The total market value of AI Agent plummeted by 67%. The competition between Solana and Base chain is surging. Can the old MEME survive by relying on AI?

Author: Frank, PANews

AI Agent is unanimously recognized by the industry as one of the most noteworthy tracks in 2025. However, with the recent market adjustments, AI Agent has also experienced a sharp decline. From the data point of view, how big is the correction of AI Agent? What kind of competition changes are quietly taking place between chains? PANews conducted an investigation on the recent data changes of AI Agent.

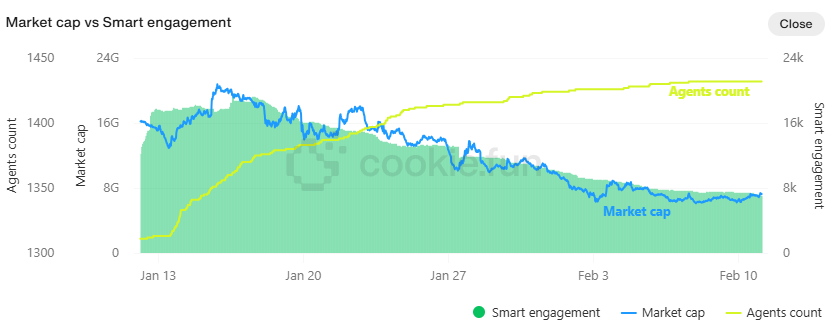

The total market value of AI Agent has fallen by 67% in the past month

According to Cookie.fun data, as of February 10, there were 1,412 AI agents with a total market value of approximately $6.52 billion, a 67% drop from the $20.2 billion on January 15. At the same time, the number of agents continues to increase, with 116 new agents added in the past month, an increase of approximately 8.9%. However, judging from the growth rate, the current rate of new AI agents has also slowed down.

According to data from January 15, the average market value of AI Agent at the time was approximately US$15.07 million, but by February 10, the figure had dropped to US$4.61 million.

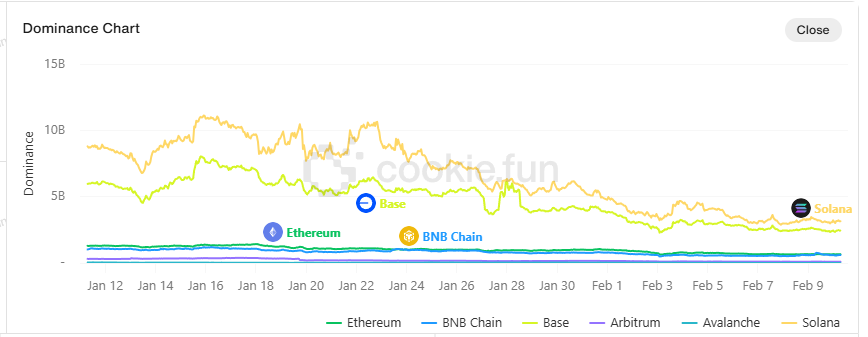

Judging from the distribution of chains, Solana and Base are still the leaders in the AI Agent track. There are 793 AI Agents on the Solana chain, accounting for more than half. The number of AI Agents on Base is 379. In terms of quantity, the number of AI Agents on Base is less than half of Solana. However, in terms of total market value, the total market value of Solana's AI Agent is about US$3.2 billion, and that of Base is US$2.47 billion, with little difference between the two. Calculated by average market value, the average market value of Solana's AI Agent is about US$4.03 million, and the average market value of Base is US$6.51 million. From this perspective, it seems that Base's AI Agent looks more valuable.

Judging from the changes, the decline on the Solana chain is indeed greater. At its peak, the total market value of AI Agent on the Solana chain reached US$11 billion, which is currently down 70%. The peak market value of Base was about US$7.94 billion, down 68.8% over the same period.

Currently, there are 6 AI Agents with a market value of more than 100 million US dollars on the Solana chain, namely FARTCOIN, AI16Z, ARC, ACT, GRIFFAIN, and GOAT. There are 5 AI Agents with a market value of more than 100 million US dollars on BASE, namely VIRTUAL, TOSHI, FAI, AIXBT, and VVV. However, the AI Agent with the highest market value is now VIRTUAL, reaching 760 million US dollars. It is worth mentioning that Virtuals Protocol has been simultaneously expanded to Solana on February 10.

BNB Chain has been developing rapidly in the field of AI Agent recently. Currently, two projects, CHEEMS and CGPT, have a market value of more than $100 million. In addition, BNB Chain has seen a significant increase in Mindshare (the percentage of total discussions about the token on Twitter) recently. On February 7, BNB Chain's Mindshare share was less than 4%. As of February 10, the figure has risen to 21.86%.

BNB Chain’s recent growth is mainly driven by two projects. One is Andy BNB, with a market value of approximately $42 million on February 10, and a mindshare increase of 1.02 to 1.44% in the past seven days. The other is CHEEMS, with a mindshare of approximately 0.97% on February 10 and a market value of approximately $144 million.

The current decline of the top tokens is over 70%. Can the old MEME have a new lease of life by relying on AI?

