Coinbase's latest financial report: 2024 annual revenue is nearly $6.6 billion, and Q4 achieved the largest quarterly revenue in three years

Compiled by: Felix, PANews

Coinbase announced its fourth quarter and full-year earnings on February 13, local time. Thanks to the strong rebound after the election, which pushed cryptocurrency prices to new highs at the end of last year, Coinbase's performance in the fourth quarter exceeded expectations and achieved the largest quarterly revenue in three years.

Coinbase reported earnings per share of $4.68, more than double the $2.11 analysts expected, and fourth-quarter profits of $1.3 billion.

In after-hours trading, Coinbase shares rose 2% to around $304, and the stock price has risen 112% over the past year. This article takes you through the key data in Coinbase's financial report.

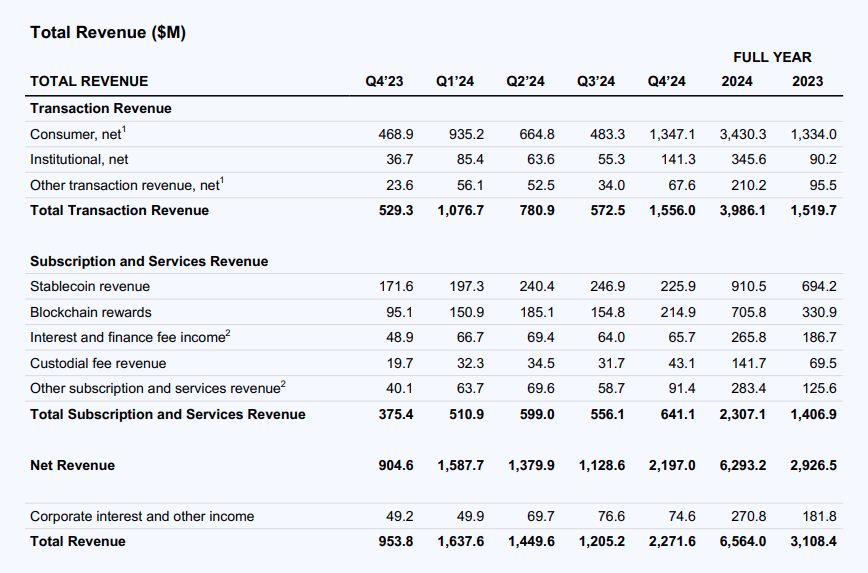

Full-year revenue will double in 2024 , with Q4 contributing more than 30% of revenue

2024 was a strong year for both cryptocurrency and Coinbase, with full-year revenue more than doubling to $6.564 billion, net income of $2.6 billion, and adjusted EBITDA of $3.3 billion. Among them, fourth-quarter revenue reached $2.27 billion, an increase of 88% from the previous quarter.

In terms of products, Coinbase gained market share in US spot and derivatives trading products in 2024, and added custody, staking, and USDC assets to its product suite, which helped drive revenue diversification. In addition, Coinbase further promoted product adoption of Base, Coinbase One, Prime Financing, and international expansion.

Trading income

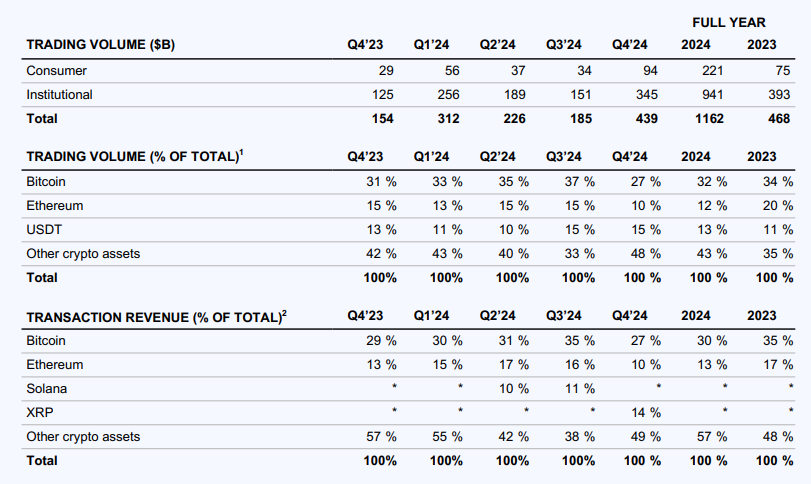

The transaction revenue for the whole year of 2024 is 4 billion US dollars, a year-on-year increase of 162%; the total transaction volume is 1.2 trillion US dollars, a year-on-year increase of 148%. Among them, the retail transaction volume is 221 billion US dollars, a year-on-year increase of 195%; the institutional transaction volume is 941.2 billion US dollars, a year-on-year increase of 139%. In the fourth quarter, Coinbase's transaction revenue reached 1.6 billion US dollars, a month-on-month increase of 172%; the transaction volume was 439 billion US dollars, a year-on-year increase of 185%.

