Tether Launches Scudo, Bringing Fractional Gold Ownership to XAUT

Tether has launched “Scudo,” a new unit of account for Tether Gold XAUT $4 485 24h volatility: 0.9% Market cap: $2.33 B Vol. 24h: $383.29 M designed to facilitate fractional transactions, making it easier to make and accept payments in gold.

According to a Jan. 6 press release from Tether, one Scudo is equal to one thousandth of a troy ounce of gold or the equivalent amount of XAUT. This allows users to price assets in a manner that avoids what Tether refers to as “complex decimal fractions of XAUT.”

Tether says users can transact in whole or partial Scudo units, making it practical to use gold as a medium of exchange, even for daily use. This added accessibility could appeal to investors and cryptocurrency holders seeking safe haven during economic disruption.

Gold reaches all-time highs

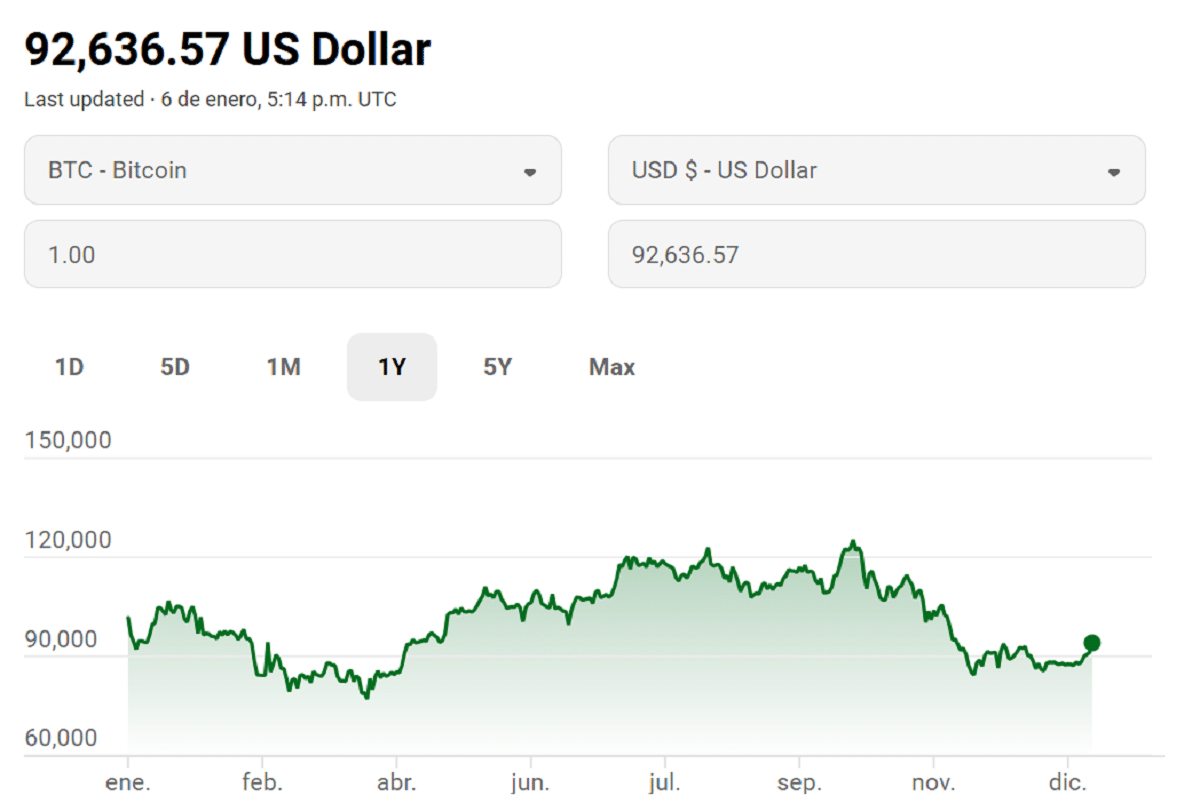

In October 2025, gold reached a new all-time high of $4,058.98 per ounce. Meanwhile, Bitcoin BTC $91 889 24h volatility: 2.2% Market cap: $1.83 T Vol. 24h: $54.86 B also claimed a new all-time high in the same month, peaking at $125,556 as 2025 came to a close. Before the year was out, however, Bitcoin would plummet below $85,000 in November. It managed to claw its way back to $90K by year’s end but, as of the time of this article’s publication, a brief pulse to $94K on Jan. 5 has been undone as BTC sits at $92.5K.

