XRP Price Today: Whale Selling vs ETF Inflows Who Takes Control?

The post XRP Price Today: Whale Selling vs ETF Inflows Who Takes Control? appeared first on Coinpedia Fintech News

XRP price today again fails to reclaim the key $2 level after falling nearly 22% over the past two months. While whales quietly reduce exposure and on-chain data shows growing stress among holders, institutional money continues to flow in through XRP ETFs.

This contrast raises one key question for traders, is XRP preparing for another drop?

Whale Selling Is Keeping XRP Under Pressure

According to on-chain data, the main reason behind XRP’s weakness is steady selling from large holders, often called whales. Wallets holding between 100,000 and over 1 million XRP have been sending tokens to exchanges, especially Binance. This usually means planned selling, not panic selling.

At the same time, data shows a small drop in the supply held by the top 1% of XRP wallets. These big holders now control about 87.6% of the total supply, slightly down from earlier this month, a clear sign of whales slowly reducing their positions.

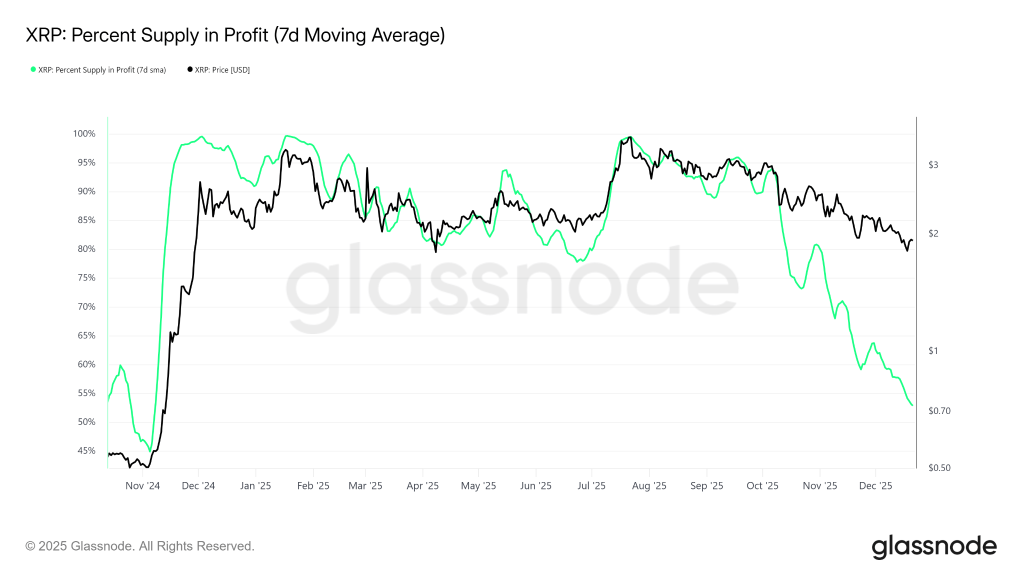

Another concern is falling profitability. Only about 52% of XRP’s supply is now in profit, meaning nearly half of all holders are sitting at a loss.

As a result, XRP has struggled to build momentum, with supply consistently meeting demand every time the price moves higher.

- Also Read :

- Has ADA Price Fallen Too Far? What Cardano’s Price Structure Signals Next

- ,

ETF Inflows Signal Institutional Confidence

Despite recent price pressure, one key reason XRP is holding near the $2 level is steady inflows into spot XRP ETFs. These ETFs have now crossed $1.2 billion in total assets, showing strong interest from institutional investors.

At the same time, Bitcoin and Ethereum ETFs have been seeing continued outflows. This contrast suggests that some institutions are shifting their focus toward XRP instead of the larger cryptocurrencies.

XRP Price Outlook

XRP recently found support near $1.85, a level that has held strong in the past. As of now, XRP price is trading around $1.92, reflecting a slight drop seen in the last 24 hours.

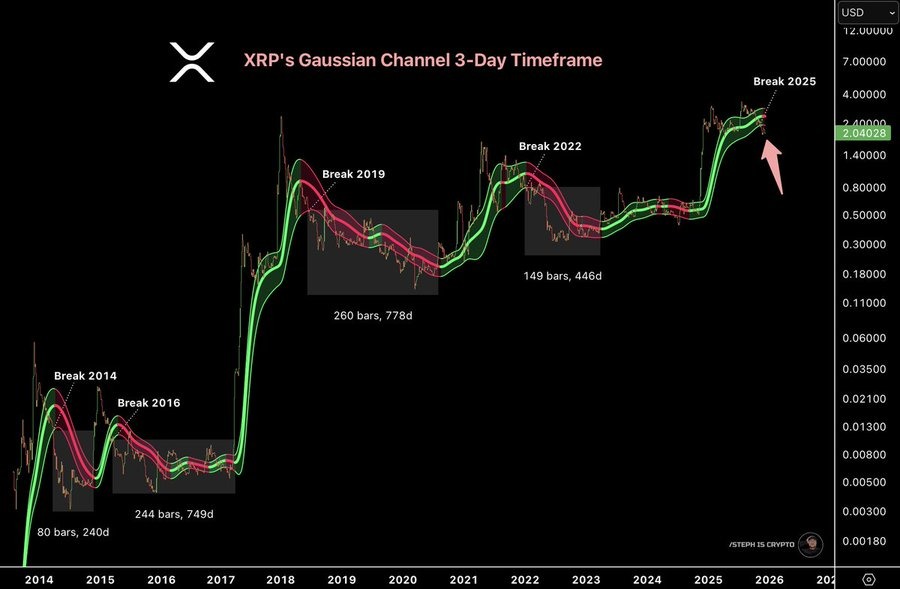

Meanwhile, looking at the XRP price chart, it is seen slipping below its 3-day Gaussian Channel, a signal that has historically marked important trend changes. In previous cycles, similar moves were followed by long periods of sideways or bearish trading before a stronger recovery took shape.

Looking ahead, XRP needs to reclaim the $2 level to bring bullish momentum back. Holding above $1.85 is crucial. If this support breaks, the price could slide toward $1.66 or even $1.50.

FAQs

Analysts predict XRP could reach $5.05 by December 2025 if bullish momentum continues and key resistance levels are broken.

XRP price is influenced by ETF approvals, on-chain activity, investor sentiment, legal developments, and broader crypto market trends.

XRP shows bullish signs with strong on-chain activity and ETF interest, but investors should watch key support and resistance levels carefully.

XRP could reach an average of $26.50 by 2030, driven by growing adoption, institutional interest, and market expansion.

You May Also Like

Intel’s stock surges as Nvidia invests $5 billion in the chipmaker

JPMorgan's Jamie Dimon doesn’t see more Fed rate cuts unless inflation drops