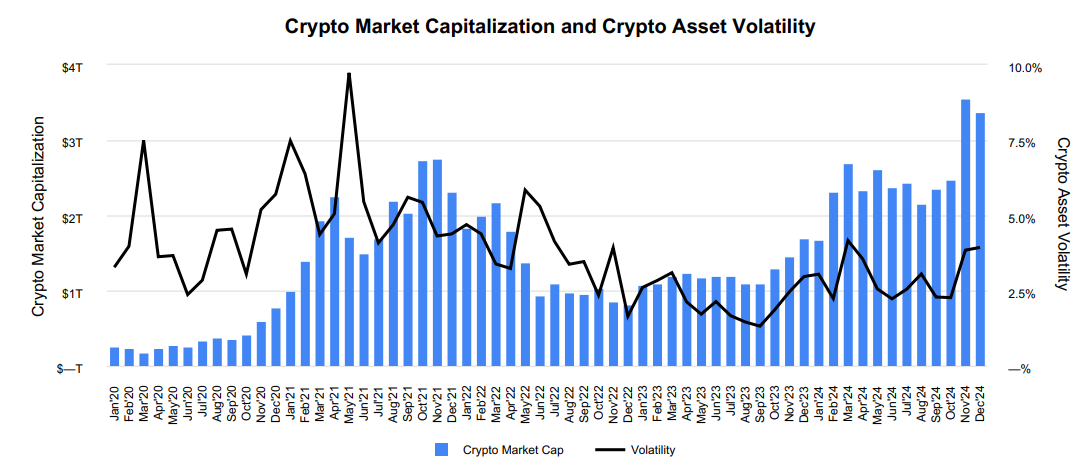

Much of Coinbase's year-over-year volume growth in 2024 is driven by higher volatility levels for crypto assets, particularly in Q1 and Q4, and higher average prices for crypto assets. Two major factors supporting these stronger macroeconomic factors are the launch of a Bitcoin ETF product in Q1 2024, and the election of a pro-cryptocurrency president and Congress in Q4 2024 and the associated expectations of regulatory clarity, both of which lead to increased spot crypto trading activity.

In addition, Coinbase's share of the US spot market increased in 2024. In terms of spot products, Coinase increased its initial listing work (i.e., the first centralized exchange to launch tokens for trading and custody) and added 48 new spot trading assets.

Not only that, Coinbase has also successfully expanded its derivatives business in 2024. For example, 92 new assets have been added for trading on the international exchange. Although it is still in its early stages, both retail and institutional derivatives trading volumes and market share hit record highs in the fourth quarter.

Retail trading income

Retail trading volume in the fourth quarter was $94 billion, up 176% from the previous quarter, far exceeding the US spot market, which grew 126% from the previous quarter. Retail trading revenue was $1.3 billion this quarter, up 179% from the previous quarter. This may be related to the fact that Coinbase listed 13 new assets in the fourth quarter, including popular memecoins such as PEPE and WlF. All in all, these efforts (plus market conditions) drove MTU up 24% from the previous quarter.

Institutional trading income

Institutional trading volume was $345 billion in the fourth quarter, up 128% from the previous quarter, outperforming the U.S. spot market. Institutional trading revenue was $141 million in the quarter, up 156% from the previous quarter. The fourth quarter was a strong performance, with significant quarter-on-quarter revenue growth in both Exchange and Prime. In addition to strong market conditions, the institutional business is also developing strong momentum.

Other trading income

Other transaction revenue in the fourth quarter was $68 million, up 99% quarter-over-quarter, primarily driven by increased revenue from Base's sorter. Transaction volume continued to grow quarter-over-quarter and revenue per transaction was higher due to increased network demand and higher ETH prices in the fourth quarter. The average cost per transaction remained below the $0.01 target.

