Ethereum Price Surge Near $3K May Face Resistance Due to Growing ETF Outflows

Ethereum’s Price Decline and Market Sentiment Signal Caution Amid Rising Risk Aversion

Ethereum has experienced significant downward pressure over the past week, with the cryptocurrency falling to $2,800 on Wednesday and prompting liquidations of over $165 million in bullish futures positions. This decline coincides with broader market concerns, including increased risk aversion and weakening institutional interest, reflected by substantial outflows from US-listed Ethereum ETFs and declining activity on the Ethereum network.

Key Takeaways

- US-listed Ether ETFs experienced heavy outflows, indicating waning institutional demand amid declining network activity.

- Futures market metrics show reduced open interest and premiums, suggesting cautious investor positioning without yet turning bearish.

- Ethereum’s network activity and staking metrics have diminished, further dampening long-term optimism.

- Market focus is now on Thursday’s US Consumer Price Index (CPI) report, which could influence monetary policy and crypto sentiment.

Tickers mentioned: Ethereum

Sentiment: Bearish

Price impact: Negative, driven by declining institutional inflows and network activity.

Trading idea (Not Financial Advice): Hold — Caution is advised as market indicators point toward increased risk and potential further downside.

Market context: A broader risk-off environment and cautious investor sentiment are weighing on Ethereum’s recent performance, amid macroeconomic concerns and rising market volatility.

Market Overview

Ethereum’s price plummeted to $2,800 on Wednesday, amidst a wave of liquidations affecting over $165 million in futures contracts. The sharp 13% weekly decline was partly fueled by investors’ risk-off stance, as equity markets such as the Nasdaq index fell 1.8%. This broader market weakness has intensified fears of further downside for ether, especially with investors scrutinizing declining on-chain activity.

