Binance launches gold and silver perpetual futures in expansion beyond crypto

- Products listed as XAUUSDT and XAGUSDT are designed to track gold and silver prices onchain.

- The contracts operate under FSRA regulation in Abu Dhabi through the ADGM framework.

- Other major exchanges already offer precious metals-linked perpetual contracts, reflecting rising demand.

Binance has widened its derivatives suite by adding perpetual futures linked to gold and silver, marking a push beyond purely digital assets.

The move reflects growing demand among crypto-native traders for exposure to traditional safe-haven markets through familiar onchain infrastructure.

By listing precious metals products that trade around the clock and have no expiry date, the exchange is positioning itself at the intersection of commodities and crypto trading.

The launch comes as gold and silver prices have reached fresh records, drawing renewed attention from investors seeking hedges against volatility across global markets.

Precious metals enter crypto derivatives

The exchange said on Thursday that it had launched perpetual futures contracts tied to gold and silver.

The products allow traders to speculate on price movements without holding the underlying metals and without worrying about contract expiration.

Trading is available continuously, mirroring the structure of crypto perpetuals that already dominate derivatives volumes on major exchanges.

The contracts are listed under the symbols XAUUSDT and XAGUSDT. Both are designed to track the market price of gold and silver, respectively.

Instead of physical settlement, positions are settled in Tether’s USDT stablecoin, giving traders onchain exposure to precious metals pricing while remaining within a crypto-based settlement system.

Settlement and market access

By settling the contracts in USDT, Binance is extending the use of stablecoins beyond crypto-native assets into traditional commodity-linked products.

This structure allows traders to gain price exposure without converting funds into fiat currencies or commodity-backed instruments.

It also removes the need for storage, delivery, or custody arrangements associated with physical gold and silver.

The approach highlights how derivatives are being used to mirror traditional financial markets inside crypto trading platforms.

Binance has indicated that additional contracts linked to traditional assets are planned, suggesting that commodities and other non-crypto markets may feature more prominently in future product rollouts.

Regulatory framework in Abu Dhabi

The gold and silver perpetuals are offered through Next Exchange Limited, a Binance entity operating under the Abu Dhabi Global Market framework.

The contracts fall under the supervision of the Financial Services Regulatory Authority, with Binance holding the relevant licences within ADGM.

This regulatory setup is central to Binance’s effort to expand its derivatives catalogue while maintaining compliance in key jurisdictions.

Abu Dhabi has also become relevant for stablecoin usage, with USDT approved for use by regulated companies in the emirate, even as Tether has chosen not to seek authorisation under the European Union’s Markets in Crypto-Assets framework.

Competition and safe haven demand

Binance is not alone in offering precious metals-linked perpetual contracts.

Other exchanges active in this segment include Coinbase, MEXC, BTCC, BingX, and Bybit, although Bybit currently limits its offering to gold-linked perpetuals.

The growing number of platforms listing such products points to rising interest in blending commodity exposure with crypto derivatives trading.

The timing of Binance’s launch aligns with a period of heightened demand for safe-haven assets.

Both gold and silver have recently climbed to new all-time highs, driven by investor appetite for assets perceived as stores of value.

By enabling trading in these markets via USDT-settled perpetuals, Binance is tapping into that demand while keeping activity within its existing derivatives ecosystem.

The post Binance launches gold and silver perpetual futures in expansion beyond crypto appeared first on CoinJournal.

You May Also Like

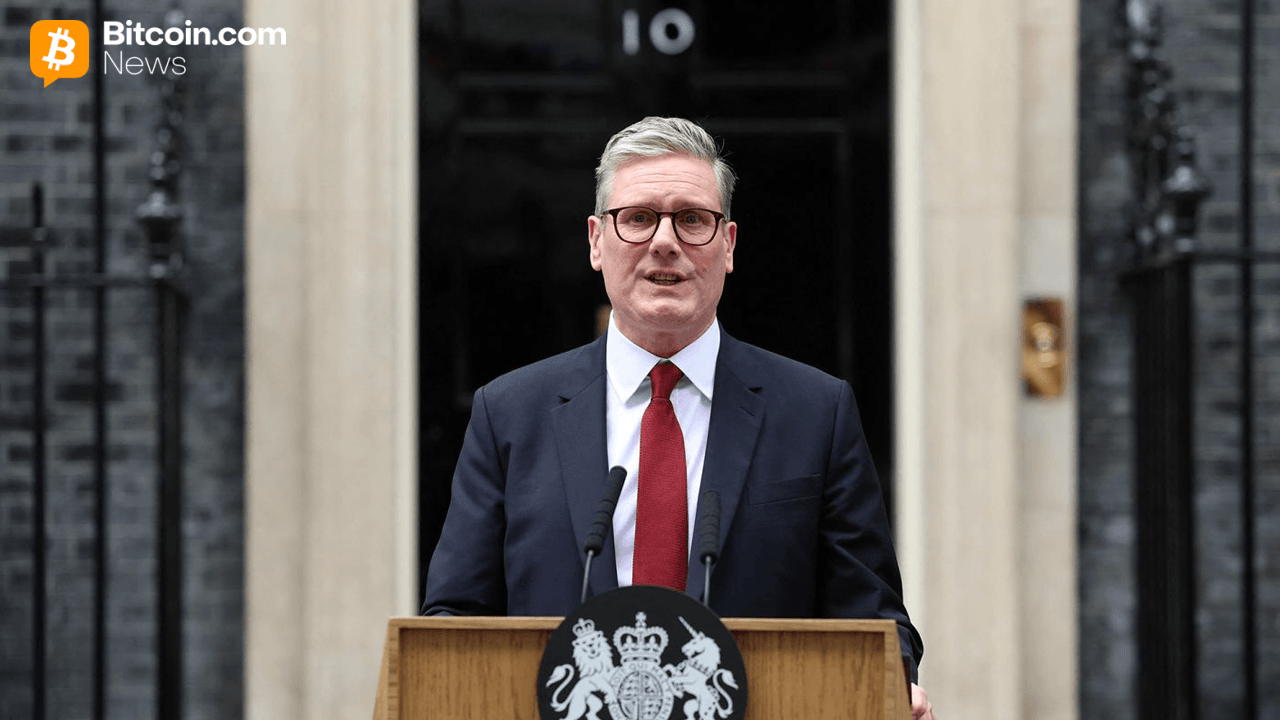

UK Lawmakers Push Starmer to Ban Crypto Donations Amid Foreign Interference Fears

SEC Approves Generic Listing Standards for Crypto ETFs