Urgent: US Senator Demands PancakeSwap Investigation Over Trump Ties and Price Manipulation

BitcoinWorld

Urgent: US Senator Demands PancakeSwap Investigation Over Trump Ties and Price Manipulation

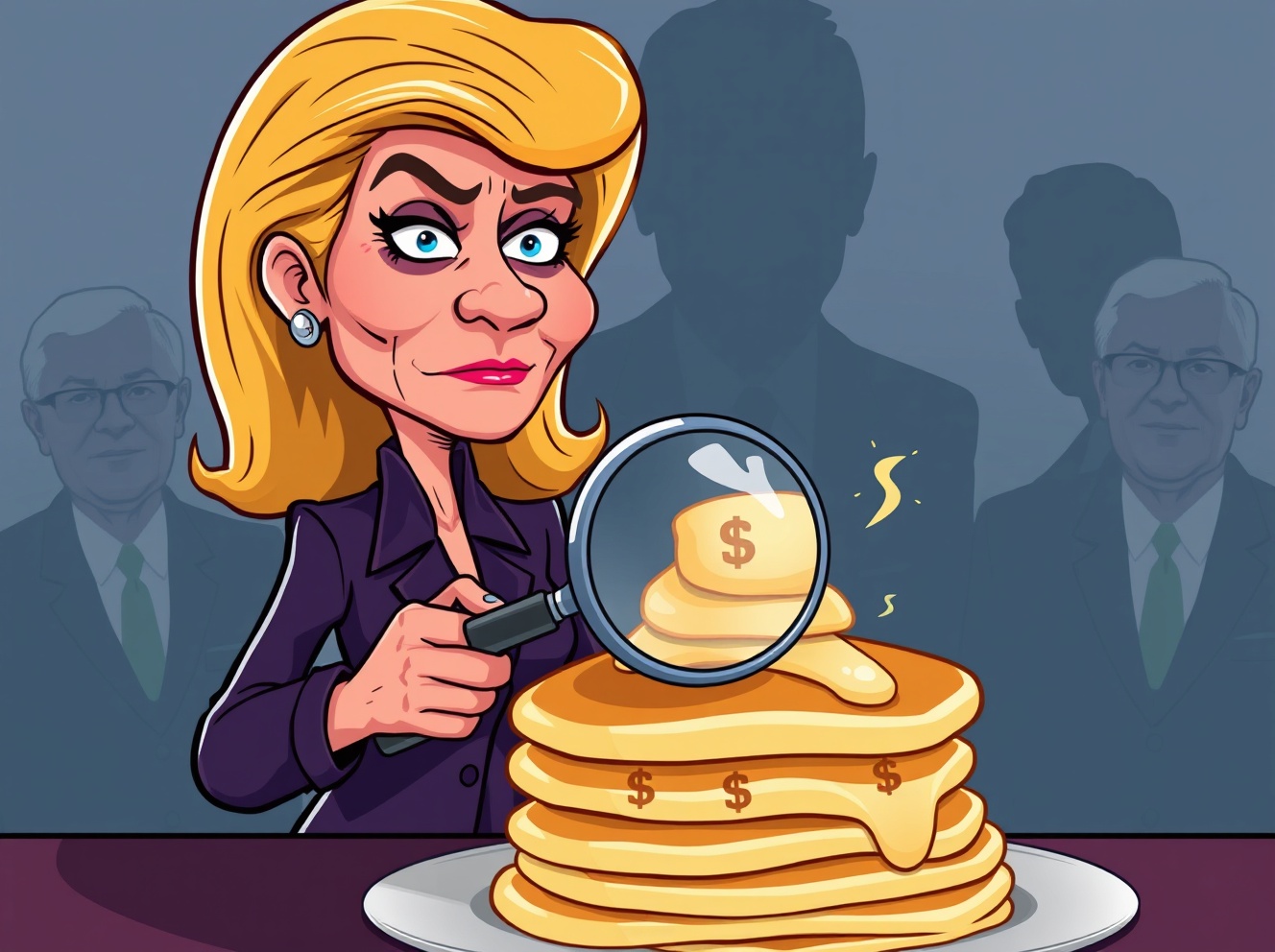

In a dramatic move that signals escalating regulatory pressure on decentralized finance, U.S. Senator Elizabeth Warren has formally demanded a federal PancakeSwap investigation. The prominent crypto critic alleges the platform may be involved in a scheme to artificially inflate a token’s price and could have improper connections to the Trump administration. This call to action targets one of the world’s largest decentralized exchanges, raising crucial questions about the future of DeFi regulation.

Why is Senator Warren Calling for a PancakeSwap Investigation?

Senator Warren’s concerns center on two explosive allegations. First, she points to potential market manipulation involving World Liberty Financial (WLFI) tokens traded on the platform. Second, and more provocatively, her letter to the Treasury and Justice Departments questions whether PancakeSwap has benefited from political influence tied to the previous administration. This dual-pronged attack combines classic financial oversight with a politically charged narrative, ensuring the investigation demand captures headlines.

Her letter, reported by CoinDesk, argues that authorities must scrutinize these allegations thoroughly. Warren emphasizes that DeFi platforms like PancakeSwap process immense volumes—hundreds of millions daily—without standard identity checks (Know Your Customer or KYC protocols). This lack of oversight, she contends, creates a dangerous environment where illicit activity can flourish undetected.