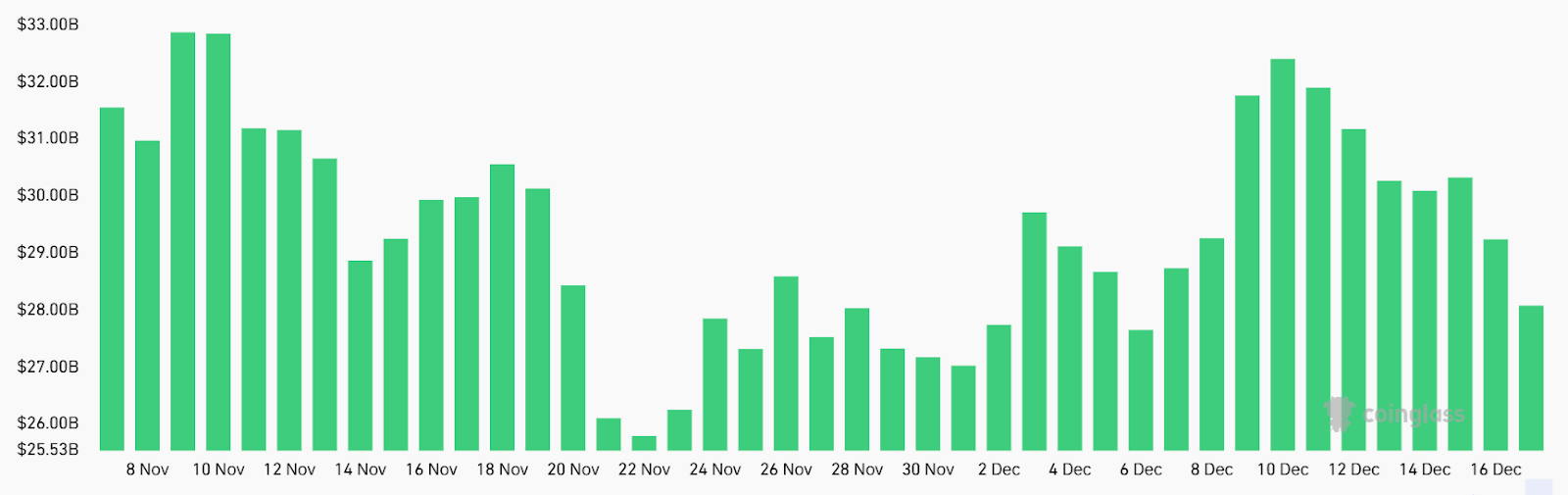

ETH/USD vs. Total Crypto Capitalization. Source: TradingViewThe declines extended to institutional investment products, with US-listed Ether ETFs recording over $533 million in net outflows since Thursday. These ETFs, which hold approximately $17.5 billion worth of ETH, traditionally signal institutional demand — but the recent exodus suggests a shift in investor interest. Meanwhile, demand for leveraged ETH futures has waned, with open interest dropping from a peak of about $32.4 billion to $28.1 billion across major exchanges.

ETH futures aggregate open interest. Source: CoinGlass

ETH futures aggregate open interest. Source: CoinGlass

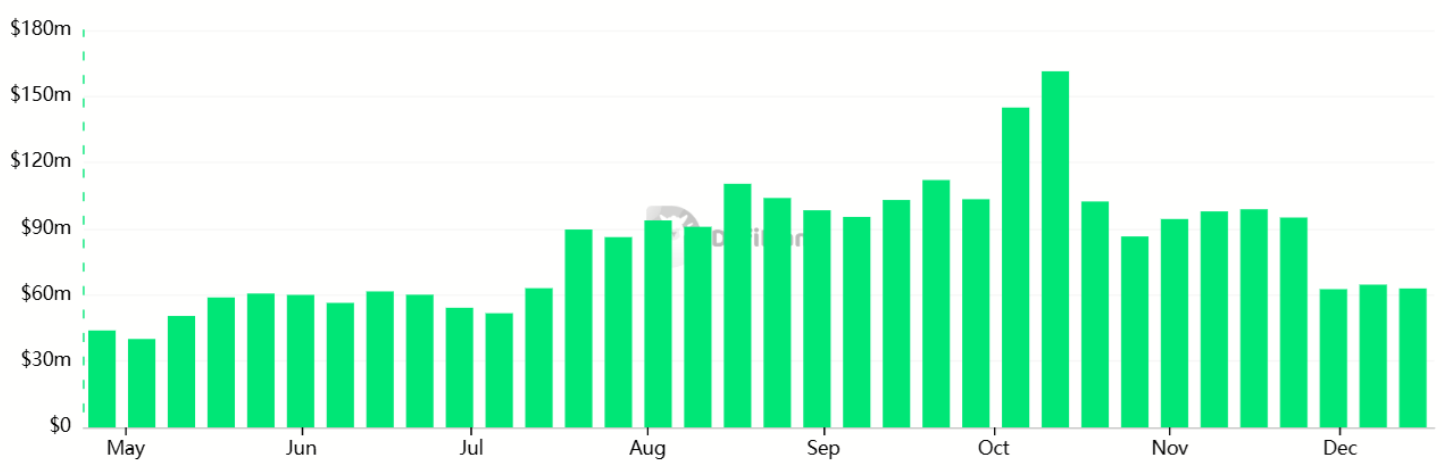

Market’s expectation of future price stability is reflected in the modest 3% premium in three-month futures, below the usual 5-10% range, indicating subdued bullish sentiment. On-chain activity further corroborates this cautious stance, with decentralized application (DApp) fees declining to $68 million over the past week, down from $98 million in recent weeks. Additionally, the total value of ETH staked on the network has subtly decreased, diminishing the long-term supply pressure that supports bullish cases.

Weekly Ethereum DApps fees. Source: DefiLlama

Weekly Ethereum DApps fees. Source: DefiLlama

Overall, the combination of ETF outflows, declining futures activity, reduced on-chain utilization, and increased macroeconomic uncertainty suggests that Ethereum faces headwinds in the near term. Investors will be closely watching the upcoming US CPI report, which could influence Federal Reserve policy and market risk appetite. Until then, caution remains advisable amid signs of weakening investor confidence in Ethereum’s recovery prospects.

This article was originally published as Ethereum Price Surge Near $3K May Face Resistance Due to Growing ETF Outflows on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

SEI Technical Analysis Feb 6