Bitcoin Flips Bullish Amid Bets of a Big Year

Bitcoin bulls sought grounds for positivity as the crucial phase of trading in the new year commences.

Over the weekend, the top token achieved a remarkable milestone by exceeding $91,000 for the first time since December 12. Early Monday, Bitcoin reached a peak of $93,000 as traders capitalized on the early 2026 recovery across leading cryptocurrencies, reflecting an increased appetite for risk.

The price of Bitcoin has begun an upward trend, recording a 3.3% weekly gain. BTC is currently exhibiting positive momentum and could potentially rise beyond $95,000 in the near-term.

Source: CoinGecko

Source: CoinGecko

The current price is positioned above $92,000 and the 100-hour Simple Moving Average. A significant bullish trend line is developing, showing support at $91,500 on the hourly chart for the BTC/USD pair. BTC could potentially maintain its upward trajectory as long as it remains above the $91,200 threshold.

Strong capital investments and active market activity have caused a noteworthy price surge and changes in short-term order flow due to the recent rise in Bitcoin spot inflows, which increased by almost 1,671% in just a few minutes.

Bitcoin ETFs saw inflows on January 1, 2026, when many institutions began buying the top token again after selling for tax reasons a quarter earlier.

Three important on-chain indicators are showing early signs of a potential upward trend: the Premium Gap is rebounding as institutional investments pick up, the Fear & Greed Index has surged, and the long/short ratio stays above 1.0 even with recent reductions in leverage.

Recent trends indicate a positive shift in market sentiment.

The Crypto Fear & Greed Index has increased from 29 last week to 40 on Monday, reflecting changes in factors like volatility, trading volume, social media sentiment, and market momentum.

This scale ranges from 0, indicating extreme fear, to 100, representing extreme greed, to assess the feelings of investors. Emerging from the "Extreme Fear" zone, often associated with surrender, serves as a definitive signal of this shift.

The data from derivatives suggests a measured yet hopeful perspective.

The BTC long/short ratio has decreased, yet it still holds above 1.0. This ratio assesses the volume of long positions against the volume of short positions in futures markets.

When surpassing the crucial 1.0 mark, it signifies that a greater number of traders are wagering on price rises rather than declines.

The slow and steady cooling trend, as opposed to a sudden drop, suggests a more robust market framework, minimizing the chances of cascading liquidations in either direction.

Even with the positive indicators, various elements call for caution. The Fear & Greed Index, although showing some signs of improvement, remains solidly within the realm of caution.

This indicates a wider apprehension regarding monetary policy, as markets adjust their forecasts for interest rate reductions after the assertive December FOMC minutes.

The selling of assets for tax purposes at year-end may have led to a temporary decline in prices, suggesting that the recent recovery might be influenced more by technical adjustments than by true confidence in the market.

Certain experts indicate that a reliable validation of a trend reversal would necessitate the Coinbase Premium to turn distinctly positive and maintain that position.

Venezuela's 'Shadow Reserves'

Significant disruptions in supply, diminished liquidity, and potentially rising prices may come from Venezuela's potential seizure of Bitcoin.

This situation is different from events like the Saxony sale of 50,000 BTC in 2024; it represents a fresh development.

Following the US-led operation that captured President Nicolas Maduro in January 2026, the much-discussed Bitcoin reserves of Venezuela have attracted considerable interest.

The country is reportedly one of the world's largest Bitcoin holders, according to recent intelligence estimates, which put its valuation between $60 billion and $67 billion with a hidden reserve of 600,000 to 660,000 BTC.

Venezuela could challenge big institutional players like BlackRock and MicroStrategy if its claimed hoard of Bitcoin tokens exceeds 600,000.

The supply dynamics and market sentiment towards Bitcoin in 2026 could be drastically altered by this finding.

Reportedly, Venezuela's Orinoco Mining Arc exported substantial amounts of gold between 2018 and 2020. The rumor mill claims that almost $2 billion in gold sales were converted into Bitcoin, with a $5,000 average purchase price per BTC.

