Rise In Adoption? Spending on Visa Crypto Cards Soared More Than 500% Last Year

Visa crypto card spending surged 525% last year as digital assets move from experimental tech to daily financial use.

Digital assets moved closer to the mainstream last year. Recent data shows that Visa crypto card spending climbed last year by more than 5 times.

People are no longer just holding their tokens in digital wallets. Instead, they are using them to buy groceries, pay for dinners or manage their monthly bills.

Visa Crypto Card Spending Hits New Records

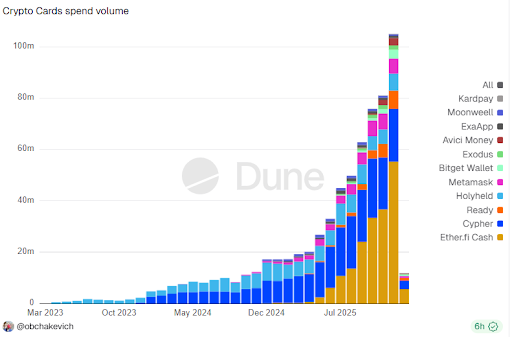

The growth from last year was explosive by all accounts. According to figures from Dune Analytics, net spending across six specific cards jumped from $14.6 million in January to $91.3 million by December.

This stands as a 525% increase in total transaction volume. These cards allow users to spend their digital holdings anywhere that accepts standard credit or debit payments.

EtherFi led this charge by a wide gap. Its users spent a total of $55.4 million throughout the year, while Cypher took the second spot with $20.5 million in total volume.

Other projects like GnosisPay, Moonwell, Exa App and Avici Money also contributed to the total. These numbers show that users feel comfortable linking their crypto wallets to the trad-fi space.

Mainstream Adoption Drives Visa Crypto Card Spending

This development shows that large payment networks like Visa are doing more than just providing a logo on a plastic card.

Visa has been busy building connections with stablecoins and blockchain networks. The company now supports these assets across four different blockchains, and this makes it easier for both regular people and big companies to use digital money.

Spending volume on crypto cards soared last year | source: Dune analytics

Spending volume on crypto cards soared last year | source: Dune analytics

Visa also launched a dedicated team late last year to advise other businesses on stablecoins. This team helps banks and fintech firms launch their own versions of digital cash.

This support is one reason why crypto card spending on Visa continues to climb month after month.

The Dominance of Stablecoins in Daily Use

Stablecoins like USDT and USDC are the silent engines behind this spending boom.

Data from the payments platform Bridge shows that stablecoin transaction volume recently topped $2.5 trillion globally.

Tether’s USDT continues to be a giant in the space, as it processes over $1 trillion in transactions every single month.

These assets offer the stability of the dollar with the tech benefits of a blockchain.

While large tokens dominate the market, smaller options are growing even faster. Tokens like EURC and PYUSD are finding specific uses in different parts of the world.

For example, EURC saw its monthly volume grow from $47 million to over $7.5 billion in just twelve months.

This variety helps different regions adopt spending habits that fit their needs.

Related Reading: Why the Crypto Market is Pumping as Bitcoin Reclaims the $92,000 Level

Looking Forward to Now and Beyond

The data indicates that the momentum from last year will carry into the new year. Visa has set itself up as a bridge between the old ways of moving money and the new digital frontier.

The company is actively courting a tech-savvy audience by working with projects like EtherFi and Moonwell, as these users are often the first to try new financial products.

The success of these cards proves that people want more control over their funds.

They want to hold their wealth in defi protocols but still have the freedom to spend it whenever they like.

The post Rise In Adoption? Spending on Visa Crypto Cards Soared More Than 500% Last Year appeared first on Live Bitcoin News.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

UK Looks to US to Adopt More Crypto-Friendly Approach