MSTR stock at a make-or-break price as Strategy buys 13,627 Bitcoins

MSTR stock remained on edge at a crucial support level and is at risk of a big dive as the recent crypto market rally lost momentum.

- The MSTR share price continued its downtrend this year and is hovering at its lowest level since September 2024.

- Strategy bought 13,627 coins worth ~$1.25 billion last week.

- Technical analysis suggests that the coin has more downside to go in the near term.

Strategy, formerly known as MicroStrategy, was trading at the key support level at $157, a few points above the year-to-date low of $150. It remains 65% below its highest level in July last year.

The stock continued to drop on Monday as Bitcoin (BTC) retreated to $90,000 from the year-to-date high of $94,550. It also dropped after the company announced a huge Bitcoin purchase.

It acquired 13,627 coins for $1.25 billion, bringing its total holdings to 687,410. Its current holdings are valued at over $62.5 billion, higher than its market capitalization of over $45 billion and its enterprise value of $59 billion. As a result, its market net-asset value has dropped to 0.726.

One major risk for the stock is that the company continues to dilute investors as its Bitcoin purchases are now fully funded by its share sales. Its outstanding shares have soared to over 300 million, up from 77 million in 2021. This dilution will continue rising as the company has over $11 billion in its at-the-money authorization.

MSTR stock has also dropped as more investors take the opposite direction. Its short interest has jumped to 10.23% from below 8% in 2025.

MSTR stock technical analysis

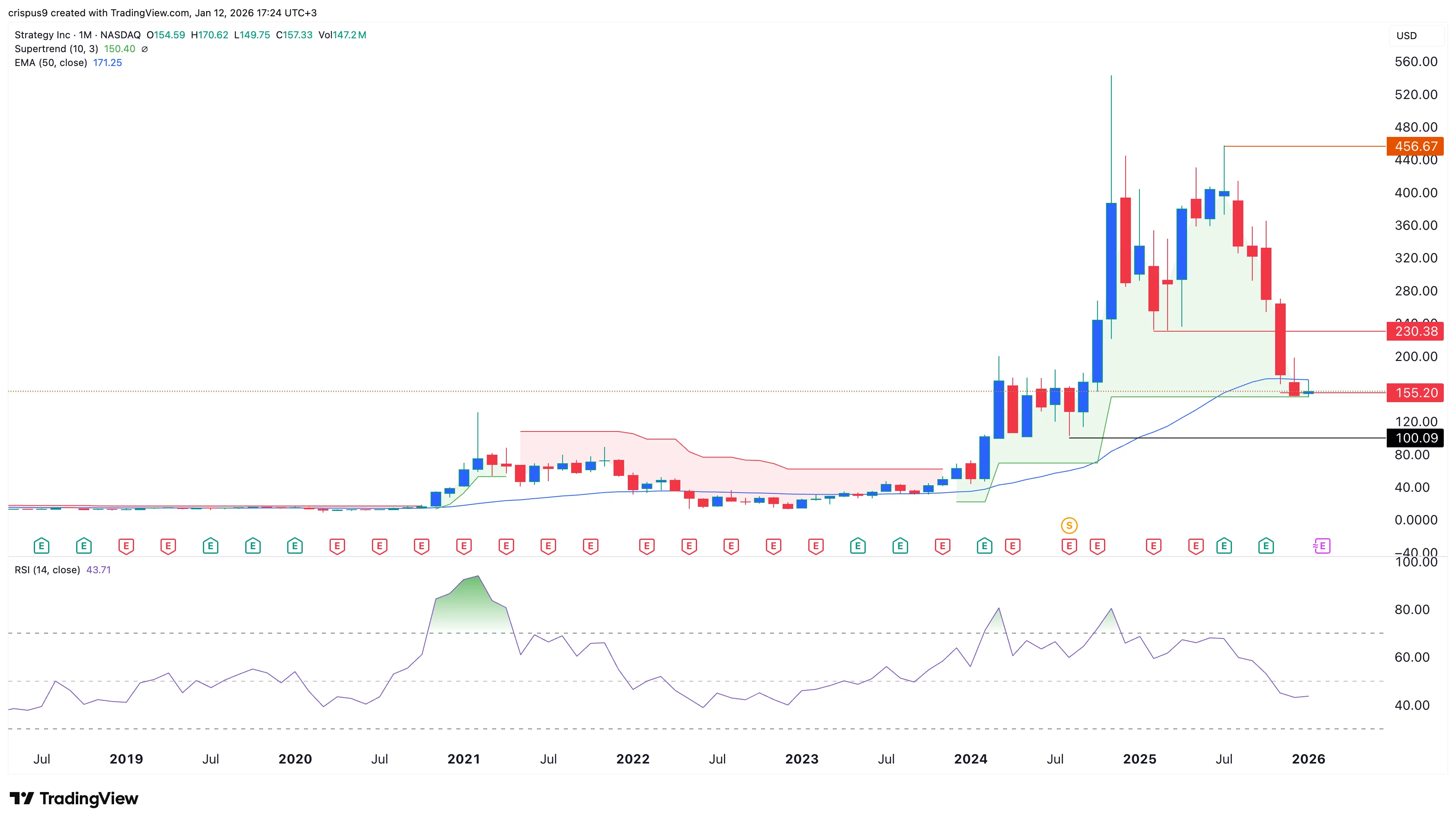

The monthly timeframe chart shows that the Strategy stock price has dropped from a high of $456 in July last year to the current $157. It has dropped in the last five months consecutively.

Most notably, has moved below the 50-month Exponential Moving Average, a sign the bears remain in control. It is about to flip the Supertrend indicator from green to red for the first time since 2021. Such a move will likely confirm the bearish outlook.

The Relative Strength Index has declined from a high of 80 in November 2024 to 43, its lowest level since 2023. Its performance indicates that it has further downside before reaching the oversold level of 30.

You May Also Like

Zcash is Predicted to Reach $215.89 By Mar 12, 2026

Why Is Crypto Down in 2026? Binance Leverage Hits Exhaustion Lows as Pepeto Lines Up a Moonshot