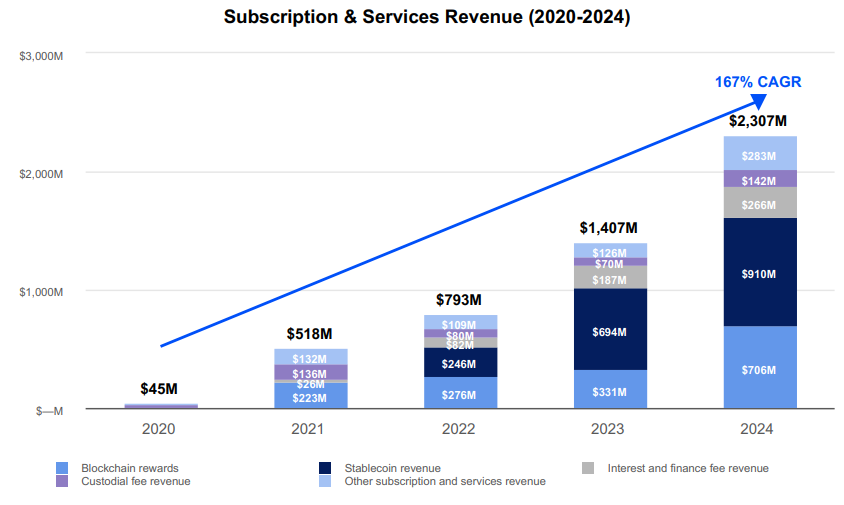

Subscription and services revenue

Subscription and service revenue in 2024 is $2.3 billion, up 64% year-over-year, and about 4.5 times higher than the bull market level in 2021. Most of the year-over-year growth in 2024 comes from blockchain reward revenue, stablecoin revenue, and Coinbase One subscription revenue.

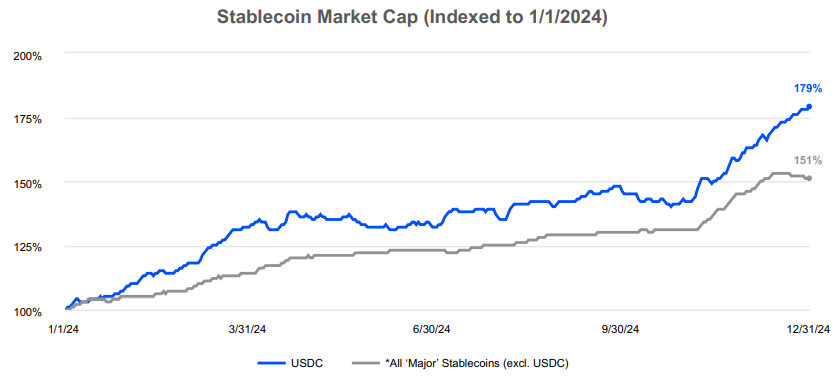

Subscription and services revenue was $641 million in the fourth quarter, up 15% from the previous quarter. Stablecoin revenue fell 9% from the previous quarter to $226 million in the fourth quarter, but increased 31% year-on-year to $910 million for the full year. Overall, USDC is the fastest growing "major" stablecoin in 2024. Stablecoin revenue in the fourth quarter was driven by a significant increase in USDC average market capitalization and USDC assets across the product suite.

Blockchain reward revenue in the fourth quarter was $215 million, up 39% from the previous quarter. The growth was driven by rising crypto asset prices, rising average protocol reward rates (especially SOL), and continued inflows of native assets.

Fourth quarter interest and financing fee income was $66 million, up 3% sequentially. Growth was primarily driven by Prime Financing, which saw record loan balances following the U.S. election in early November. Loan volume growth was driven by increased trade finance activity related to ETF products and increased utilization of bilateral loan products. Growth in Prime Financing fees was partially offset by a decline in client managed fiat balance revenue, as average balances increased 7% sequentially to $5.1 billion, but this was offset by lower effective interest rates.

Custody fee revenue was $43 million in the fourth quarter, up 36% from the previous quarter. Growth was driven by rising crypto asset prices and continued growth in the number of custody accounts. BTC inflows were the biggest driver of growth, thanks to Coinbase's role as the primary custodian of the vast majority of ETFs, as well as other customer activity. It also benefited from the first-day launch program in the fourth quarter. As of the fourth quarter, assets under custody ("AUC") were $220 billion, which is part of the platform's total assets.

Other subscription and services revenue was $91 million, up 56% sequentially. Coinbase One was the largest driver of sequential growth.

