PostgreSQL & HypoPG: The Experimental Foundation of IA2 Index Selection

Table of Links

Abstract and 1. Introduction

-

Related Works

2.1 Traditional Index Selection Approaches

2.2 RL-based Index Selection Approaches

-

Index Selection Problem

-

Methodology

4.1 Formulation of the DRL Problem

4.2 Instance-Aware Deep Reinforcement Learning for Efficient Index Selection

-

System Framework of IA2

5.1 Preprocessing Phase

5.2 RL Training and Application Phase

-

Experiments

6.1 Experimental Setting

6.2 Experimental Results

6.3 End-to-End Performance Comparison

6.4 Key Insights

-

Conclusion and Future Work, and References

6 Experiments

Our experiments are designed to evaluate the IA2 on several critical aspects of database optimization and index selection. Specifically, we aim to (1) analyze the performance of IA2’s core algorithm, TD3-TD-SWAR, against other reinforcement learning algorithms, showcasing its unique strengths and contributions; (2) assess the efficiency of the action masking technique in IA2 for action space reduction and learning process acceleration; and (3) measure the end-to-end (E2E) workload runtime improvements achieved with IA2, highlighting its practical impact on database performance.

6.1 Experimental Setting

Implementation and Environment: Our prototype is implemented in Python, utilizing PyTorch for model development. Interfaced with PostgreSQL 15.6, it integrates HypoPG for what-if analysis, aiding in query cost estimation. Experiments are conducted on a virtual machine powered by a shared Nvidia Quadro RTX8000 GPU and equipped with 8 CPU cores, within a single-threaded SQL-DB environment.

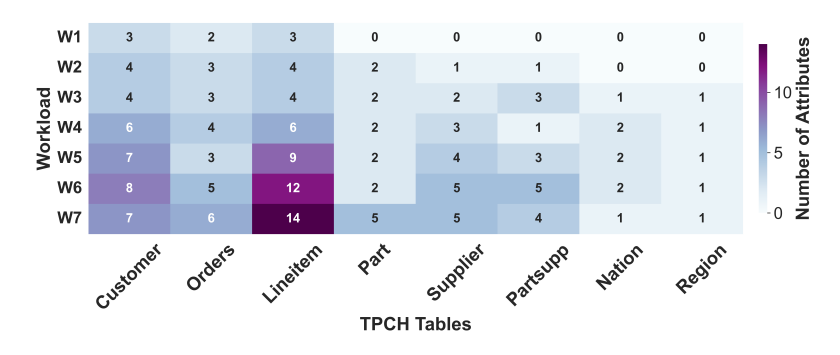

\ Benchmark Workloads: TPC-H (SF1) forms the basis for seven workloads (W1 - W7), derived from its 22 query templates plus additional queries for a broad evaluation scope. Each workload contains 50 queries, with complexity reflected in the diversity of tables and attributes. W7, uniquely, serves as a test for IA2’s ability to generalize, being unseen during training. W1-W6 are used for standard training and evaluation, while W7 undergoes slight fine-tuning on a subset of the training set for performance assessment on novel queries. Workload outlines are depicted in Figure 4.

\

\ Competitors: Our evaluation includes comparisons with SWIRL, DRLinda, Extend, and Lan et al., as discussed in Section 2, to benchmark IA2 against the state-of-the-art in index selection. Comparison of these selected RL-based index advisors is shown in Tabel 1

\ Evaluation Metrics: The primary metric for assessing IA2 and its competitors is the end-to-end runtime of workloads, using the performance gain ratio for direct optimization comparisons across index advising methods. The evaluation covers trends in Storage Budget (2-8), Workloads, and Training Episodes (50-400), with storage quantified in units where 1 unit equals 128MB.

\

:::info Authors:

(1) Taiyi Wang, University of Cambridge, Cambridge, United Kingdom (Taiyi.Wang@cl.cam.ac.uk);

(2) Eiko Yoneki, University of Cambridge, Cambridge, United Kingdom (eiko.yoneki@cl.cam.ac.uk).

:::

:::info This paper is available on arxiv under CC BY-NC-SA 4.0 Deed (Attribution-Noncommercial-Sharelike 4.0 International) license.

:::

\

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Trading bots gain traction as crypto markets move sideways: HTX 2025 recap

The cryptocurrency exchange reported sharp growth in automated trading as vol