as a sudden, overnight crash, but rather as a decade-long migration phase. During extended periods of technological uncertainty, some investors reassess where they seek returns, often revisiting core financial ideas such as yield vs return, especially when evaluating the risk-adjusted appeal of traditional assets versus crypto.

The blockchain sector actually holds a distinct survival advantage over the traditional banking sector – agility.

While TradFi relies on codebases that are already decades old and difficult to patch, blockchain networks operate on consensus mechanisms capable of hard forks. This allows networks such as Ethereum or Bitcoin to upgrade their cryptographic schemes relatively quickly once a threat becomes tangible.

In the end, the blockchain ecosystem is likely to remain trustless, with or without unpredictable quantum computing milestones.

The post Is there Meat in the Quantum-Crypto Collision? appeared first on Crypto News Australia.

You May Also Like

Obscura Brings Bulletproofs++ to the Beldex Mainnet for Sustainable Scaling

Ondas Holdings (ONDS) Stock: Why Analysts Just Raised Their Price Target to $12