Decoding DeFi 2025: Ten key insights from consumer finance to technological innovation

Original: Delphi Digital

Compiled by: Yuliya, PANews

Decentralized finance (DeFi) is regaining momentum as the market refocuses on utility value. From stablecoins to intent execution layers, innovation is on the fast track. Here are 10 key insights into the future of DeFi.

1. Consumer-grade DeFi applications are coming

Crypto payment cards are evolving from simple cash withdrawal channels to self-hosted smart contract wallets that can interact directly with DeFi protocols. New crypto payment cards such as Gnosis Pay , Argent , and Fuse support programmable spending, automatic top-ups, and integration with lending protocols, making the vision of banklessness closer than ever before.

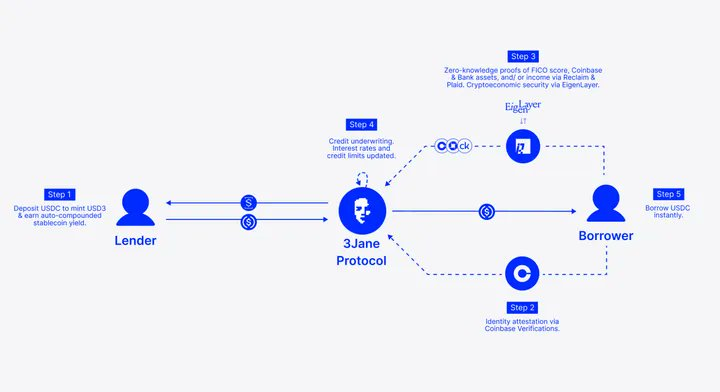

2. zkTLS opens a new frontier for DeFi

Zero-knowledge TLS (zkTLS) technology allows users to prove sensitive data on-chain without exposing private information. Projects such as 3Jane (credit lending), Camp Network (customized user experience), and Showdown (Web2 games) are using zkTLS technology to expand DeFi to new markets. This may push features such as on-chain credit scoring and low-collateral lending into the mainstream market.

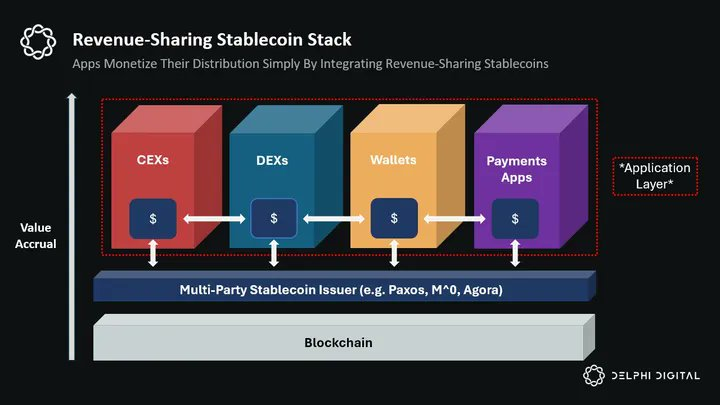

3. Revenue-sharing stablecoins reshape the market landscape

Stablecoin issuers earn huge income through reserve interest, but DeFi projects are subverting this model. New stablecoins such as M^0 , Agora , and Paxos USDG share revenue with applications, incentivizing wallets and DeFi platforms to integrate. This model may promote the decentralization of stablecoin issuance and reshape the competitive landscape by rewarding distribution partners, rather than relying solely on network effects.

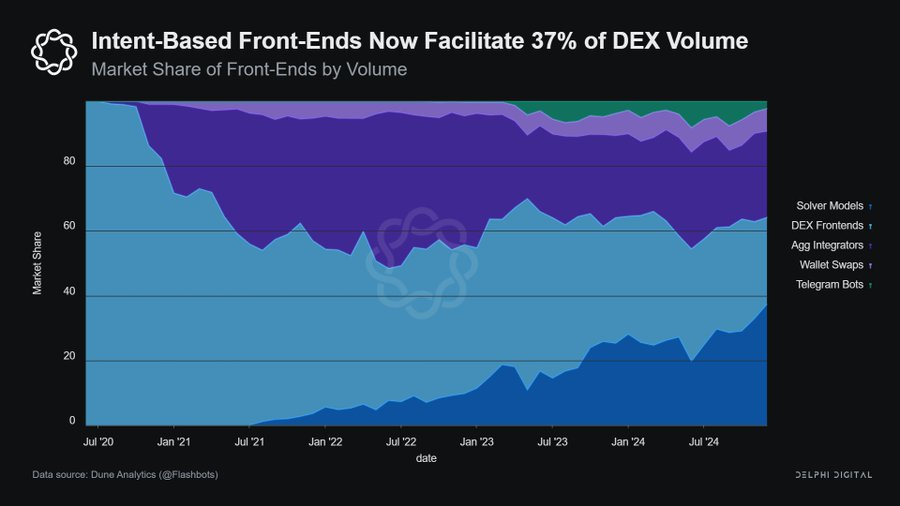

4. DeFi value transfers from the bottom layer of the protocol to the front end

The value of DeFi protocols is shifting to those entities that control exclusive order flows, especially wallets and intent-driven front-ends. Platforms such as Jupiter and Phantom are planning to monetize order flows, aiming to reshape the value distribution of DeFi. As the MEV supply chain matures, the focus of competition will shift from DEX to the front-end, and distribution capabilities will become the key to value capture.

