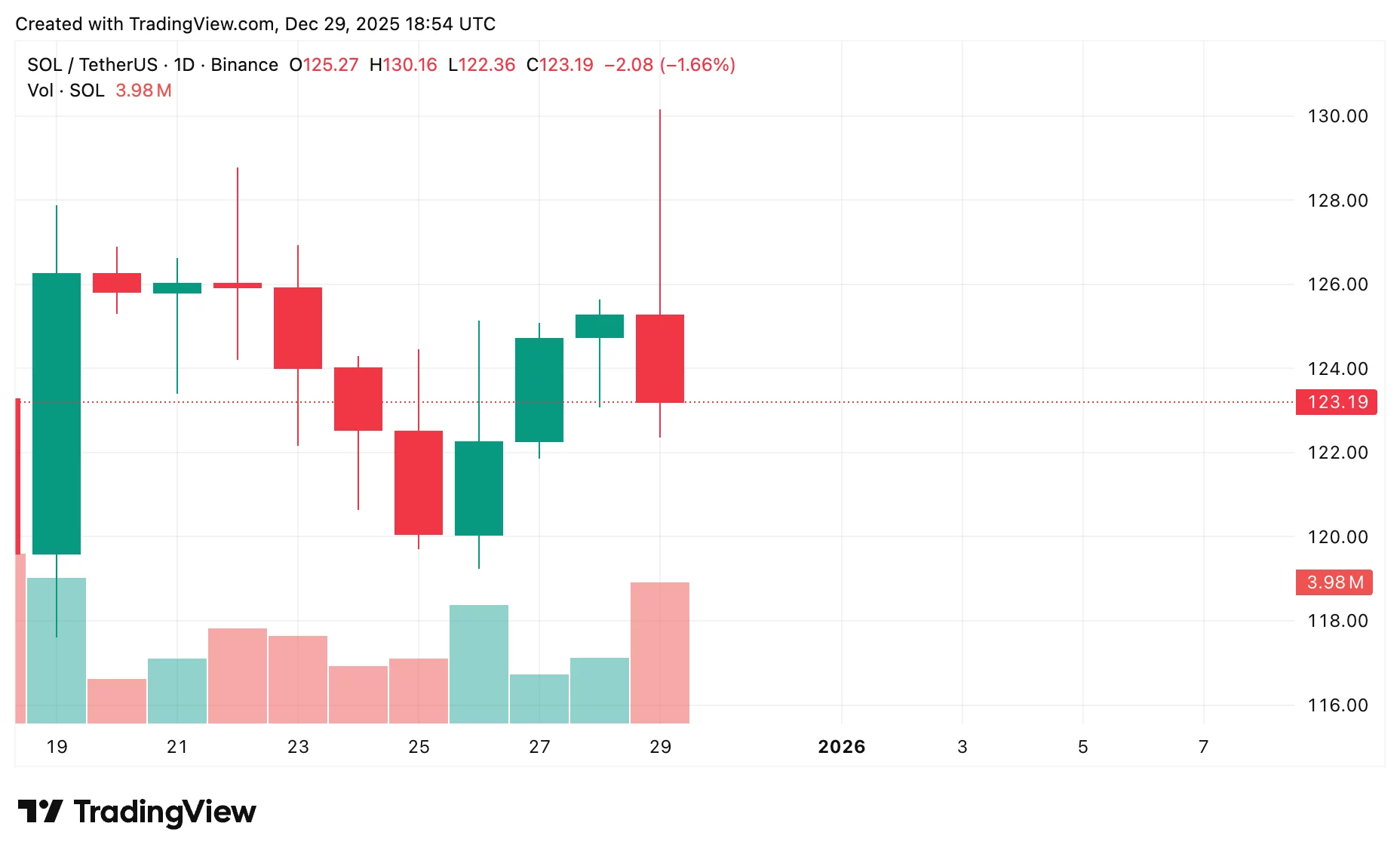

Solana price prediction: Will SOL rally to $150?

The Solana price declined after a brief intraday rally. SOL briefly touched $129.3 on December 29 but encountered resistance and reversed, raising questions about the strength of the move.

Table of Contents

- Current market scenario

- Upside outlook

- Downside risks

- Solana price prediction based on current levels

With holiday-driven volatility increasing, this Solana price prediction examines the key technical levels and potential scenarios for Solana as 2025 comes to a close.

- SOL is hovering near $123, with light selling and the $120–$130 zone acting as strong support that has triggered sharp bounces in the past.

- A daily close above $129 would signal returning momentum, boosting the SOL price prediction and opening the door for a rally toward $150.

- On the downside, failing to hold the $123–$124 zone could push SOL toward $115, making the short-term outlook cautious before a potential recovery.

Current market scenario

Solana (SOL) is hovering near $123.2, nearly back to pre-spike levels. It’s down 0.11% today and about 3% for the week, but the selling is light — more of a breather.

Volume’s tapering off on the pullback, and the $120–$130 zone has been a solid support area, often sparking big bounces earlier.

Overall, this gives some perspective on the Solana outlook. Momentum might be slowing a bit in the short term, but buyers are holding key levels, keeping the bigger picture intact.

Upside outlook

Bulls need to keep their eyes on $129. If SOL manages a convincing daily close above that, it’d mean momentum’s returning and buyers are running the show. In that case, the recent dip loses its sting, and a rally to $150 and beyond becomes realistic.

Downside risks

Things are still looking okay, but there’s some risk on the downside. The $123–$124 area has repeatedly attracted sellers. SOL’s trading right in that zone, and failing to defend it could push it lower.

Breaking below this area would place $115 on the radar as the next support level. If it fails, short-term momentum is fading, and a seasonal rally might be delayed. That would shift the SOL forecast to cautious, with more sideways or downside likely before it recovers.

Solana price prediction based on current levels

SOL’s trading appears to remain in the $120–$130 range for now. Staying above $120 keeps the setup intact and leans bullish, while breaking $129 would improve the SOL price prediction and open the door for a year-end rally.

You May Also Like

Waters’ Scathing Critique Exposes Regulatory Retreat

US Dollar Loses 10% of Its Value in Just One Year As Gold and Silver Send ‘Flash Warning’ To Markets