What to Expect From Bitcoin, Ethereum & XRP Prices Ahead of ‘CPI-Day’

The post What to Expect From Bitcoin, Ethereum & XRP Prices Ahead of ‘CPI-Day’ appeared first on Coinpedia Fintech News

The crypto markets, including Bitcoin, Ethereum, and XRP, are heading into CPI Day with price action still tight and traders clearly positioned for a volatility spike. BTC price is holding key support after a muted rebound, ETH remains firm above a major psychological zone, and XRP is consolidating near its short-term pivot, signalling hesitation rather than weakness.

With liquidity stacked on both sides of the range, the inflation print can act as the trigger that decides the next directional move, either a breakout driven by easing rate expectations or a sharp rejection if inflation surprises to the upside.

CPI Expectations: Key Numbers Traders Are Watching

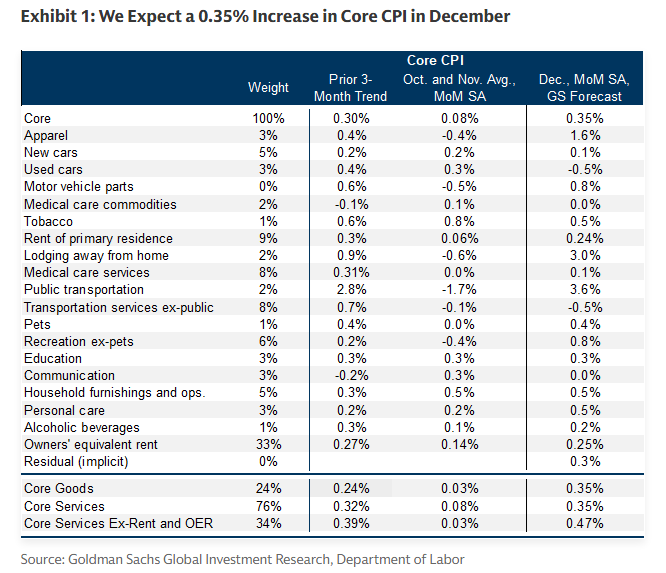

Goldman Sachs is leaning slightly above consensus into this CPI print, which matters because crypto is trading a tight range and needs a trigger. GS expects core CPI to rise 0.35% month-on-month versus the 0.30% consensus, which would keep the year-on-year core rate near 2.78% compared to 2.70% expected. They also estimate this CPI path points to a core PCE reading around +0.30% for December—not a re-acceleration, but not soft enough to fully calm rate anxiety either.

For traders, the setup is straightforward: a print closer to GS (or above) usually means higher yields and a firmer dollar, which can translate into a risk-off dip in BTC, with ETH and XRP often swinging harder. A print at or below consensus can flip the tape risk-on, where BTC typically leads the move and the broader crypto market follows.

How CPI Rates Will Impact the Bitcoin, Ethereum & XRP Prices

If CPI comes in dovish and BTC breaks above $92K–$93K, the move usually turns into a short risk-on squeeze across majors. In that setup, ETH can build on its strength above $3,100 and push toward $3,250–$3,300 first, with an extension to $3,450–$3,550 if BTC holds above the breakout zone. XRP often follows with a delayed but sharper momentum leg, targeting $2.45–$2.55 initially and potentially $2.70–$2.85 if the market keeps bidding risk.

If CPI prints hawkish and BTC loses $90K, the first reaction is usually a leverage flush. That puts ETH at risk of sliding back to $3,050–$3,000, and if BTC drifts toward $88K, ETH could sweep deeper supports near $2,900–$2,850. XRP tends to amplify the downside in risk-off tapes, with bearish targets at $2.20–$2.15, and a deeper drop toward $2.05–$1.95 if BTC’s weakness persists.

Conclusion

The ‘CPI-Day’ usually triggers the crypto markets, where the cryptos move aggressively, which largely turns out to be a trap. Historically, the bullish momentum fades in no time, which further compels the prices of the popular cryptos to remain within the consolidated phase. Therefore, the traders are required to wait and watch the market reaction before entering any position.

You May Also Like

The Channel Factories We’ve Been Waiting For

Onyxcoin Price Breakout Coming — Is a 38% Move Next?