The $10,000 Trump Trade: What Actually Made Money Since Inauguration Day

When Donald Trump took the oath of office back on January 20th this year, the investment narrative was largely led by one large prediction: an explosion in cryptocurrency prices based largely on favorable regulation (or deregulation).

But it wasn’t only the crypto industry that was keeping its fingers crossed for a rally. Recall that Trump also promised to cut corporate tax rates to 15% from 21% for companies that make their product in America, to remove taxes on tips, to eliminate taxes on social security, to make car loans fully tax-deductible, and much more. All of this led to expectations of a booming US economy, with thriving small businesses driven by tax relief and government assistance.

The reality, though? Well, nearly one year later, we have the numbers, and they tell a radically different story.

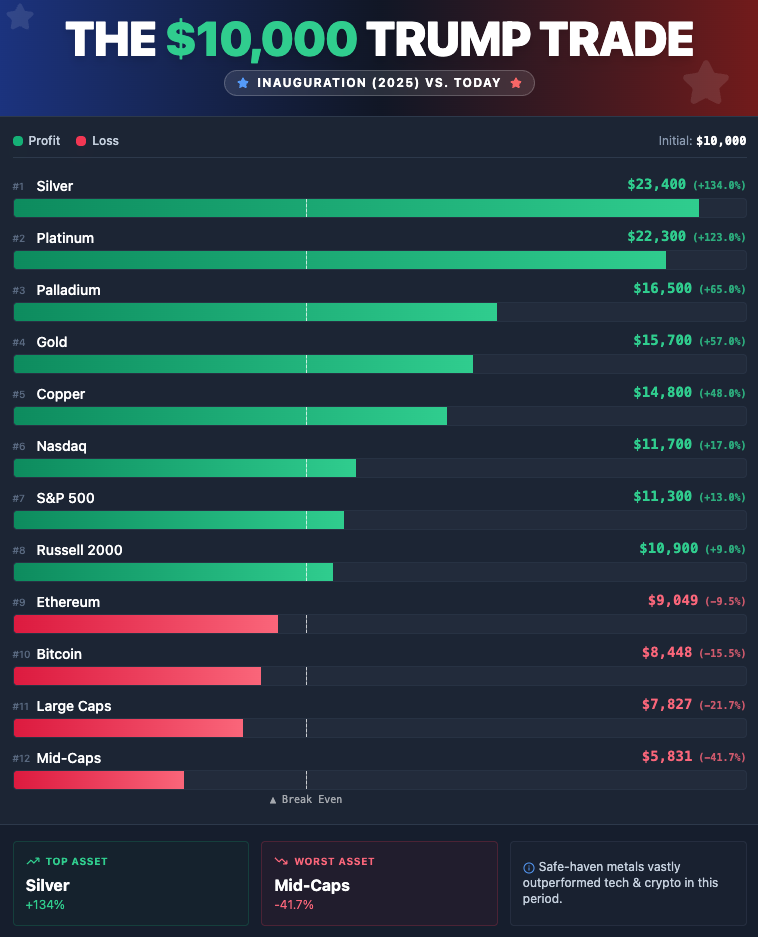

Tracking a hypothetical $10,000 investment made on Inauguration Day 2025 across 12 major asset classes, the results reveal a considerable capital flight from speculative assets into traditional, tangible safe havens. What does this signal? To many – uncertainty.

The Bottom Line: From Inauguration Day to Now

Below you will find the current value of a $10,000 investment made on January 20th, 2025, across a range of asset classes (and subcategories).

Image created by CryptoPotato, Data Source: X

Image created by CryptoPotato, Data Source: X

It’s a Supercycle, Alright

Indeed, we saw a supercycle, just not where most of the crypto industry was expecting it. Don’t get me wrong, BTC painted multiple all-time highs, altcoins (or at least some of them) had their moment under the sun, but the year has undoubtedly been a lot different from what most of the analysts expected it would be.

The rally didn’t come from traditionally volatile and speculative assets, but rather from the exact opposite.

The most striking trend of the post-inauguration period is, without a doubt, the dominance of precious and industrial metals. While most of the attention was focused on stock indices, silver delivered a staggering return of 134%. Mind you, some of the numbers might be different at the time you are reading this article because, well, precious metals are more or less acting like sh*tcoins right now.

But what does this mean?

Well, experts speculate about the parabolic price rises in precious and industrial metals. Some of them justify the increase with fundamentals such as increasing global uncertainty around the war between Russia and Ukraine, the tensions in the Middle East, the Trump-led policy of virtually slamming every country with tariffs, the demand for certain metals to produce graphic chips because of the booming AI sector, and much more. One report from the BBC recently explained that the supply for silver (as the most dominant performer in the selected period) is expanding because of:

- Its use in various industries, such as EV manufacturing and solar panels

- Fears of Trump imposing tariffs on it

- Inability to quickly increase supply

Remember, most of these are natural resources and not a product, meaning that there’s a finite supply of it. Although silver’s supply is estimated to be at least ten times that of gold, the majority of its global output is a by-product of mines that mainly extract other metals, making it harder to meet the increasing demand.

Gold is also up by around 60%. Never has the precious metal seen such an impressive 12-month performance.

And while many experts find reasoning behind fundamentals, others are of the opinion that markets are pricing in increasing inflation and uncertainty, treating the silver trade as a beta to gold, which started to increase a lot sooner. In other words, some are already bracing for impact.

In any case, the “Trump Trade” in 2025 turned out to be a commodities trade rather than a tech trade.

The Surprise Loser: Speculation Deflates

Donald Trump promised a lot of things to crypto proponents in a bid to win them over, and to an extent, it worked. Many in the industry favored him, and, in all fairness, we’ve seen a lot of fundamental progress, especially in terms of legislation.

From a hawkish SEC that was legislating through enforcement, the US currently has an administration that is actively working on adequate bills. In July, the President’s Working Group on Digital Assets published a comprehensive roadmap to strengthen the country’s leadership in the digital asset field, calling for swift implementation of the GENIUS act, the modernization of AML legislation, enactment of laws aimed at market structure, and more.

Both regulatory heavyweights, in the face of the CFTC and the SEC, have changed their stance, while the government is also an official “HODLer” because of the Strategic Bitcoin Reserve – something Trump signed an executive order for back in March.

And despite all of the above, price action has been nothing but disappointing over the past few months, which ultimately led to the negative performance since Inauguration Day.

I read a tweet saying that Bitcoin at $90K feels like we’re at $10K, and indeed, sentiment is near all-time lows.

And here’s why:

Regardless of the reasons, it’s evident that funds are flowing out of speculative assets.

The real alpha this year was in metals. A portfolio allocated to a basket of Silver, Gold, Platinum, and Palladium would have more than doubled in value in 12 months.

The post The $10,000 Trump Trade: What Actually Made Money Since Inauguration Day appeared first on CryptoPotato.

You May Also Like

‘Love Island Games’ Season 2 Release Schedule—When Do New Episodes Come Out?

Solana Price Prediction Stuck at $85 While Pepeto Presale Delivers What Solana Holders Have Been Waiting For