Pyth DAO to Convert Revenue Into PYTH Reserves

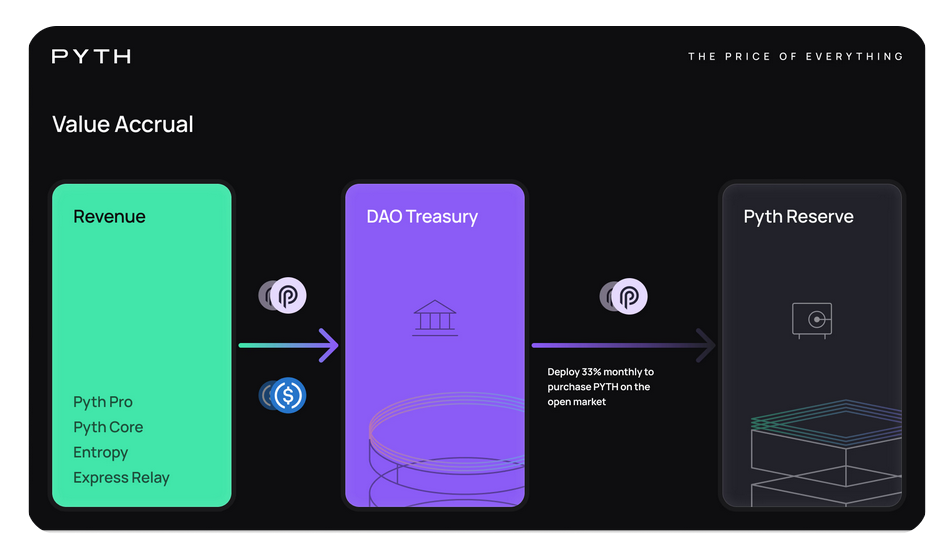

The Pyth Network announced a new reserve strategy. The protocol will convert one-third of its revenue into open-market PYTH token purchases.

The Pyth Network, a blockchain oracle provider, has unveiled a new reserve strategy. The decentralized autonomous organization (DAO) will convert a portion of the protocol’s revenue into PYTH token purchases.

Pyth said the tokens it purchases in open market would form the new reserve of the network. One third of the revenue generated by the protocol will be used for these systematic purchases. The goal of the network is to scale at a globally scale. The tactic is overtly aimed at raising revenue and thus purchases of tokens.

New PYTH Reserve Links Adoption to Network Value

The introduction of the PYTH Reserve is a mechanism of structure. It turns the protocol revenue into systematic purchases of PYTH tokens. This directly links the adoption of the product to network value. Pyth emphasized that it has achieved product-market fit. Therefore, the network will now recycle value back into the ecosystem.

Related Reading: Pyth Partners with Revolut to Integrate Digital Banking Data into DeFi | Live Bitcoin News

The PYTH DAO Treasury receives a fraction of the protocol’s revenue. It invests these funds into purchasing PYTH tokens on the open market monthly. This allows transparent mathematical control of the relationship between use and long-term value for the network. More usage means more revenue and more revenue means more tokens purchased.

Source: Pyth Network

Source: Pyth Network

First, the DAO announced the initiative on December 12, 2025, confirming monthly treasury buybacks. Moreover, the strategy aims to create consistent and predictable token demand. Meanwhile, the network will scale buybacks alongside revenue growth. Initially, the first month’s buybacks are estimated between $100,000 and $200,000.

Pyth Expands Oracle Revenue Through Institutional Subscriptions

The Pyth Network earns revenue from a number of products and services. These include its standard Pyth Core price feeds on over 100 blockchains. It also includes Pyth Entropy, a random number generation service.

One of the important causes of revenue increase is Pyth Pro. This is a new institutional subscription product. In its first month, Pyth Pro is on its way to achieving an annualized recurring revenue (ARR) of $1M. This proves that the financial institutions are willing to pay for Pyth data.

The network is looking for ambitious growth. It hopes to capture just 1% of an estimated $50 billion market for institutional financial data every year. This would amount to $500 million of revenue per year. As a result of this, there would be significant growth for the PYTH Reserve.

The total supply of PYTH token is 10 billion tokens. Its current circulating quota is about 5.75 billion. The tokens that are not in circulation are subject to a structured cliff vesting schedule. This schedule extends into 2027. This structure fosters long-term commitment on the part of participants. Token holders are involved in the Pyth DAO. They vote on important network parameters such as fees and asset coverage.

The post Pyth DAO to Convert Revenue Into PYTH Reserves appeared first on Live Bitcoin News.

You May Also Like

‘Bitcoin Rodney’ faces decades in prison as feds add wire fraud to HyperFund charges

Is the Bittensor (TAO) Price Reset Complete? This Level Could Decide the Next 5x