Bitcoin Price Prediction As SEC Chair Paul Atkins Says “This Is A Big Week For Crypto”

The Bitcoin price is still capped below $92,000, as investors hold steady ahead of what US Securities and Exchange Commission (SEC) Chair Paul Atkins says will be a big week for crypto.

Atkins’ remarks came a few days before the US Senate Banking Committee is scheduled to hold a markup on the Digital Asset Market Clarity Act (CLARITY).

BTC edged down a fraction of a percentage over the last 24 hours to trade at $91,997 as of 12:49 a.m. EST, with trading volume surging 40% to $42.4 billion, indicating a rise in trader activity despite the slight drop.

Senate To Hold Market Structure Markup on Thursday

According to Atkins, “Passing bipartisan market structure legislation will help us future-proof against rogue regulators.”

House of Representatives lawmakers passed the bill in July, and it has been under review in the Senate for months, likely slowed by a 43-day government shutdown in October and November.

Banks and several cryptocurrency companies have raised concerns about provisions in the draft bill regarding stablecoin rewards, while many Democrats are reportedly pushing for stronger ethics safeguards and clearer guidance on decentralized finance.

In the interview with Fox Business’s Stuart Varney, Atkins also did not rule out the possibility of US authorities seizing Venezuela’s reported Bitcoin holdings after US forces unseated and captured President Maduro.

The SEC chair said it “remains to be seen” what action, if any, the US would take if it had the opportunity to seize the reported 600,000 BTC.

Crypto Markets Trade Cautiously Amid Political and Economic Tensions

However, the crypto market is still trading in a cautious, modest risk bid, as traders took in the Department of Justice’s criminal investigation into Federal Reserve Chair Jerome Powell.

The crypto space edged down a fraction of a percentage point to a $3.21 trillion market capitalization, as the S&P 500 and Dow Jones Industrial Average closed at record highs on Monday, hitting 52-week highs of 6,986 and 49,633, respectively.

Amid the escalating political tensions, Gold and Silver also hit all-time highs, with gold exceeding $4,600/ounce and silver reaching over $85/ounce, driven by safe-haven demand.

Meanwhile, data from Coinglass shows that US spot BTC ETFs recorded a net inflow of $116.70 million, a positive number after four consecutive days of net outflows.

Can the BTC price also soar?

Bitcoin Price Analysis: Traders Eye A Breakout

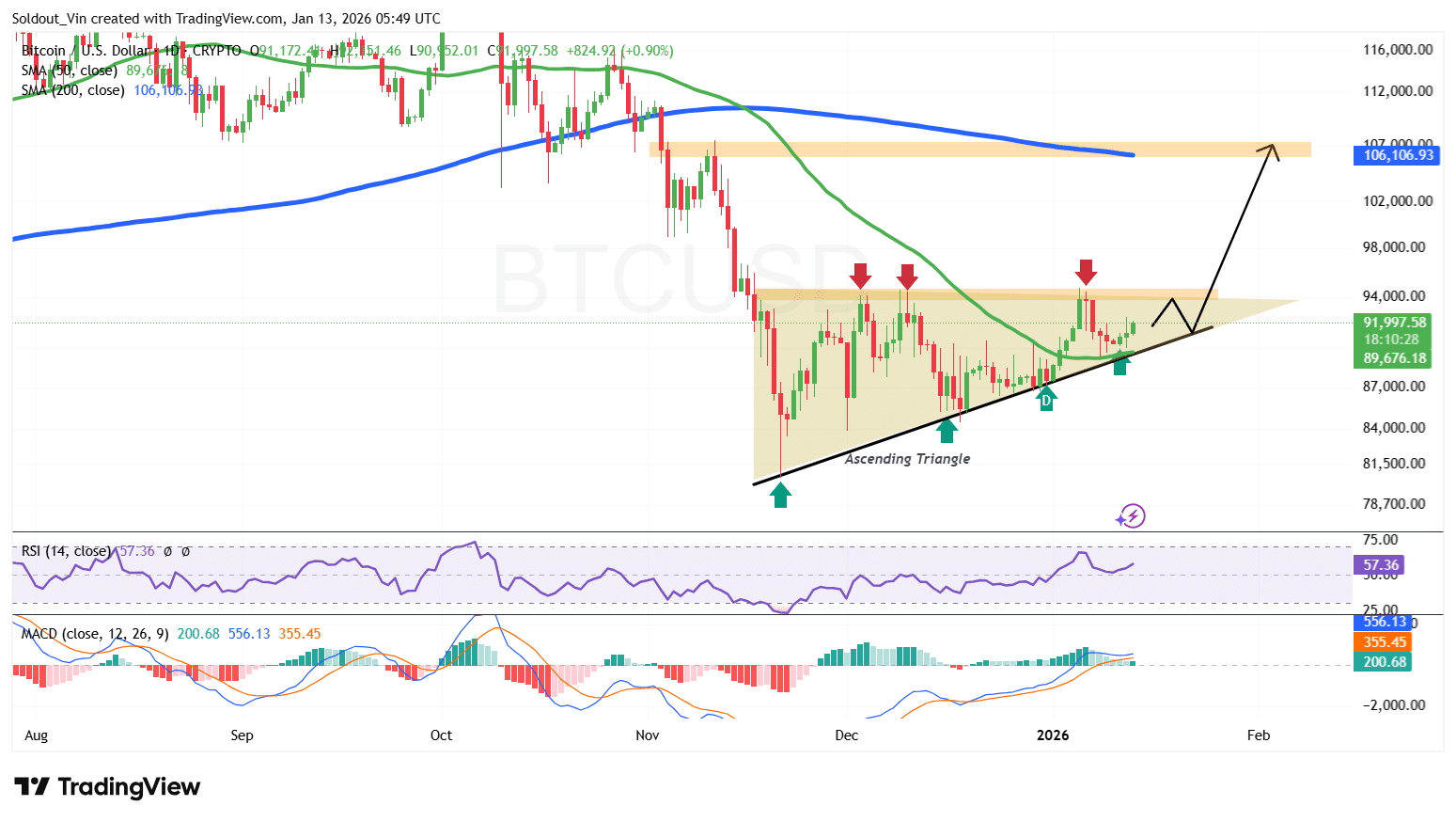

Bitcoin investors are still cautious amid the ascending triangle pattern, a formation that, in most cases, signals a bullish rally after a breakout.

The BTC price is trading below a sustained resistance level of around $94,000 and a rising support level, with supply zones at $80,500, $85,300, and $87,200, now supported by $89,600.

In the short term, the Bitcoin price has crossed above the 50-day Simple Moving Average (SMA) on the daily chart, which adds to the bullish outlook and the possibility of a breakout.

Meanwhile, major indicators support a bullish outlook. The Relative Strength Index (RSI) at 57 and climbing signals that investors are entering the market, which could translate into a price push.

Bitcoin’s Moving Average Convergence Divergence (MACD) has also turned positive, with the blue MACD line crossing above the orange signal line, confirming that sentiment has turned positive.

BTC/USD Chart Analysis Source: TradingView

BTC/USD Chart Analysis Source: TradingView

If the rally picks up and momentum continues to build, the price of Bitcoin could surge towards the $94,000 psychological resistance. If this level is breached, the next likely target will be the previous demand area at $106,106, which lies within the 200-day SMA.

Conversely, if the bears act on BTC at this level, the key support around $89,000 would hold.

Related News:

You May Also Like

The Channel Factories We’ve Been Waiting For

Trading time: Tonight, the US GDP and the upcoming non-farm data will become the market focus. Institutions are bullish on BTC to $120,000 in the second quarter.