Part of this portion, which is now valued at around $36 billion, laid the framework for the country's secret cryptocurrency reserve.

Following the demise of the state-backed Petro cryptocurrency, the Maduro government has stepped up its demands for PDVSA, the national oil company, to trade crude oil exports in USDT from 2023 through 2025.

To mitigate exposure to the US currency and account freeze risk, these stablecoins were subsequently changed into Bitcoin.

An additional 600,000+ BTC, or about 3% of the overall supply, have been added to the total due to seizures at home mining operations.

There has been a notable increase in the size of Venezuela's alleged reserves compared to previous government liquidations.

A market drop of 15-20% in 2024 was the consequence of the German state of Saxony selling 50,000 BTC, which was around $3 billion at the time.

Contrarily, if Venezuela's 600,000 BTC were to be frozen or confiscated, it might cause massive disruptions to the supply chain, reducing available liquidity and possibly pushing prices higher.

This action could effectively secure supply for 5–10 years, fostering a positive outlook for Bitcoin and benefiting institutional stakeholders such as MicroStrategy.

More Upside, Anyone?

For now, Bitcoin has exceeded $92,000. The recent surge has established a new multi-week high at $93,333, and the price is currently in a phase of consolidating its gains.

The asset remains steady above the 23.6% Fibonacci retracement level following the recent rise from the $90,804 swing low to the $93,333 peak.

At its present price, Bitcoin has surpassed the 100-hourly Simple Moving Average and is valued at more than $92,000. On the hourly chart of the BTC/USD pair, there is support near $91,500, and a notable upward trend line is also taking shape.

According to TradingView, it might start a fresh recovery phase if the price stays above $91,500. Around $93,200 is the present level of resistance.

The initial substantial hurdle is approximately $93,500. It is possible that $94,000 will be the next obstacle. The price could go considerably higher if it breaks past the $94,000 resistance mark.

Under these conditions, the price has the potential to rise and test the $94,650 level of resistance. The price might reach $95,000 if there are more rises. Bulls may see resistance at $95,500 and $95,800 in the near future.

According to TradingView, a further decline could be on the horizon for Bitcoin if it fails to surpass the $93,200 resistance threshold. The level of $92,200 offers prompt backing.

The initial notable support level is around $92,000, which corresponds to the 50% Fibonacci retracement of the latest upward movement from the $90,804 swing low to the $93,333 high.

The upcoming support level is currently around the $91,500 area.

Further declines could push the price down to the $90,500 support level in the short term. The primary support level is at $90,000; if BTC falls below this point, it could experience a more rapid decline in the short term.

What Do Broader Technicals Show?

