CryptoQuant founder Ki Young Ju has criticized X for suppressing crypto-related posts while failing to rein in a surge of automated spam, arguing that the platform is punishing legitimate users instead of addressing the underlying bot problem.

In a Sunday post on X, Ju pointed to a sharp spike in automated activity tied to the keyword “crypto,” citing data showing more than 7.7 million posts generated in a single day, an increase of over 1,200% compared with prior levels. According to Ju, the flood of low-quality content has triggered algorithmic crackdowns that also affect genuine crypto accounts.

“As AI advances, bots are inevitable,” Ju wrote, adding that X’s inability to distinguish automated accounts from humans is the real issue. He also criticized the platform’s paid verification system, saying it has failed as a filtering tool and now allows bots to “pay to spam,” while authentic users see their reach reduced.

“It is absurd that X would rather ban crypto than improve its bot detection,” Ju wrote.

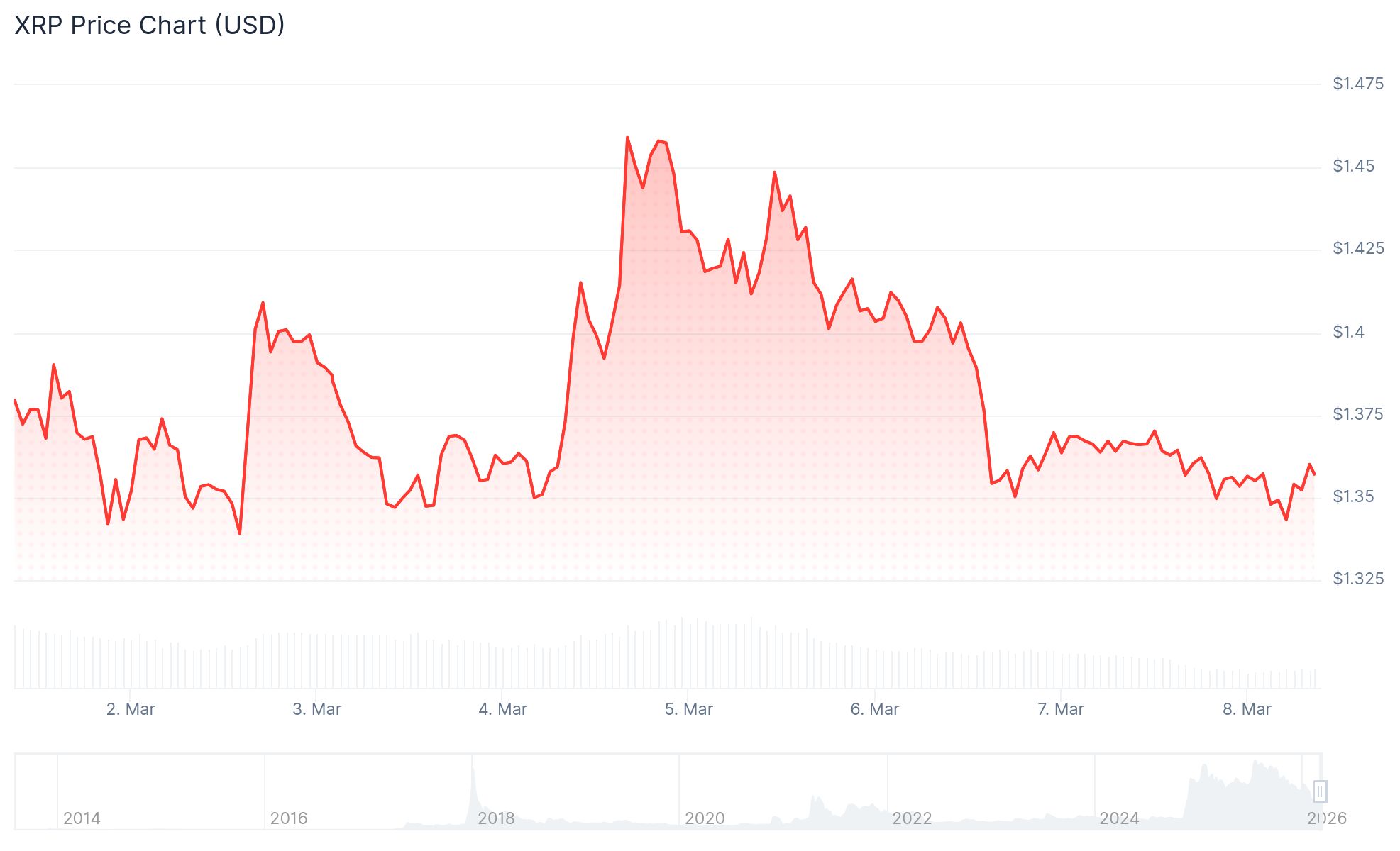

Bots generate massive amount of crypto posts. Source: Ki Young JuRelated: Vitalik says Grok arguably a ‘net improvement’ to X despite flaws

X product lead blames CT’s reach decline on overposting

The criticism came after Nikita Bier, X’s head of product, revealed that Crypto Twitter’s (CT) visibility problems are partly self-inflicted. Bier said many accounts burn through their daily reach by posting or replying excessively, often with low-value messages such as repeated “gm” replies, leaving little visibility when they later share substantive content like project updates.

“CT is dying from suicide, not from the algorithm,” Bier wrote, arguing that over-posting dilutes reach because the average user only sees a limited number of posts per day.

The remark sparked debate across crypto circles. “They’ve been openly suppressing CT content, forgetting that it’s a large niche that keeps X alive,” one crypto user said.

Related: Bitcoiners bullish over Elon Musk tipping ‘double-digit’ economic growth

X remains crypto’s main communication platform

Crypto users rely on X as their primary real-time communication hub, using the platform to share market insights, project updates, breaking news and onchain analysis.

Last year, X rolled out a messaging feature called XChats, which Elon Musk said would include “Bitcoin-style encryption” alongside audio and video calls, vanishing messages, file sharing and a redesigned architecture built using the Rust programming language.

Magazine: How crypto laws changed in 2025 — and how they’ll change in 2026

Source: https://cointelegraph.com/news/cryptoquant-founder-slams-x-over-bot-spam-and-crypto-suppression?utm_source=rss_feed&utm_medium=feed&utm_campaign=rss_partner_inbound