Will Bitcoin price rise or fall after the BoJ rate decision on Dec. 19?

The Bitcoin price has remained on edge this week as investors await the Bank of Japan’s interest rate decision scheduled for Dec. 19.

- Bitcoin price has pulled back this week as traders wait for the BoJ interest rate decision.

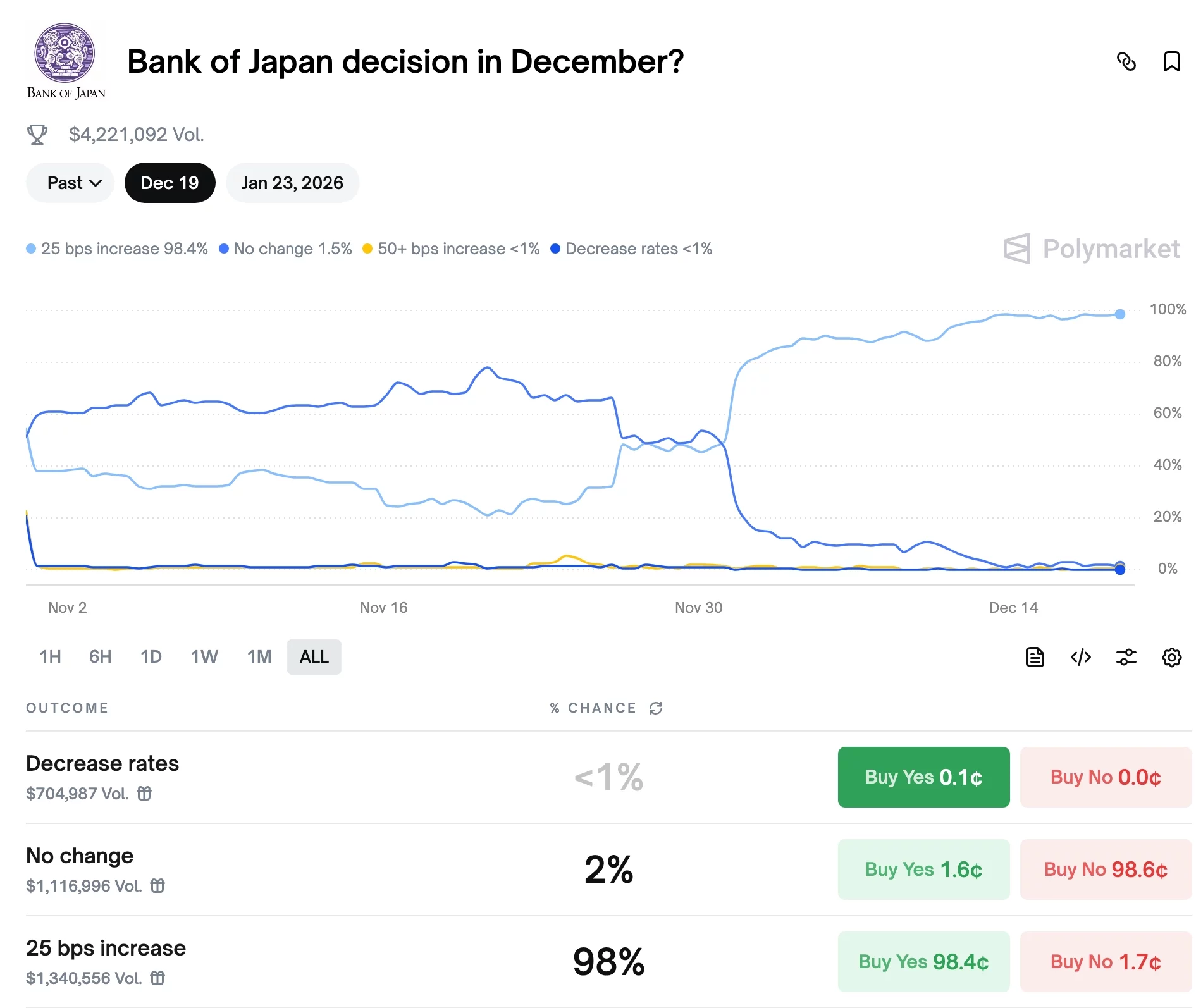

- Polymarket odds of a rate cut have jumped to 99%.

- Bitcoin has formed a bearish flag pattern on the daily chart.

Bitcoin (BTC) token was trading at $87,700 at press time. This price was about 7.47% below the highest point this month, and 30% below the all-time high.

Odds of BoJ interest rate hike are rising

Bitcoin, altcoins, and the stock market have pulled back in the past few days as odds of a BoJ rate hike have jumped. Polymarket assigns a 98% probability to a hike.

A BoJ rate hike is important given its size, as it is one of the largest central banks globally, with over $4.48 trillion in assets. It is also the biggest holder of US government bonds.

The risk of a BoJ hike at a time when the Fed is cutting rates is that it may now push investors to unwind their carry trades. A carry trade happens when an investor borrows from a low-interest-rate country and invests in higher-yielding assets.

Japan has been one of the biggest catalysts for a carry trade, as it maintained low interest rates for decades. As such, as the spread between U.S. and Japanese yields narrows, investors may sell the risky assets they bought.

However, the BoJ rate hike may not drive Bitcoin lower. With odds of a hike at 99%, it has now been priced in by market participants. As such, the coin may rebound as investors buy the news and embrace the new normal.

Bitcoin price technical analysis

The daily chart shows that the path of the least resistance for Bitcoin is bearish in the near term. It is slowly forming a bearish flag pattern. It has already completed the formation of the inverted flagpole and is now in the flag section.

Bitcoin remains below the Supertrend indicator and the 100-day Exponential Moving Average. It is also nearing the 78.6% Fibonacci Retracement level.

Therefore, there is a risk that the Bitcoin price will eventually decline and retest the year-to-date low of $74,423, approximately 15% below the current level.

While the most likely Bitcoin outlook is bearish, it may rebound and retest the upper side of the flag at $94,500, and then resume the bearish trend.

You May Also Like

No Longer Just a Token: Pi Network Is Quietly Building a Massive Digital Economy

Zoomex & UR Debut Transparent Multi-Currency Virtual Card