What Are the Core Allegations Against the DeFi Giant?

To understand the gravity of the situation, let’s break down the specific claims prompting the PancakeSwap investigation.

- Price Inflation Scheme: The primary allegation involves World Liberty Financial (WLFI). Warren suggests the token’s value may have been artificially pumped, a classic manipulation tactic that harms ordinary investors.

- Political Influence: The letter raises the possibility of a connection to “improper political influence from the Trump administration.” While details are scarce, this implies regulators should examine if the platform received favorable treatment.

- Regulatory Evasion: Warren criticizes the fundamental design of many DeFi platforms, which operate without collecting user identities, calling it a major loophole for bad actors.

This is not an isolated incident. Therefore, it reflects a broader, intensifying crackdown on the cryptocurrency sector by U.S. lawmakers concerned about consumer protection and financial stability.

How Does This Impact the Future of Decentralized Finance?

The call for a PancakeSwap investigation is a potential watershed moment. A major federal probe into a top DeFi protocol could set powerful precedents. For users and developers, the implications are significant.

Potential Outcomes:

- Stricter KYC Rules: Platforms may be forced to implement identity verification, challenging DeFi’s core principle of permissionless access.

- Legal Precedent: How U.S. law applies to decentralized, globally operated protocols remains unclear. An investigation could help define these boundaries.

- Market Volatility: Regulatory uncertainty often spooks investors, potentially leading to short-term price swings across the DeFi ecosystem.

While Senator Warren frames this as necessary consumer protection, many in the crypto community see it as an attack on financial innovation and privacy. The tension between these viewpoints will likely define the regulatory battle ahead.

What Can Crypto Investors Learn From This Situation?

This development serves as a stark reminder of the regulatory risks inherent in cryptocurrency investing. Platforms operating in legal gray areas face existential threats from government action. For anyone using PancakeSwap or similar services, due diligence is more critical than ever.

Actionable Insights:

- Research Platform Compliance: Prefer platforms that proactively engage with regulators and implement robust compliance measures.

- Diversify Holdings: Avoid over-concentration in assets or platforms under specific regulatory scrutiny.

- Stay Informed: Follow regulatory news closely. Political and legal developments can impact asset values as powerfully as market trends.

The path forward is fraught with challenge. However, clear regulation could also provide the legitimacy needed for mass adoption. The coming months will reveal whether the PancakeSwap investigation becomes a case study in overreach or a necessary step toward a safer digital asset market.

Conclusion: A Defining Moment for DeFi Regulation

Senator Elizabeth Warren’s demand for a PancakeSwap investigation is a powerful escalation in the clash between decentralized finance and traditional regulatory frameworks. It highlights the growing political will to bring the “wild west” of crypto under control. Whether the allegations hold merit is for investigators to determine. Nevertheless, the message to the entire industry is clear: operate in the shadows at your own peril. The era of unchecked DeFi growth is facing its most formidable investigation yet.

Frequently Asked Questions (FAQs)

Q1: What exactly is PancakeSwap?

A1: PancakeSwap is a leading decentralized exchange (DEX) built on the Binance Smart Chain. It allows users to trade cryptocurrencies directly with one another without a central intermediary, using automated liquidity pools.

Q2: Why is Senator Warren targeting PancakeSwap specifically?

A2: Warren’s letter cites allegations of a specific price manipulation scheme involving a WLFI token on the platform and raises questions about potential political ties. As a major DEX, it also represents a high-profile target in her broader campaign for stricter crypto regulation.

Q3: Has PancakeSwap responded to these allegations?

A3: As of the writing of this article based on the initial report, there has been no public statement from PancakeSwap’s anonymous development team regarding Senator Warren’s specific call for an investigation.

Q4: What could happen if a federal investigation is launched?

A4: Potential outcomes include fines, mandated changes to how the platform operates (like adding KYC checks), or even restrictions on U.S. users accessing the service. It could also establish important legal precedents for all DeFi protocols.

Q5: Should I stop using PancakeSwap?

A5: This is not financial advice. However, all crypto investors should be aware of the increased regulatory risk associated with platforms under political and legal scrutiny. It’s wise to assess your own risk tolerance and consider diversifying across different protocols and services.

Q6: Does this affect other DeFi platforms like Uniswap?

A6: While the direct call is for a PancakeSwap investigation, the regulatory principles Senator Warren is advocating—especially regarding KYC and anti-money laundering—would apply to the entire decentralized finance sector if enacted into law.

Call to Action: Did this article help you understand the high-stakes regulatory clash unfolding in DeFi? Share this critical analysis on your social media to keep your network informed about the forces shaping the future of cryptocurrency. The conversation about regulation affects every investor.

To learn more about the latest cryptocurrency regulatory trends, explore our article on key developments shaping DeFi and its ongoing confrontation with global authorities.

This post Urgent: US Senator Demands PancakeSwap Investigation Over Trump Ties and Price Manipulation first appeared on BitcoinWorld.

You May Also Like

Crypto ETF Floodgates Open With SEC Listing Standards. What Does It Mean For Prices?

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement