👨🏿🚀TechCabal Daily – Banks can no longer gatekeep

TGIFFOTY!

Last year, more African healthtechs launched “AI doctors,” smart chatbots that could diagnose symptoms, suggest treatments, and—when things got serious—tell you to see a real physician, or connect you with one. While it truly helps expand healthcare access in rural areas, cutting wait times, these systems were, still at heart, wrappers around information.

That line blurred when OpenAI, working with the US government, unveiled ChatGPT Health. It’s still the same diagnosis play, aiming to support and not replace medical care; it will become accessible to every user in the coming weeks. The question I have is: if ChatGPT Health becomes available for free to every user, will AI doctors still be viable healthtech products that people will pay money to use?

Truly, tech infrastructure providers are the unplayable final boss in hard game mode.

—Emmanuel

- Quick Fire

with Jessica Tee Orika-Owunna

with Jessica Tee Orika-Owunna - South Africa opens payment system to non-banks

- More Nigerians registered for BVN in 2025

- Who secured the bag?

- World Wide Web 3

- Opportunities

features

Quick Fire  with Jessica Tee Orika-Owunna

with Jessica Tee Orika-Owunna

Image: Jessica Tee Orika-Owunna

Image: Jessica Tee Orika-Owunna

Jessica Tee Orika-Owunna is an experienced SaaS content marketing specialist who has worked with global brands such as Vena Solutions, Softr, Contentsquare, Foundation Marketing, and Hotjar, while based in Nigeria. Her work focuses on content strategy and production: creating buyer-first content that drives conversions and supports go-to-market (GTM) teams.

Explain what you do to a 5-year-old.

I help software companies teach their target buyers what their product does and how to use it, so people can decide if it’s the right fit for their needs.

I do this by learning what buyers are trying to get done, what frustrates them, and how they work. Then I create content based on the patterns I see—showing, step by step, how the product helps with real examples and practical tips, or how it compares to other options—so choosing feels easy.

I also make sure these explanations show up in the right places and formats, so the people who need them actually see and use them.

What’s been your biggest career win, and what’s the biggest lesson you’ve learned along the way?

One of my biggest career wins has been building a thriving business after a layoff. I had built an additional income stream alongside my full-time role. It was exhausting at the time, but that extra income became a foundation when my job ended.

Second, I learned to document my work properly. I used to assume good work would automatically lead to promotions or opportunities, but that wasn’t enough. Tracking results, saving proof of impact, and being intentional about presenting my work helped me secure promotions, negotiate better pay, and eventually transition to solopreneurship.

What is one hack you swear by when finding global SaaS jobs?

Be good at what you do but make sure that you’re easy to find and easy to trust online. That’s the one hack I swear by.

Most global opportunities I’ve landed didn’t come from applications. They came from people already having a sense of who I was and how I think. That starts with something as simple as your LinkedIn title. I treat it like a keyword, not a job description, so recruiters and potential clients can actually find me when they search.

Your 2026 demands disciplined financial operations

Fincra powers the payments infrastructure businesses rely on to collect, pay, and settle across local and major African currencies with confidence. Get started.

banking

South Africa is opening its payment rails to non-banks

Image Source: The South African Reserve Bank

Image Source: The South African Reserve Bank

The South African Reserve Bank (SARB), the country’s central bank, plans to open the National Payments System (NPS) to licenced non-bank financial institutions, allowing them to use the country’s core payments infrastructure directly.

State of play: The NPS is the national framework and infrastructure for clearing and settlement—similar in role (though broader in scope) to systems like Nigeria’s NIBSS, Tanzania’s TIPS, or Rwanda’s Rswitch—that enables your funds to move from one account to another. When the NPS opens up the NPS to authorised “non-bank” players, fintechs and mobile money services will be able to access the network directly instead of always going through sponsoring banks; previously, non-banks had to rely on traditional banks—with access to NPS—as intermediaries, and banks charged marked-up processing fees to settle payments.

Between the lines: This development will open the market for banks and non-banks to operate more equitably over time. As a result, banks have lost their gatekeeping hold on the market, where they previously dictated how payments flowed between themselves and fintechs. It will likely force them to lower fees and improve their digital services to compete with nimble fintechs.

Why this matters: While the SARB has blown the whistle on reforming the NPS, it has not yet completed a large-scale rollout, with key directives and the activity‑based authorisation framework still in consultation and phased implementation. When the NPS opens fully, and the new licences are in place, companies like MTN could pursue their own banking or payment‑institution licences and rely less on traditional banking partners to offer payment and money‑holding services for their subsidiaries.

For customers, it means cheaper and faster ways to send money without needing a bank account.

banking

Nigeria saw more BVN registrations in 2025

Image Source: TechCabal

Image Source: TechCabal

When Nigeria introduced Bank Verification Numbers (BVNs), in 2014, the goal was to combat fraud. The country’s banking system was having a hard time identifying customers, and BVNs, which provide a way to identify every Nigerian with a formal bank account, were created to solve that problem.

Over a decade later, 67.8 million Nigerians now have a BVN, or have at least registered. It is a 6.7% jump from 2024’s 63.5 million, showing a steady climb that has lasted half a decade.

BVN 101: It is a biometric identifier that links all of an individual’s bank accounts, now firmly embedded in how Nigeria’s financial system works.

Why are the numbers rising? Policy has done much of the heavy lifting. In April 2024, the Central Bank of Nigeria (CBN) ordered banks to freeze customers’ accounts without a BVN or National Identification Number (NIN), pushing millions to register or risk losing access to their money. The introduction of the Non-Resident BVN (NRBVN), which allows diasporan Nigerians to enrol remotely, also widened the net.

What does it mean? Nigeria had over 320 million active bank accounts by March 2025, many tied to the same BVN. The BVN growth would ensure that trust is improved and fraud, the main reason it was created, is curbed.

insights

Funding Tracker

Image Source: TechCabal Inights

Image Source: TechCabal Inights

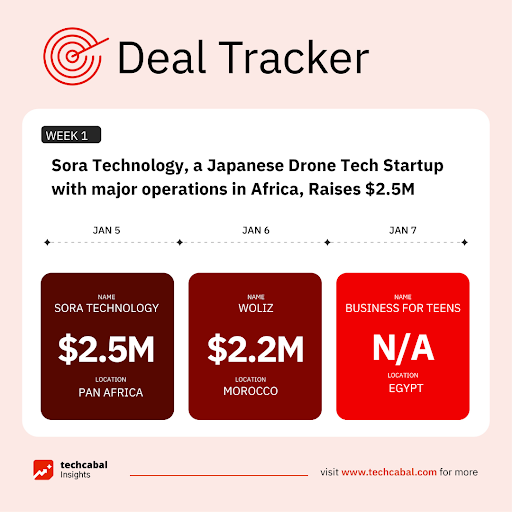

Sora Technology, a Japanese drone technology startup with significant operations in Africa, secured $2.5 million in a late-stage seed funding round. The investment was led by three investors, including Daiwa House Group Investment Limited Partnership, Central Japan Innovative Research Fund I, and UNERI Capital Fund Series I, which joined existing investors. (Jan 5)

Here are the other deals for the week:

- Woliz, a Moroccan retailtech startup, raised $2.2 million in equity investment from Sanlam Maroc. (Jan 6)

- Business For Teens, an Egyptian Edtech startup, raised an undisclosed pre-seed funding led by Salah Abou Elmagd, alongside a group of angel investors. (Jan 7)

Follow us on Twitter, Instagram, and LinkedIn for more funding announcements. Before you go,what did we learn about African tech in 2025? Find out here.

CRYPTO TRACKER

The World Wide Web3

Source:

|

Coin Name |

Current Value |

Day |

Month |

|---|---|---|---|

| Bitcoin | $90,918 |

– 0.05% |

– 1.84% |

| Ether | $3,114 |

– 1.21% |

– 6.22% |

| XRP | $2.12 |

– 1.81% |

+ 1.73% |

| BNB | $894 |

+ 0.33% |

+ 0.31% |

* Data as of 06.27 AM WAT, January 9, 2026.

Opportunities

- Detty December is getting more expensive, but young Africans are not backing down from the vibes. A 2025 Accrue report surveyed 631 people across Ghana, Nigeria, and Kenya—86% of them Gen Zs and late millennials aged 18–34—most living in moderately sized households with at least one income source, yet only 4% earn above $5,000 in total monthly household income. Yet, 60% say they planned to spend more in 2025, with outdoor events, concerts, house parties, travel, dining out, and leisure activities taking the biggest share of their budgets as Detty December cements itself as both culture and economic force. Many rely on money from abroad, receiving funds via mobile money, bank transfers, and virtual USD accounts, while navigating fees and delays. They plan ahead, stretch budgets, borrow, or sell assets just to keep the Detty December tradition alive. Download the report.

- The Growth Talent Accelerator Programme

- (GTAP) is alGROWithm’s flagship training experience designed to turn ambitious professionals, operators, and teams into world-class Growth Engineers. If you’re an individual looking to upskill and become indispensable in 2026, or a company looking to strengthen your team, optimise operations, and increase revenue, GTAP 2026 is the right place to start. Apply for the Lite stream as an individual or nominate your team for the Pro stream. Over 50 companies in Africa have transformed their team members into business growth operators with alGROWithm’s Growth Talent Accelerator Programme. Nominate your team members for the February cohort today.

- TechCabal is conducting a short survey to help identify the ecosystem’s performance, capital conditions, choices, and trade-offs in 2025. You can also share this poll with anyone that works in African tech. We would appreciate your participation; fill the form here.

- In 2026, smart money will find its way to Francophone Africa

- Why failed airtime top-ups in Nigeria will now be refunded in 30 seconds Will Nigeria get its first AI data centre in 2026? The data says it is likely

Written by: Emmanuel Nwosu and Opeyemi Kareem

Edited by: Emmanuel Nwosu & Ganiu Oloruntade

Want more of TechCabal?

Sign up for our insightful newsletters on the business and economy of tech in Africa.

- The Next Wave: futuristic analysis of the business of tech in Africa.

- Francophone Weekly by TechCabal: insider insights and analysis of Francophone’s tech ecosystem

P:S If you’re often missing TC Daily in your inbox, check your Promotions folder and move any edition of TC Daily from “Promotions” to your “Main” or “Primary” folder and TC Daily will always come to you.

You May Also Like

U.S. workers received 53.8% of GDP in the third quarter, the lowest share since records began in 1947

Why AI Needs Access Controls Before It Gets Out of Control