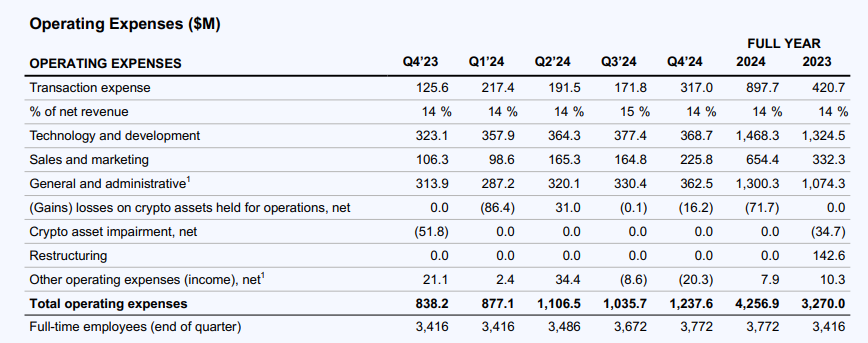

Full-year operating expenses were $ 4.3 billion, with transaction and marketing costs rising

Total operating expenses in 2024 are $4.3 billion, up 30% year-over-year to $1 billion. Technology and development, general and administrative, and sales and marketing expenses combined increased 25% year-over-year to $692 million. The increase was mainly due to increased variable area expenses, especially USDC reward expenses and marketing expenses, as well as higher stock compensation and policy expenses due to increased cryptocurrency publicity. At the end of the year, there were 3,772 full-time employees, up 10% year-over-year.

Total operating expenses for the fourth quarter were $1.2 billion, up 19% sequentially to $202 million, primarily due to higher transaction fees as a result of increased trading activity. Technology and development, general and administrative, and sales and marketing expenses increased by a total of $84 million, or 10% sequentially, primarily due to performance marketing expenses, higher USDC rewards (due to a significant increase in USDC assets across the product suite), and policy-related expenses.

Transaction fees in the fourth quarter were $317 million, accounting for 14% of net revenue, an increase of 85% from the previous quarter. The previous quarter growth was mainly due to the increase in transaction volume, blockchain reward fees, and blockchain transaction fees (primarily BTC and ETH).

Technology and development expenses were $369 million, down 2% sequentially due to lower personnel-related expenses, partially offset by higher professional services-related expenses.

General and administrative expenses were $363 million, up 10% sequentially. The increase was driven by investments in customer support related to the strong market environment in the fourth quarter and higher legal-related and policy-related expenses.

Sales and marketing expenses were $226 million, up 37% quarter-over-quarter. Market momentum in the fourth quarter was supported by increased variable performance marketing spend and promotional activities to drive user acquisition and revenue growth in the United States and internationally. USDC rewards also increased 29% quarter-over-quarter to $80 million due to the increase in USDC assets in the product suite.

In addition, in terms of the number of shares, Coinbase's fully diluted share count at the end of the fourth quarter was 286.5 million shares. This number includes 253.6 million common shares and 32.9 million diluted shares.

