Glassnode: Bitcoin Is Back At $96K, Hitting The Same Sell Ceiling Again

Bitcoin’s early-2026 bounce has pushed back into a familiar problem area: a dense pocket of overhead supply that Glassnode says has repeatedly capped rallies since November. In its latest Week On-chain report, the analytics firm frames the move above $96,000 as constructive on the surface, but still largely dependent on derivatives positioning and liquidity conditions rather than persistent spot accumulation.

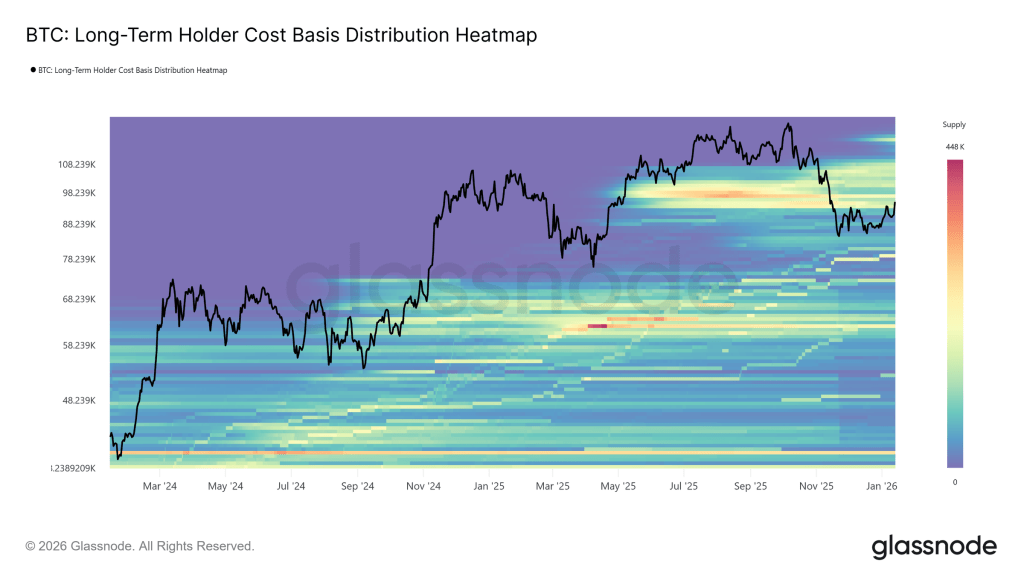

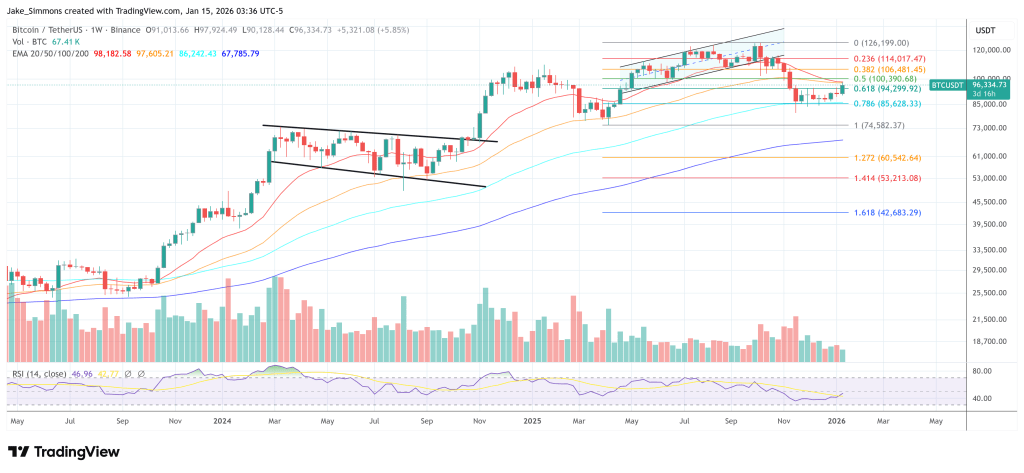

Glassnode’s central argument is that Bitcoin has rallied straight into a historically significant band of long-term holder (LTH) cost basis, built during April to July 2025 and associated with sustained distribution near cycle highs. The report describes a “dense cluster” spanning roughly $93K to $110K, with rebounds since November repeatedly stalling near the lower boundary.

“This region has consistently acted as a transition barrier, separating corrective phases from durable bull regimes,” Glassnode wrote. “With price once again pressing into this overhead supply, the market now faces a familiar test of resilience, where absorbing long-term holder distribution remains a prerequisite for any broader trend reversal.” The firm’s framing is blunt: the market is back at the same sell ceiling, and clearing it requires real absorption, not just price probing.