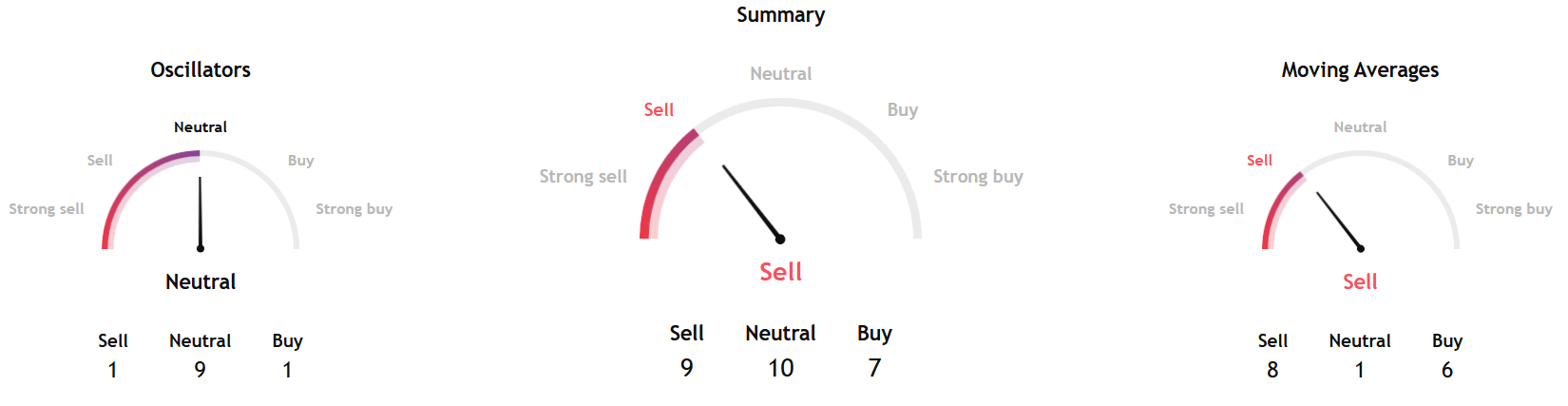

TradingView's overall Bitcoin Technical analysis gauge, based on key data from moving averages, oscillators, and pivots, gave a sell signal.

Short-term indicators pointed to a neutral stance, while long-term gauges showed a sell signal.

Source: TradingView

Source: TradingView

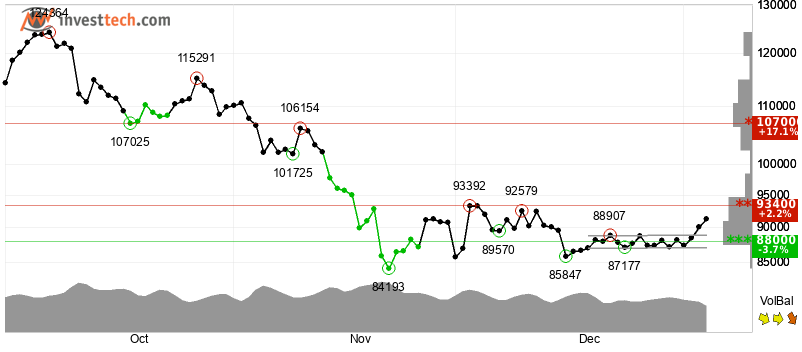

Separately, InvestTech's Algorithmic Overall Analysis pointed to a cautious hold signal, and the research's recommendation for one to six weeks was a weak positive score.

Source: InvestTech

Source: InvestTech

Investech said, "An approximate horizontal trend channel in the short term is broken up. Continued strong development is indicated, and the token now meets support on possible reactions down towards the trend lines. The token is between support at $88,000 and resistance at points $93,400."

"A definitive breakthrough of one of these levels predicts the new direction. The RSI curve shows a rising trend, which could be an early signal of the start of a rising trend for the price as well. The token is overall assessed as technically slightly positive for the short term," added the research.

The alignment of revitalized institutional interest, enhanced market sentiment, and ongoing long positions sets a positive stage for Bitcoin in early 2026.

Nonetheless, with anxiety remaining high and broader economic challenges still in play, market participants seem to be carefully building their positions instead of making bold purchases—a wise approach considering the recent fluctuations.

Podcast

Decentralization and Privacy: Insights from TEN Protocol's Cais Manai

In this episode of Blockcast, host Takatoshi Shibayama sits down with Cais Manai, co-founder of TEN Protocol, to delve into the intricacies of blockchain privacy and decentralization. Cais shares his journey from discovering Bitcoin in 2012 to co-founding TEN Protocol, a project focused on integrating privacy into Ethereum's Layer 2 solutions.

Tune in at blockcast.blockhead.co or on Spotify, Apple, Amazon Music, or any major podcast platform.

Blockhead is a media partner for Consensus Hong Kong 2026. Readers can save 20% on tickets using exclusive code BLOCKDESK at this link.

You May Also Like

Telegram Sells $450M In Toncoin As Token Plunges: Report

Polymarket Adds Taker Fees to 15-Minute Crypto Markets