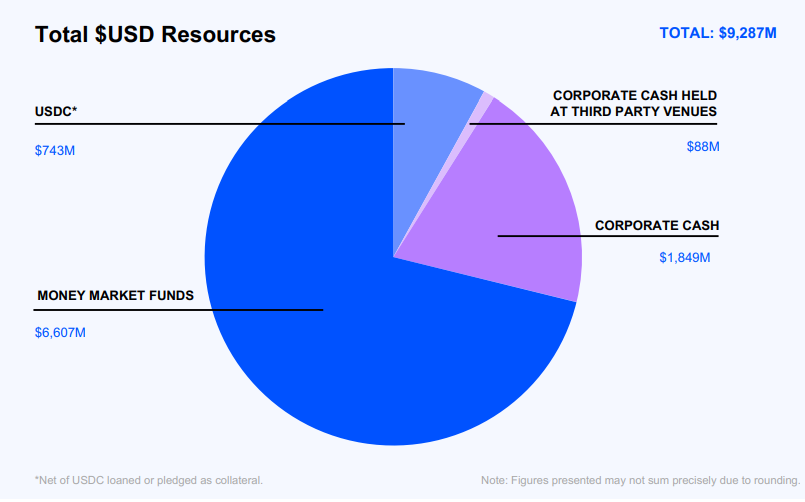

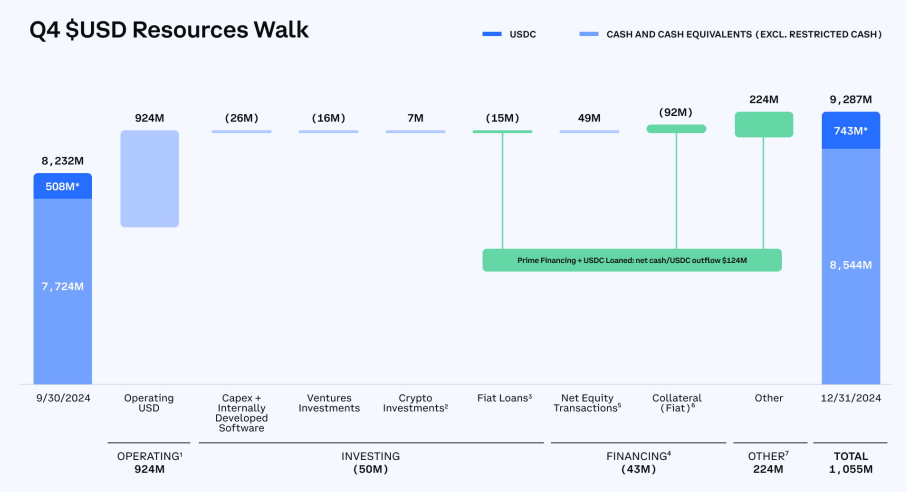

In terms of capital and liquidity, Coinbase had USD resources of $9.3 billion at the end of the fourth quarter, which is defined as cash and cash equivalents and USDC (net of USD lent or pledged as collateral). USD resources increased by 13% month-on-month to $1.1 billion.

In the first quarter of this year, the company has achieved transaction revenue of US$ 750 million and will continue to promote revenue diversification

The report said that as of February 11, Coinbase had generated about $750 million in trading revenue in the first quarter of this year. Coinbase said it is working to diversify its revenue sources and no longer rely solely on trading. According to last year's financial report, as of the fourth quarter, Coinbase's trading revenue accounted for 68.5% of its total revenue, most of which came from retail traders.

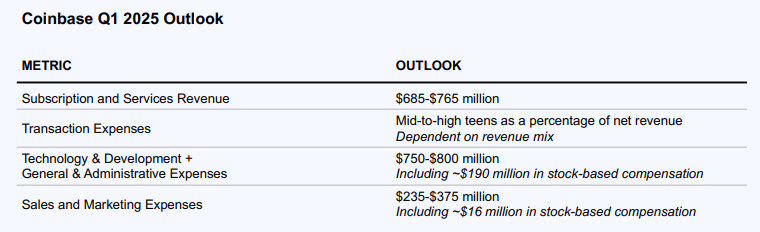

For the quarter, revenue from its subscription and services business, which includes stablecoin, staking, custody, and Coinbase One products, is expected to be between $685 million and $765 million.

Coinbase also expects the USDC stablecoin, which is issued by Circle and has a revenue-sharing agreement with Coinbase, to drive a sequential increase in sales and marketing expenses in the first quarter.

Coinbase CEO Brian Armstrong said on an earnings call that the company has “an ambitious goal of making USDC the number one stablecoin.”

Transaction costs are expected to be in the mid-to-high range as a percentage of net revenue. Technology and development and general and administrative expenses are expected to be between $750 million and $800 million. In addition, payroll taxes are expected to increase quarter-over-quarter due to seasonal factors. Net income growth is expected to be slightly higher than in the fourth quarter.

Sales and marketing expenses are expected to be between $235 million and $375 million in the first quarter of 2025. Marketing opportunities that met or exceeded ROI thresholds have increased significantly since mid-Q4 across both new and existing paid marketing channels in the U.S. and key international markets. Nonetheless, day-to-day spending on performance marketing varied widely in the first quarter due to continued volatility in crypto market conditions. As a result, the range of potential results for the first quarter is expected to be much wider than in previous periods. Whether or not this range is within this range will depend largely on the

- Do we continue to see attractive performance marketing opportunities in the remainder of the first quarter, which have historically been closely correlated with market volatility and asset prices?

- USDC assets in the product suite that drive USDC rewards. For reference, this accounted for approximately 35% of sales and marketing expenses in the fourth quarter.

Related reading: Coinbase report: Outlook for the entire crypto market in 2025

You May Also Like

Momentous Grayscale ETF: GDLC Fund’s Historic Conversion Set to Trade Tomorrow

The UA Sprinkler Fitters Local 669 JATC – Notice of Privacy Incident