YZi Labs Injects 8-Figures Into Genius Trading as CZ Joins as Advisor

YZi Labs, the independent investment firm led by Binance founder Changpeng Zhao, has made an eight-figure investment in on-chain trading terminal Genius Trading, showing growing confidence in cross-chain execution infrastructure.

While the firm did not disclose the exact size of the round, it confirmed the investment on Tuesday and said Zhao will also join Genius Trading as an advisor.

The backing comes at a time when crypto markets are undergoing a structural shift.

Onchain Trading Grows, Putting Execution Infrastructure in the Spotlight

Trading activity is increasingly distributed across blockchains rather than concentrated on a small number of centralized exchanges.

That change has created new challenges around execution, liquidity access, and information leakage, particularly for larger traders.

Against that backdrop, YZi Labs’ investment shows growing interest in infrastructure that focuses less on launching new liquidity venues and more on how trades are executed across them.

Genius Trading is an onchain trading terminal aggregating spot, perpetual, and copy trading across multiple blockchains, unveiled publicly on Tuesday.

Ahead of launch, Genius said it had already processed more than $160 million in trading volume across ten blockchains, including Ethereum, Solana, BNB Chain, and several others.

YZi Labs manages roughly $10 billion in assets and operates as Zhao’s family office, following its evolution from Binance’s former venture arm.

The firm focuses on venture-stage investments spanning Web3, artificial intelligence, and biotechnology, and has increasingly emphasized infrastructure plays rather than consumer-facing applications.

In its announcement, YZi Labs framed Genius as part of that strategy, pointing to the growing share of trading volume migrating from centralized exchanges to decentralized venues.

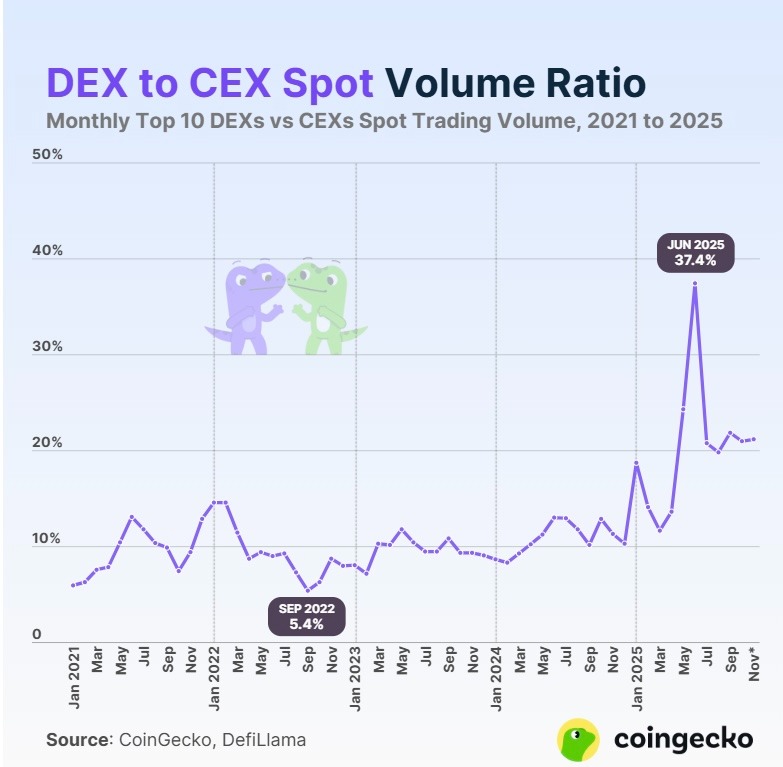

Data from recent years shows that as of early 2021, decentralized exchanges accounted for just 6% of spot trading volume relative to centralized platforms.

By November 2025, that figure had climbed to 21.2%, with a peak of 37.4% reached in June 2025 during a surge in on-chain activity.

Source: CoinGecko

Source: CoinGecko

Although centralized exchanges still dominate in absolute terms, decentralized venues now command a durable share of both spot and derivatives markets.

YZi Labs Targets On-chain Privacy With Genius Trading Investment

YZi Labs said this transition introduces what it described as a “transparency bug.”

Because trades on public blockchains are visible by default, large orders can signal intent and move markets before execution is complete.

According to the firm, that dynamic makes it difficult for professional traders to deploy size without losing value, even as they benefit from self-custody and on-chain settlement.

YZi Labs said Genius seeks to address that issue by prioritizing execution quality and discretion.

It added that the firm uses a “Ghost Order” system to run complex strategies across multiple wallets discreetly.

The company says the process remains non-custodial and auditable, meaning users retain control of their keys while masking execution patterns from the broader market.

Armaan Kalsi, co-founder and chief executive of Genius, said the partnership with YZi Labs is focused on alignment rather than capital alone, describing the goal as building an on-chain trading experience that matches the speed and privacy traders associate with centralized exchanges.

Genius said the new funding will be used to accelerate development of the platform’s privacy features ahead of a broader open-access rollout planned for late 2026.

The investment also fits within YZi Labs’ broader push to support foundational infrastructure.

The firm has backed more than 300 companies and recently announced a $1 billion fund to support builders on BNB Chain through its Most Valuable Builder and EASY Residency programs.

That model combines capital with mentorship, ecosystem access, and operational support, and Zhao has taken an active advisory role in several portfolio companies.

You May Also Like

‘One Battle After Another’ Becomes One Of This Decade’s Best-Reviewed Movies

Economic policies are chasing investors away from US – Mercer