Bitcoin Downtrend Raises Questions About Options Market Impact

Bitcoin slipped into a clear downtrend in November. As prices fell, traders started asking why heavy institutional inflows and corporate buying failed to keep Bitcoin above $110,000.

One idea getting more attention points to the surge in Bitcoin options trading. Much of it centers on contracts tied to BlackRock’s iShares spot Bitcoin ETF, known as IBIT.

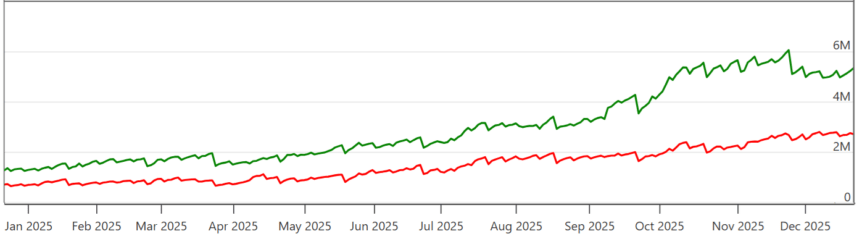

Source: OptionCharts.io

Source: OptionCharts.io

Total Bitcoin options open interest reached $49 billion in December 2025, up from $39 billion a year earlier. That growth has put covered call strategies under the spotlight.

Critics say large investors are selling calls to earn yield and, in the process, giving up Bitcoin’s upside. In simple terms, a covered call means an investor who owns Bitcoin sells a call option. The buyer gets the right to buy Bitcoin at a set price by a certain date. The seller collects a premium upfront, much like interest.

The trade comes with a limit. If Bitcoin rises above the strike price, the seller misses out on further gains. Some traders argue that dealers who buy these calls hedge by selling Bitcoin in the spot market. That can add selling pressure near key price levels.

But the data suggests the story isn’t that simple.

From cash-and-carry to options-based yield

Funds are moving toward options-based yield strategies after the cash-and-carry trade lost its appeal. That trade involved selling Bitcoin futures while holding spot Bitcoin.

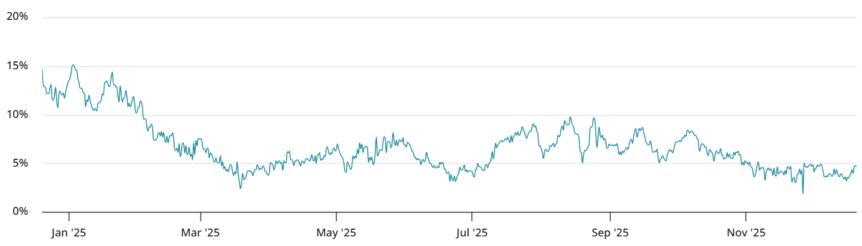

Source: laevitas.ch

Source: laevitas.ch

In late 2024, it paid 10% to 15% a year. By February 2025, returns fell below 10%. By November, they barely held above 5%.

As yields dropped, many funds shifted to covered calls. These strategies offered higher returns, around 12% to 18% a year. The change shows up clearly in IBIT options. Open interest jumped from $12 billion in late 2024 to $40 billion.

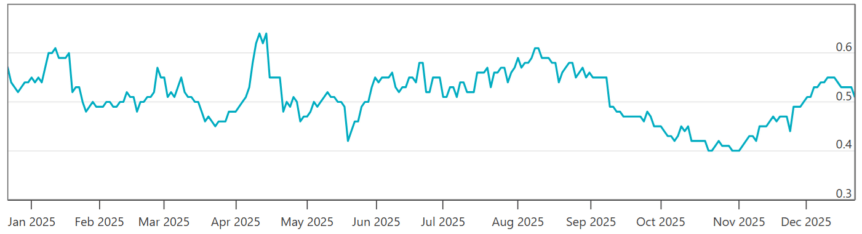

Even with more call selling, the market hasn’t tilted in one direction. The put-to-call ratio for IBIT options has stayed below 60%. If call selling dominated, that ratio would likely fall much further. Instead, the data shows balance. For every investor selling calls for yield, another is betting on a move higher.

At the same time, many traders are buying put options to protect against losses. That points to caution, not an effort to hold prices down.

Source: OptionCharts.io

Source: OptionCharts.io

Bitcoin price driven by macro, spot demand

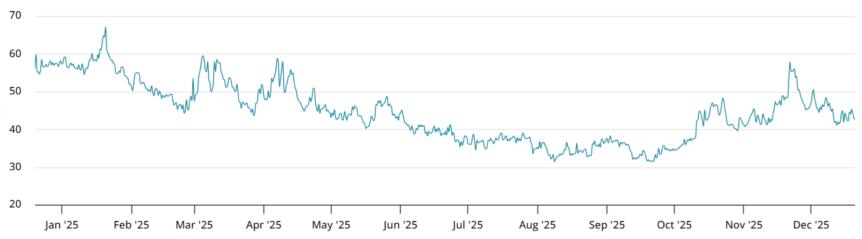

Options data make the price-suppression argument harder to support. In late 2024, IBIT put options traded at a 2% discount. Now they carry a 5% premium. That shift points to stronger demand for downside protection.

At the same time, implied volatility has dropped. Since May, it has stayed at 45% or lower, down from 57% late last year. Lower volatility means cheaper options. And cheaper options mean less income for call sellers.

Source: laevitas.ch

Source: laevitas.ch

Because of that, the case for aggressive covered call strategies has weakened. That’s true even as total options open interest keeps rising.

Some market watchers say blaming covered calls for Bitcoin’s flat price misses the point. Call sellers make the most money when prices move up toward their strike levels. They don’t benefit from prices staying stuck.

Rather than capping Bitcoin’s price, the growing options market looks more like a place where traders earn yield from volatility. It’s about income, not control.

Looking ahead, traders expect Bitcoin’s next move to depend more on macro forces and spot demand than on options activity alone.

This article was originally published as Bitcoin Downtrend Raises Questions About Options Market Impact on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Solana Hits $4B in Corporate Treasuries as Companies Boost Reserves

A whale that made a 141% profit on PUMP three days ago bought 321 million TRUMPs today, with a floating profit of $223,000.