Red alert: The Shiba Inu price rally could be shortlived

Shiba Inu price has inched higher this week as investors return to the crypto market, but key fundamentals and technical indicators suggest the rally may be short-lived.

Shiba Inu (SHIB) rose to $0.000012 on Thursday, with its 24-hour volume jumping to over $270 million. This rebound lagged behind that of the top meme coins like Dogecoin (DOGE) and Pepe (PEPE).

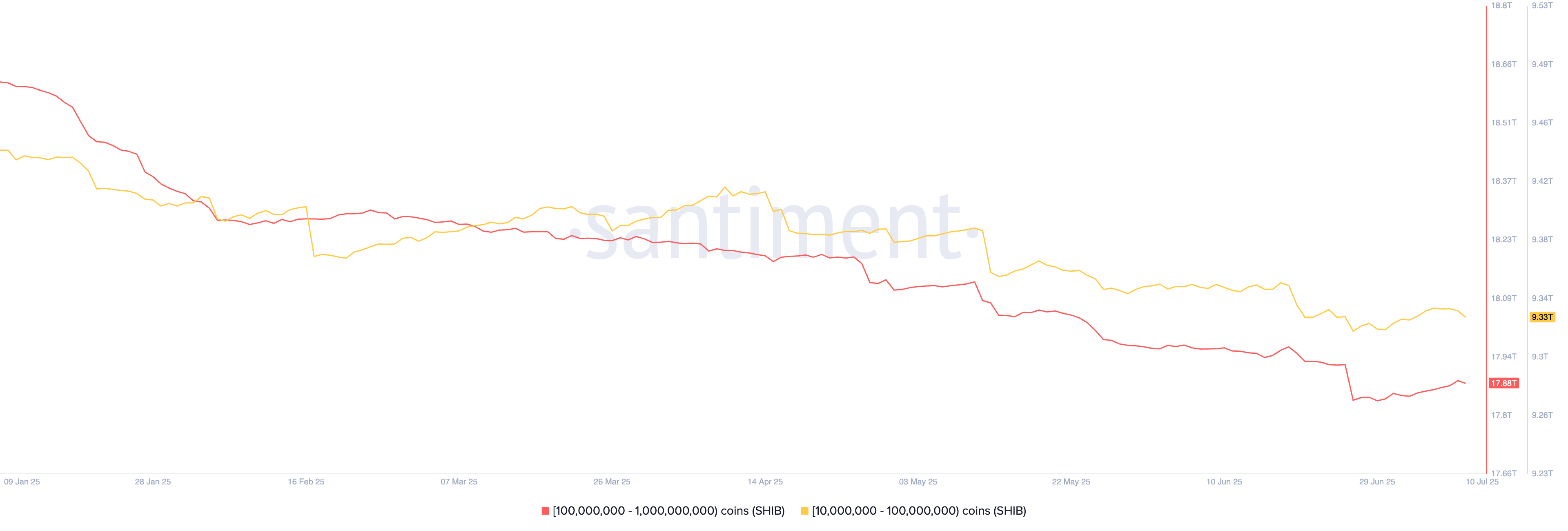

There are several reasons why Shiba Inu’s rally may be short-lived. First, whales have remained on the sidelines this year, with many selling their coins in a sign of capitulation.

Santiment data shows that holders of between 10 million and 1 billion coins have been on a selling spree this year. This selling pressure explains why SHIB has underperformed other meme coins.

Second, Shiba Inu’s open interest in the futures market has been weak in the past few months. Open interest stood at just $179 million on Thursday, July 10, much lower than that of other smaller meme coins like Pepe and Bonk.

The same is true for Shiba Inu’s volume in the spot market. The $270 million volume on Thursday was lower than Dogecoin’s $2.4 billion, while Pepe, Bonk, and Pudgy Penguins each had over $1 billion.

Shiba Inu’s ecosystem is also struggling, with Shibarium holding a total value locked of just $2.3 million and its transaction growth declining. Its other tokens, such as BONE, TREAT, and LEASH, have also not gained traction.

Shiba Inu technical analysis points to a dive

Meanwhile, technical analysis signals that Shiba Inu price may be on the verge of a bearish breakout. The Average Directional Index has tumbled to 18, a sign that the rally has no momentum. An ADX figure of 20 and below, especially when pointing downward, is usually a bearish sign.

Further, Shiba Inu remains below the Supertrend indicator, indicating that this recovery is still weak. The coin also remains below the 50-day and 100-day moving averages.

The biggest risk, however, is that the ongoing rally is part of the handle section of the inverse cup-and-handle pattern. This pattern often leads to a strong bearish breakdown.

Therefore, the coin will likely have a bearish breakout in the near term. This view will be confirmed if it drops below the lower side of the inverse cup-and-handle. Such a move will likely push it below $0.000001.

You May Also Like

Michael Saylor’s Strategy follows Metaplanet, adding 6,269 BTC worth $729 million

Payward Revenue Hits $2.2 Billion as Kraken Exchange Reports Strong 2025 Growth