Bitcoin Eyes To Reclaim $100,000 As 2022-2021 Market Setup Reappears – Details

Over the last week, volatility levels surged in the Bitcoin market as prices exhibited sharp movements at the two extremes. Data from CoinMarketCap showed the leading cryptocurrency lost its support around $90,000 but repeatedly found strong buying interest near $85,000, effectively creating a volatile price range between both levels. Despite an uptick in the last day, investors’ uncertainty remains at its peak level considering a broader correction trend that has persisted since early October. Prominent market analyst Ted Pillows has identified some historical data that could guide in navigating this fragile market.

Bitcoin To $100,000?

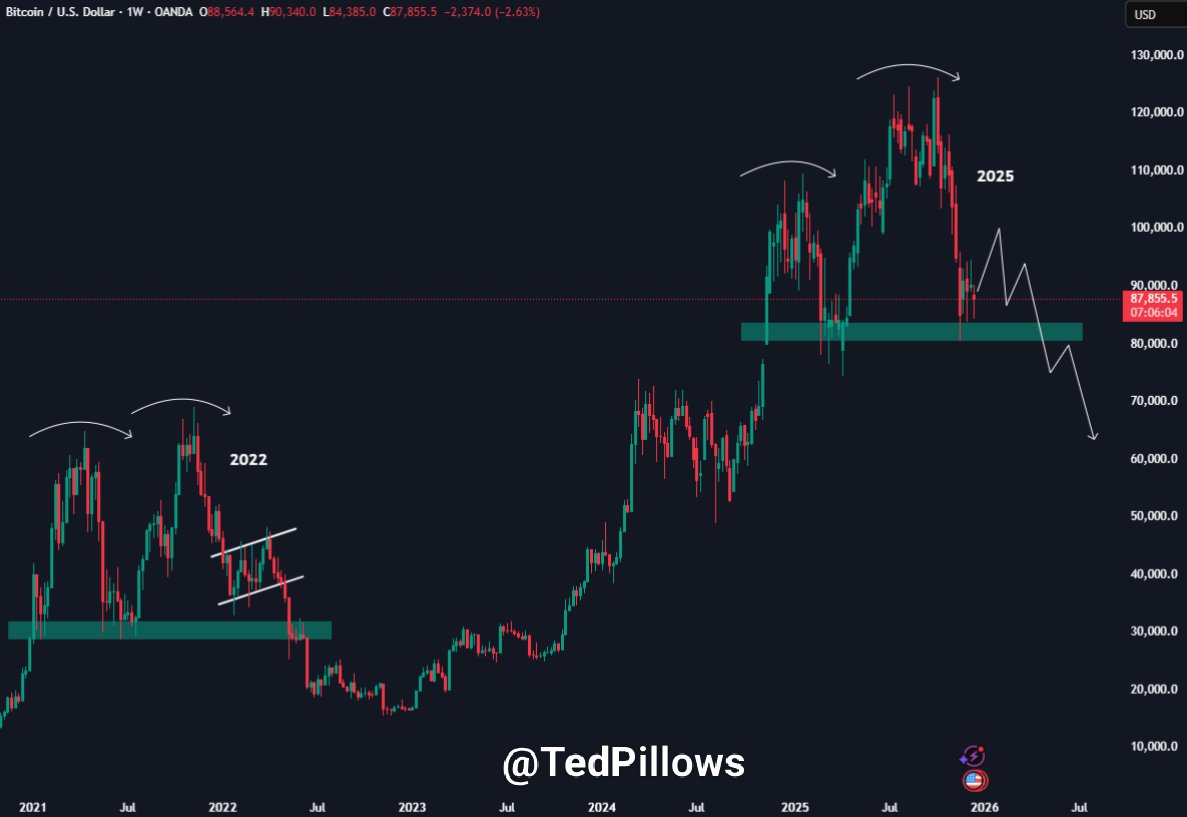

In an X post on December 19, Pillows shares a technical analysis of Bitcoin’s price structure, projecting some significant market gains in the short-term. According to the market expert, Bitcoin is presently mirroring a 2021-2022 market setup, which suggests the asset may be headed for the $100,000 mark. In the chart below, Pillows’ annotations suggest that Bitcoin is forming a head-and-shoulders pattern. The left shoulder emerged after Bitcoin peaked at $110,000 in January 2025, followed by a rally to a new all-time high of $126,100 in October, which formed the head.

Notably, a similar pattern was observed in 2021-2022, when prices reached $63,600 (left shoulder) in April 2021, $69,100 (head) in November 2021, and $48,433 (right shoulder) in March 2022 . Currently, Bitcoin appears to be in the final corrective phase ahead of the right-shoulder formation, which Pillows expects to develop near the $100,000 level, implying a potential 13.6% upside in the coming days.

However, the head-and-shoulders is a bearish chart pattern, indicating that completion could initiate a cascading price fall that was similarly seen in the 2021—2022 cycle. During this time, Bitcoin’s price dropped by half, trading as low as $22,000. However, Pillows’ projections are that Bitcoin could drop by around 35% after touching the $100,000, indicating a potential bottom price target of $65,000. Interestingly, this aligns with other cautious predictions that suggest Bitcoin remains highly vulnerable to future financial trends and is likely to fall to around $70,000.

Bitcoin Market Overview

At the time of writing, Bitcoin was trading at $88,168, reflecting a 3.16% gain in the past 24 hours. Meanwhile, the daily trading volume is down by 14.81% and valued at $44.83 billion.

Meanwhile, investors transferred over 11,000 BTC to exchanges this week, signaling a significant selling intent amid recent price swings. Crypto analyst Ali Martinez reports that the BTC exchange balance has now moved from 2.753 million BTC to 2.764 million BTC, representing 13.84% of all circulating supply.

You May Also Like

Bitcoin ETF by BlackRock Draws Billions in 2025 Despite Price Decline

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council