Bitcoin Price Pumps Above $90,000 Then Dumps to $85,000 in 4 Hours

Bitcoin Magazine

Bitcoin Price Pumps Above $90,000 Then Dumps to $85,000 in 4 Hours

The bitcoin price (BTC) briefly surged above $90,000 early Wednesday in U.S. trading, only to tumble back below $87,000 within minutes, reflecting a fragile and volatile crypto market.

The largest cryptocurrency rallied from roughly $87,000 to above $90,000 around 10:00 a.m EST before rapidly retracing to the $86,500–$87,500 range.

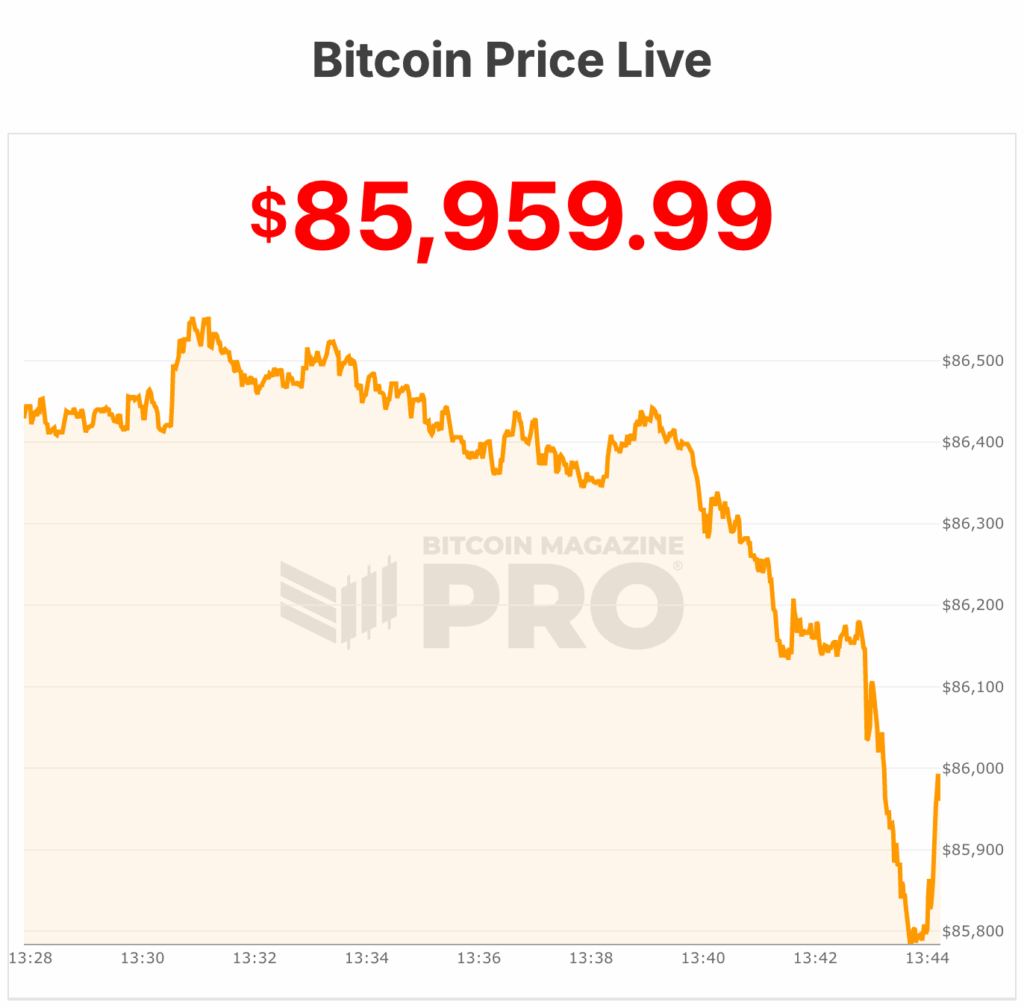

At the time of writing, Bitcoin price was near $86,000, down over 0.5% over the past 24 hours despite having been higher by more than 3% minutes earlier.

The swift swings triggered more than $190 million in liquidations across crypto derivatives markets, hitting both long positions — bets on rising prices — worth $72 million, and short positions — bets on declines — totaling $121 million, according to CoinGlass data.

Bitcoin price support during an ‘exhausted market’

Market observers point to the sharp losses in AI-focused technology stocks as a primary factor behind Bitcoin’s erratic moves. Shares of Nvidia, Broadcom, and Oracle dropped between 3% and 6%, dragging the Nasdaq down more than 1% in early trading.

Contributing to the deflation in AI sentiment, Blue Owl Capital reportedly withdrew from funding a $10 billion Oracle data center project in Michigan, unsettling traders who had leaned on tech optimism to fuel risk appetite.

“I think we’re now seeing an exhausted market,” Hunter Rogers, co-founder of bitcoin yield protocol TeraHash wrote to Coindesk. “In that environment, even mild selling activity pushes the market lower.”

Shrinking liquidity, particularly over weekend trading periods, amplifies these moves, leaving the bitcoin price vulnerable to sharp whipsaws with limited buy-side support.

Bitcoin price downsides

Technical analysts are closely watching the $80,000–$85,000 range as critical support. Holding this zone could prevent deeper retracement, while a sustained break below it may open the door to further declines.

Short-term caution, however, remains prevalent. Georgii Verbitskii, founder of crypto investment platform TYMIO, warned to DLnews that a prolonged period of consolidation or correction is a likely scenario, with potential downside moves toward $60,000 or $70,000 possible if current levels fail to hold.

Mike McGlone, senior commodity strategist at Bloomberg Intelligence, has even suggested Bitcoin could drop as low as $10,000 in 2026, highlighting the divergence of expert opinions on the coming year.

Despite the near-term uncertainty, longer-term narratives remain largely intact. Institutional participation in Bitcoin continues to grow, supported by spot bitcoin ETFs and a more defined regulatory landscape.

Analysts at Bitwise recently released a report suggesting Bitcoin could break away from its historical four-year market cycle, potentially achieving new all-time highs in 2026 while exhibiting lower volatility and reduced correlation with equities.

The Bitwise report argues that Bitcoin’s historical four-year cycle, tied to halvings and marked by gains followed by pullbacks, may no longer hold. Analyst Matt Hougan noted that the traditional drivers — halving effects, interest rate swings, and leverage-driven booms — are weaker now.

He cited diminishing halving impact, expected lower interest rates in 2026, and reduced systemic leverage after October 2025’s record liquidations. Greater regulatory clarity is also seen as reducing the risk of major market crashes, potentially altering the cycle.

The firm also challenged the long-standing criticism that BTC is too volatile for mainstream investors.

According to Bitwise, BTC was less volatile than Nvidia stock throughout 2025, a comparison Hougan says underscores the asset’s ongoing maturation.

Data cited in the report shows bitcoin’s volatility has steadily declined over the past decade as its investor base has diversified and traditional investment vehicles like ETFs have expanded access.

Market in ‘extreme fear’

At the time of writing, the Bitcoin Fear and Greed Index sits at 16/100, signaling extreme fear among market participants. This reflects heightened investor anxiety, with many traders potentially overreacting to recent price movements.

Historically, readings in this range have often coincided with undervalued market conditions, suggesting a contrarian buying opportunity for those willing to navigate the emotional volatility.

Yesterday, the market sat near 11/100 despite a higher bitcoin price point. At the time of writing, the bitcoin price is trading below $86,000.

This post Bitcoin Price Pumps Above $90,000 Then Dumps to $85,000 in 4 Hours first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Marathon Digital BTC Transfers Highlight Miner Stress