POL Skyrockets by 17% Daily, BTC Price Calms Above $90K: Weekend Watch

The expectations for a highly volatile Friday due to the numerous significant developments in the US didn’t really materialize, and BTC has calmed at $90,500.

Most larger-cap alts have remained sluggish over the past 24 hours, with ETH struggling below $3,100, and XRP close to breaking beneath $2.10.

BTC Calms

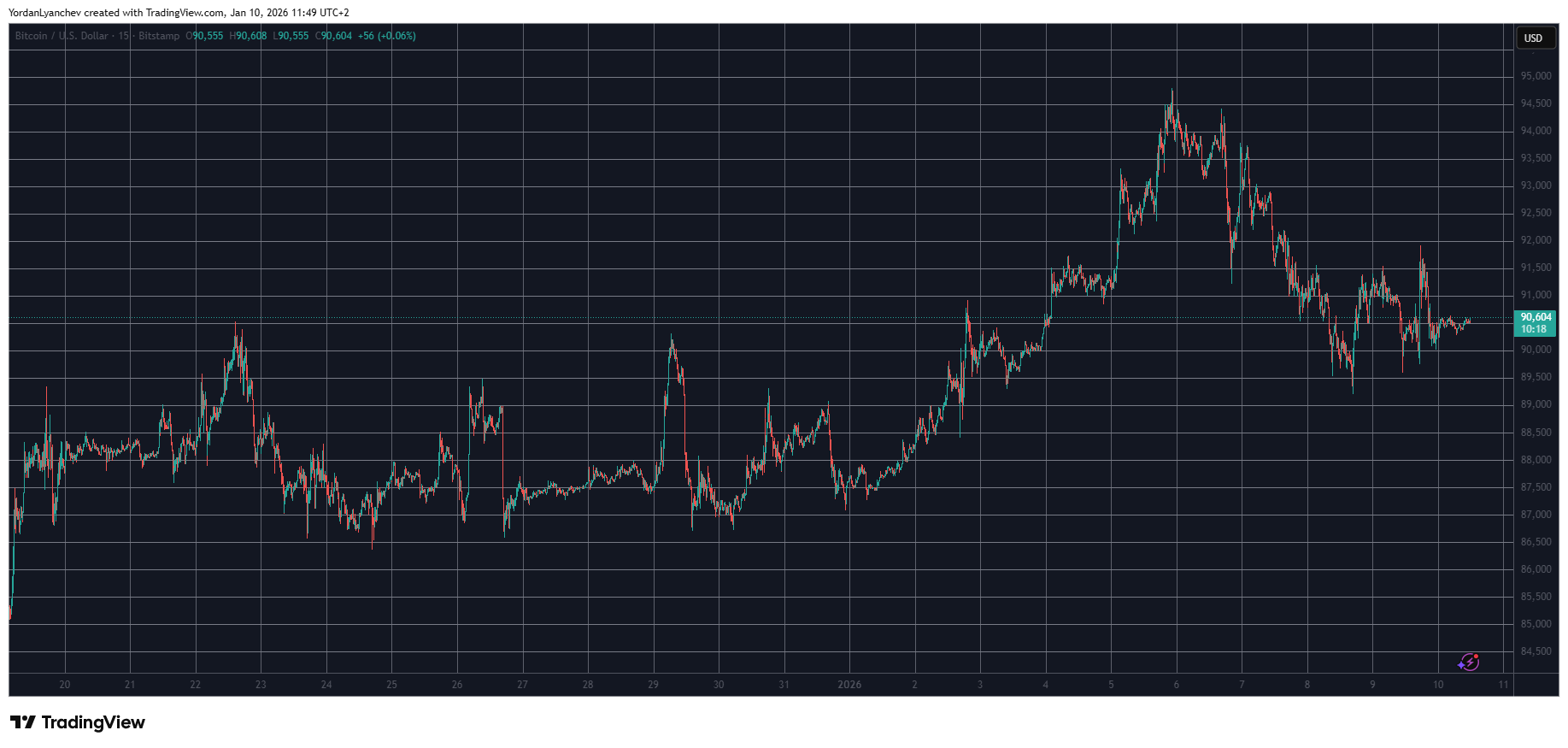

The primary cryptocurrency began the business week on the right foot, surging to almost $95,000 on Tuesday morning. This impressive price jump came after the volatile weekend, in which bitcoin defended the $90,000 support even after the US carried out a successful military operation in Venezuela and captured its president.

After that multi-week peak, though, BTC faced an immediate rejection. It dumped to $91,200 almost immediately, before it jumped to $94,000, only to be halted once again. Its nosedive continued as the week progressed and slipped to just over $89,000 on Thursday. The bulls managed to contain the losses and pushed it to $92,000 yesterday.

More volatility was expected throughout the day as the US Supreme Court was scheduled to release its decision on the legality of Trump’s tariffs. However, the decision was delayed, and BTC remained relatively stagnant as it now trades at $90,500, with little to no movement over the past 12 hours.

Its market cap stands at $1.810 trillion, while its dominance over the alts is close to 57% on CG.

BTC USD Jan 10. Source: TradingView

BTC USD Jan 10. Source: TradingView

POL Up, ZEC Down

ETH, XRP, SOL, and DOGE are slightly in the red on a daily scale. As a result, ETH is inches below $3,100, while XRP is shaky at $2.10. SOL has slipped to $136, while DOGE is at $0.14. ZEC has plunged the most from the larger-cap alts, losing 12% of value to $380 as of press time.

In contrast, POL has skyrocketed by 17% and now sits close to $0.17. TAO and SUI have also marked gains over the past day, while BNB sits above $900, and TRX is close to $0.30.

The total crypto market cap has increased by around $20 billion in a day, and is now up to $3.180 trillion.

Cryptocurrency Market Overview January 10. Source: QuantifyCrypto

Cryptocurrency Market Overview January 10. Source: QuantifyCrypto

The post POL Skyrockets by 17% Daily, BTC Price Calms Above $90K: Weekend Watch appeared first on CryptoPotato.

You May Also Like

The Channel Factories We’ve Been Waiting For

Vitalik: The crypto industry needs to address three major issues to develop better decentralized stablecoins.