From the perspective of classification, the current tokens in the AI field are still dominated by MEME and basic frameworks. Among them, the market value of AI tokens in the MEME category is about 1.94 billion US dollars, and the market value of framework-class AI tokens is about 1.49 billion US dollars. The token with the highest market value in the MEME category is still FARTCOIN, with a market value of about 524 million US dollars. Its highest market value once exceeded 2.7 billion US dollars, and its current decline is about 80%. The leading token in the framework category is VIRTUAL, with a current market value of 760 million US dollars and a highest market value of 3.3 billion US dollars, a decline of more than 76.8%.

Another previously popular framework, AI16Z, had a maximum market value of $2.7 billion and fell to a minimum of $270 million, a pullback of 90%. Currently, the market value of AI16Z's token has slightly rebounded to $450 million.

What is a little surprising is that in the MEME category, in addition to FARTCOIN, the second and third ranked tokens are TOSHI (market value of 304 million US dollars) and TURBO (market value of 271 million US dollars).

TOSHI was originally a pet-themed meme coin named after the cat of Brian Armstrong, founder and CEO of Coinbase. The token was issued as early as the end of 2023, and its market value once exceeded US$300 million in 2024, and then fell all the way to around US$30 million. By November 2024, with the rise of the AI Agent trend, the TOSHI token was transformed into an AI token based on the VIRTUAL framework, and its market value took off, reaching a peak of US$960 million. However, judging from the current product framework, the main function of TOSHI is automatic tweeting, and its Twitter followers are only 779.

Another MEME token ranked third is Turbo, which was issued in April 2023 and is said to be the first AI-generated MEME token. The token was issued on Ethereum and is one of the few AI tokens issued on Ethereum with a high market value. Previously, Turbo's highest market value reached US$990 million, and its maximum retracement was more than 80%.

The trend is synchronized with MEME, and the value attribute is not yet displayed

In general, the AI Agent tokens with higher market value have generally fallen back by more than 80% from their peaks. For example, the earliest popular GOAT had a maximum market value of $1.37 billion and a minimum market value of $97.37 million, with a fallback of more than 92%. Observing the market value curves of the top AI tokens, almost all of them show a "painted mountain" shape.

GOAT market value chart

However, judging from the changes in the entire market, this trend is not unique to AI Agent tokens. Looking at other types of MEME coins, the trend is roughly the same. In terms of the share of the top market capitalization, AI Agent tokens may still be the highest type. The only MEME tokens on the Solana chain with a market value of more than $1 billion are TRUMP and BONK. In November 2024, there will be 6 MEME tokens with a market value of $1 billion.

Overall, the total market value of AI tokens in the current crypto space is about $6.67 billion, which is a significant correction from the high of $22 billion. However, in terms of the actual functions and capabilities of these AI agents, there has not yet been an explosive application, and the vast majority of AI agents are still simply tweeting or riding on the popularity of AI. Perhaps for this reason, the volatility of AI tokens is highly similar to that of MEME coins, and does not show the proper value logic at all. As for whether the current market value of AI tokens has been underestimated? It should be noted that the valuation of DeepSeek, which is popular all over the world, was reported on February 9 to be only $8 billion. At least from this perspective, the bubble of AI Agents seems to be quite large.

You May Also Like

The Role of Blockchain in Building Safer Web3 Gaming Ecosystems

- Immutable Ownership of Assets Blockchain records can be manipulated by anyone. If a player owns a sword, skin, or plot of land as an NFT, it is verifiably in their ownership, and it cannot be altered or deleted by the developer or even hacked. This has created a proven track record of ownership, providing control back to the players, unlike any centralised gaming platform where assets can be revoked.

- Decentralized Infrastructure Blockchain networks also have a distributed architecture where game data is stored in a worldwide network of nodes, making them much less susceptible to centralised points of failure and attacks. This decentralised approach makes it exponentially more difficult to hijack systems or even shut off the game’s economy.

- Secure Transactions with Cryptography Whether a player buys an NFT or trades their in-game tokens for other items or tokens, the transactions are enforced by cryptographic algorithms, ensuring secure, verifiable, and irreversible transactions and eliminating the risks of double-spending or fraudulent trades.

- Smart Contract Automation Smart contracts automate the enforcement of game rules and players’ economic exchanges for the developer, eliminating the need for intermediaries or middlemen, and trust for the developer. For example, if a player completes a quest that promises a reward, the smart contract will execute and distribute what was promised.

- Anti-Cheating and Fair Gameplay The naturally transparent nature of blockchain makes it extremely simple for anyone to examine a specific instance of gameplay and verify the economic outcomes from that play. Furthermore, multi-player games that enforce smart contracts on things like loot sharing or win sharing can automate and measure trustlessness and avoid cheating, manipulations, and fraud by developers.

- Cross-Platform Security Many Web3 games feature asset interoperability across platforms. This interoperability is made viable by blockchain, which guarantees ownership is maintained whenever assets transition from one game or marketplace to another, thereby offering protection to players who rely on transfers for security against fraud. Key Security Dangers in Web3 Gaming Although blockchain provides sound first principles of security, the Web3 gaming ecosystem is susceptible to threats. Some of the most serious threats include:

Vitalik Buterin Challenges Ethereum’s Layer 2 Paradigm