5. 2025 will be the year of DEX growth and aggregator-driven trading

On-chain trading is undergoing a major transformation as DEX volumes rise and aggregators redefine execution methods.

- Angstrom is working on solving the MEV and LVR issues;

- Bunni v2 enhances passive liquidity strategy;

- Whetstone Research is innovating the token issuance mechanism through Doppler.

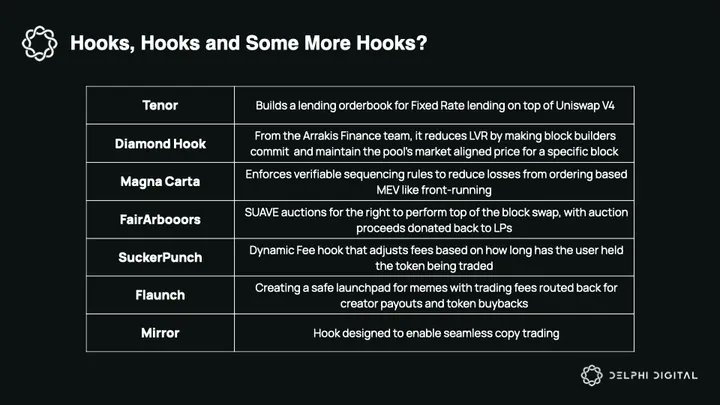

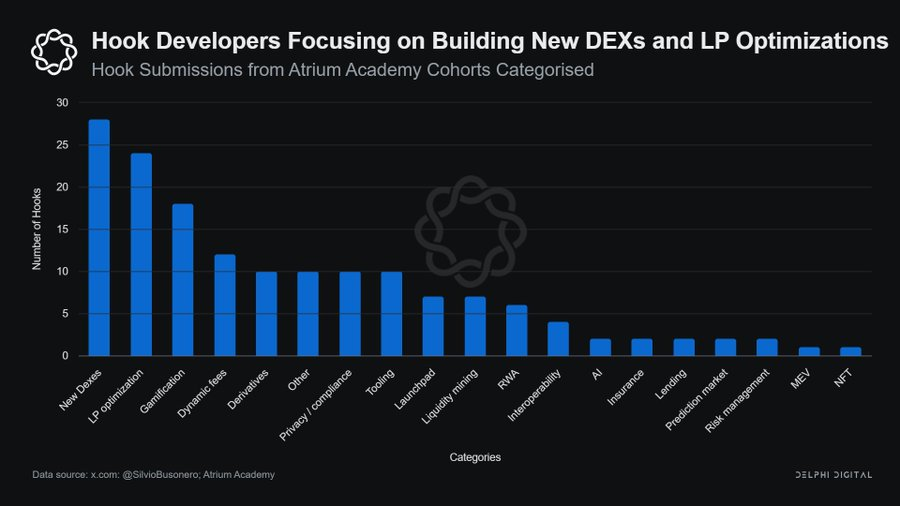

6. Uniswap’s strategic layout

Uniswap is transforming from a single DEX to DeFi’s liquidity infrastructure:

- Uniswap Labs v4’s Hooks feature supports AMM customization, automatic LP management, and advanced order types;

- As a blockchain specifically for DeFi, Unichain has the characteristics of high speed and resistance to MEV;

- UniswapX is expected to become the main intention execution layer in the DeFi space.

7. Paradigm shift in DeFi transactions

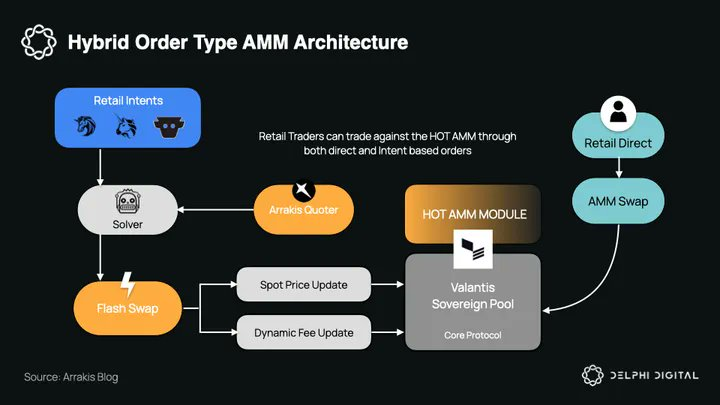

DeFi transactions are moving towards modularization, intent-driven, and high-speed execution. A new generation of DEX architectures is emerging to optimize liquidity, execution quality, and MEV protection:

- Valantis Labs provides a modular DEX framework that supports flexible exchange development;

- Arrakis Finance aggregates OTC order flows through RFQ to protect LPs from MEV;

- Fluid uses "smart collateral" to achieve leveraged market making and automated fee optimization;

- Order book DEX: High-performance public chains such as Monad, Sui and Aptos are realizing efficient order book transactions.