Bitcoin price as of Jan. 6 | Source: LSEG

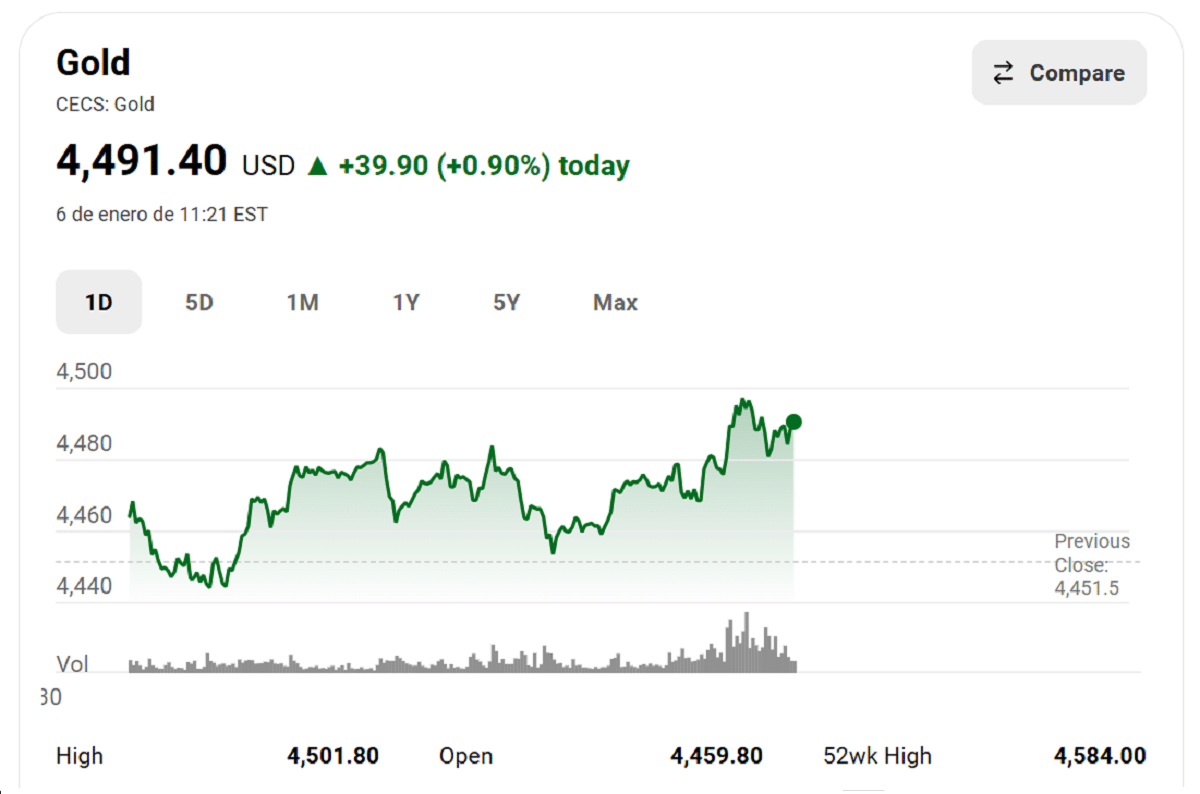

Gold managed to maintain its post-October momentum, reaching a new all-time high price of $4,525.16 per ounce on Dec. 23, 2025 before retreating slightly over the next week. As of Jan. 6, gold has reclaimed $4,491 and is up nearly a percent for the day.

Gold price as of Jan. 6 | Source: LSEG

The economic impact of skyrocketing gold prices and relative instability within the cryptocurrency market, especially among cornerstone tokens such as Bitcoin and Ethereum ETH $3 219 24h volatility: 0.5% Market cap: $388.33 B Vol. 24h: $29.26 B , has positioned both stablecoins and gold as prime value stores for investors and traders.

nextThe post Tether Launches Scudo, Bringing Fractional Gold Ownership to XAUT appeared first on Coinspeaker.

You May Also Like

Last Chance: BlockDAG’s $441M Presale Ends Jan 26, While Cardano & SUI Price Generate Buzz

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more