Ethereum Price Pushes Toward Breakout Levels, Bulls Smell Opportunity

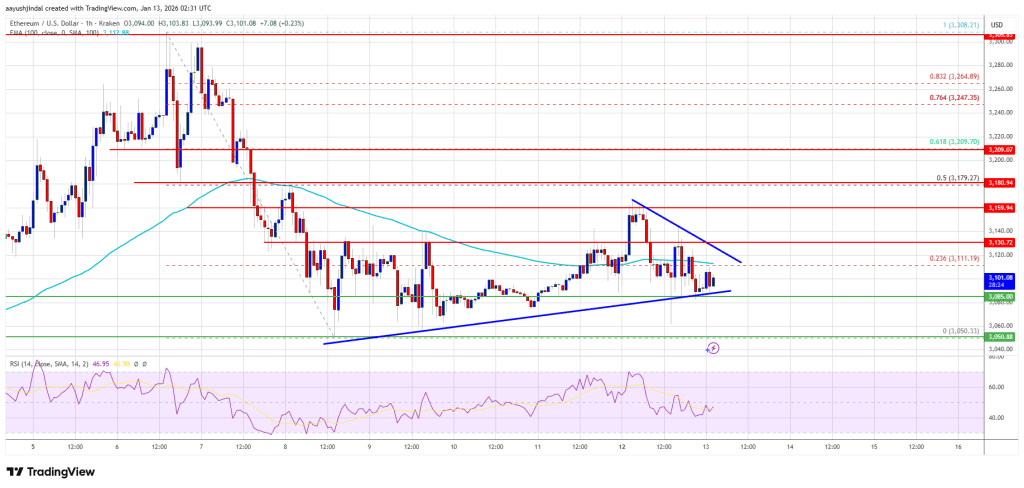

Ethereum price failed to clear the $3,160 resistance and dipped again. ETH is now consolidating and might make another attempt to surpass $3,200.

- Ethereum started a downside correction below $3,180 and $3,150.

- The price is trading below $3,120 and the 100-hourly Simple Moving Average.

- There is a key bullish trend line forming with support at $3,085 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could continue to move up if it stays above the $3,080 zone.

Ethereum Price Starts Consolidation

Ethereum price failed to surpass $3,150 and trimmed gains, like Bitcoin. ETH price declined below $3,120 and $3,120 to enter a short-term bearish zone.

The last major swing low was formed at $3,050 before the price started a consolidation phase. There was a minor upward move above $3,130, and the 23.6% Fib retracement level of the recent decline from the $3,308 swing high to the $3,050 low.

However, the bears are active near $3,150 and $3,180. Ethereum price is now trading below $3,120 and the 100-hourly Simple Moving Average. Besides, there is a key bullish trend line forming with support at $3,085 on the hourly chart of ETH/USD.

If the bulls can protect more losses below $3,080, the price could attempt another increase. Immediate resistance is seen near the $3,120 level. The first key resistance is near the $3,180 level and the 50% Fib retracement level of the recent decline from the $3,308 swing high to the $3,050 low.

The next major resistance is near the $3,200 level. A clear move above the $3,200 resistance might send the price toward the $3,265 resistance. An upside break above the $3,265 region might call for more gains in the coming days. In the stated case, Ether could rise toward the $3,320 resistance zone or even $3,350 in the near term.

Downside Break In ETH?

If Ethereum fails to clear the $3,150 resistance, it could start a fresh decline. Initial support on the downside is near the $3,085 level and the trend line. The first major support sits near the $3,050 zone.

A clear move below the $3,050 support might push the price toward the $3,000 support. Any more losses might send the price toward the $2,925 region.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $3,080

Major Resistance Level – $3,150

You May Also Like

Solana Price Could Reach $200 as WisdomTree Sees Structural Strength

BlackRock Increases U.S. Stock Exposure Amid AI Surge