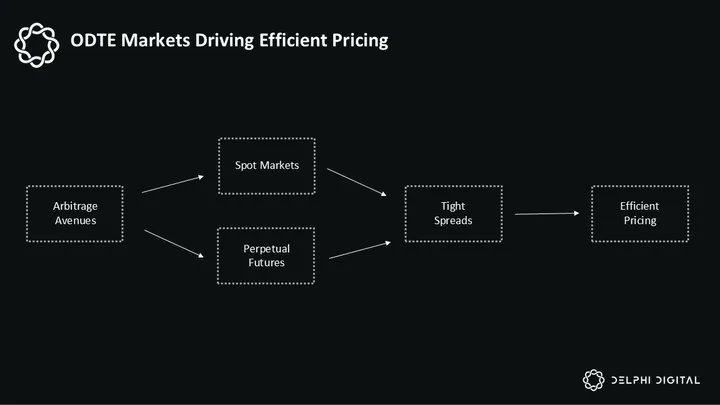

8. Evolution of prediction markets

Prediction markets are no longer just pure speculation, such as:

- Limitless Exchange ’s on-chain 0DTE derivatives provide efficient pricing and leverage;

- Truemarkets ensures fair outcomes through its Truth Oracle+AI-driven verification and decentralized governance.

As these models develop, prediction markets may become a core component of on-chain finance.

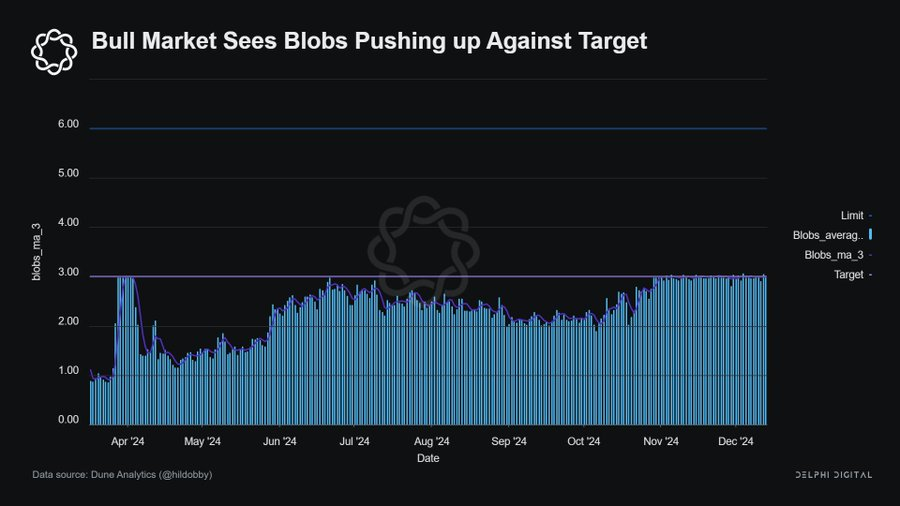

9. Starknet Development

Although Starknet still faces challenges, low-cost transactions, staking mechanisms, and an expanding ecosystem lay the foundation for its growth.

Key catalysts:

- Bitcoin rollup could make Starknet the BTC Layer 2 leader;

- Lower blob costs bring expansion advantages over other L2s;

- On-chain gaming is becoming a new adoption driver.

10. Challenges and Innovations

Despite the rapid development of the DeFi field, it still faces some key challenges.

- High entry barriers: Due to the limited support of centralized exchanges, users have to cross the Ethereum chain or rely on intermediary services;

- Insufficient token incentives: Many top protocols lack tokens or points programs, and users are not very motivated to participate.

However, these challenges indicate that DeFi still has huge room for innovation and development potential in the following areas:

- Low-collateral loan products

- Lending Aggregator

- Interest rate derivatives

- On-chain securitization protocol

- Advanced Prediction Markets

Looking ahead, the next wave of DeFi will focus on improving efficiency, risk management, and the development of more advanced financial tools.

You May Also Like

What Would Happen If Amazon Were To Incorporate XRP Into Its Services?

US Jobless Claims Lower Than Forecasted, Impact on Crypto Unclear