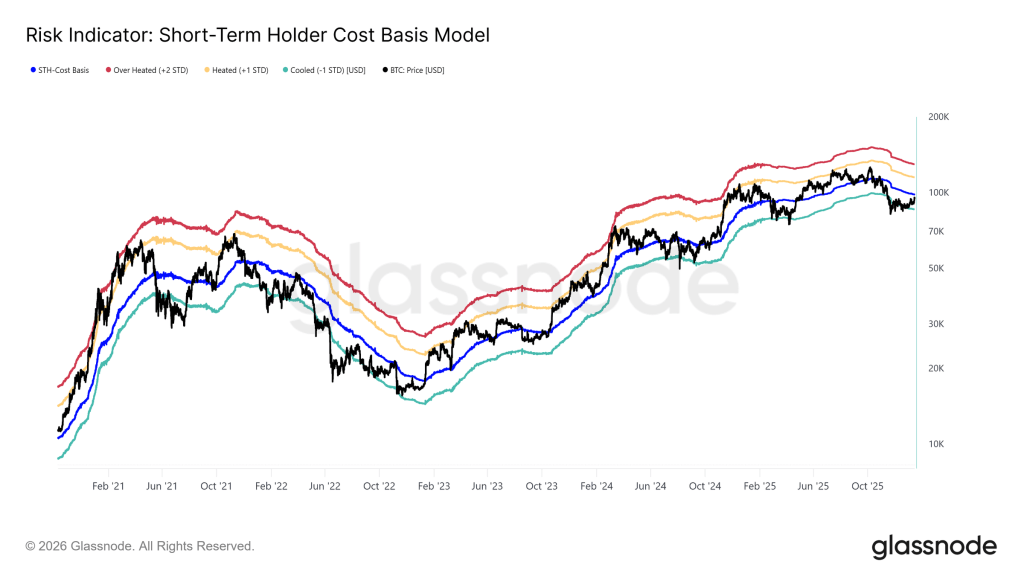

The next level the report highlights is the short-term holder (STH) cost basis at $98.3K, which it treats as a confidence gauge for newer buyers. Sustained trading above it would indicate that recent demand is strong enough to keep late entrants in profit while soaking up overhead supply.

On-chain, Glassnode notes long-term holders remain net sellers, with total LTH supply still trending lower. The key change is speed. The report says the rate of decline has “slowed materially” versus the aggressive distribution seen in Q3 and Q4 2025, suggesting profit-taking is continuing but with less intensity.

“What follows will depend primarily on the demand side’s ability to absorb this supply, particularly from investors accumulated over Q2 2025,” the report said. “Failure to hold above the True Market Mean at ~$81k, in the long term, would significantly increase the risk of a deeper capitulation phase, reminiscent of the April 2022 to April 2023 period.” It is one of the clearest downside conditionals in the note: if the market loses the long-run mean, the probability distribution shifts toward a more severe unwind.

A related signal is the Net Realized Profit and Loss of Long-Term Holders, which Glassnode says reflects a “markedly cooler distribution regime.” Long-term holders are realizing roughly 12.8K BTC per week in net profit, a sharp slowdown from cycle peaks above 100K BTC per week. That moderation does not imply capitulation risk is gone, but it does suggest the heaviest phase of profit-taking has eased.

Bitcoin Demand Remains Uneven

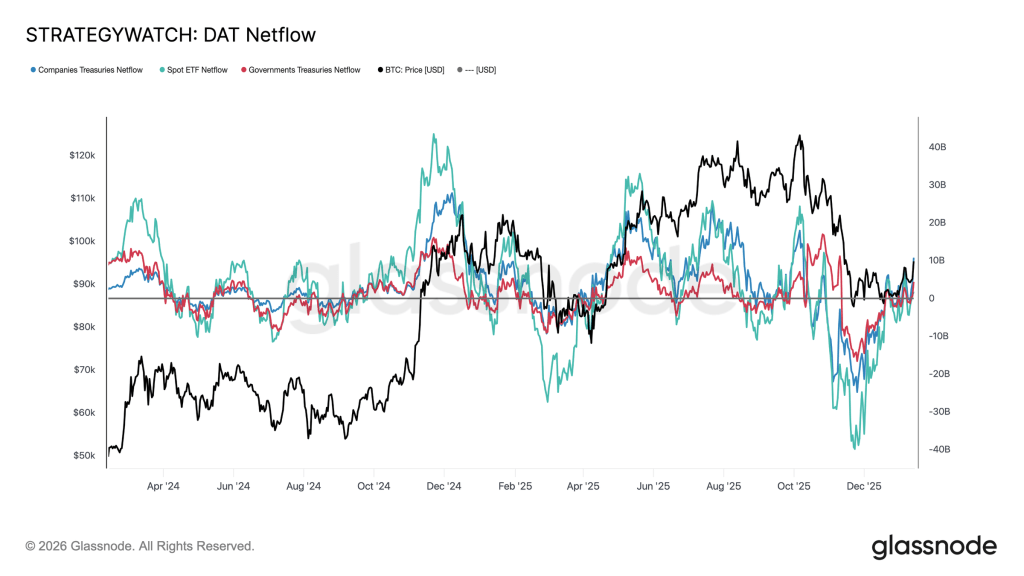

Off-chain indicators lean more constructive. Glassnode argues institutional balance-sheet flows have “gone through a full reset” after months of heavy outflows across spot ETFs, corporates, and sovereign entities, with net flows stabilizing as sell-side pressure appears exhausted. Spot ETFs are described as the first cohort to turn positive again, re-establishing themselves as the primary marginal buyer.

Corporate and sovereign treasury flows, by contrast, are portrayed as sporadic and event-driven rather than consistent. The upshot is a market where balance-sheet demand can help stabilize price, but may not yet function as a sustained growth engine, leaving short-term direction more sensitive to derivatives positioning and liquidity conditions.

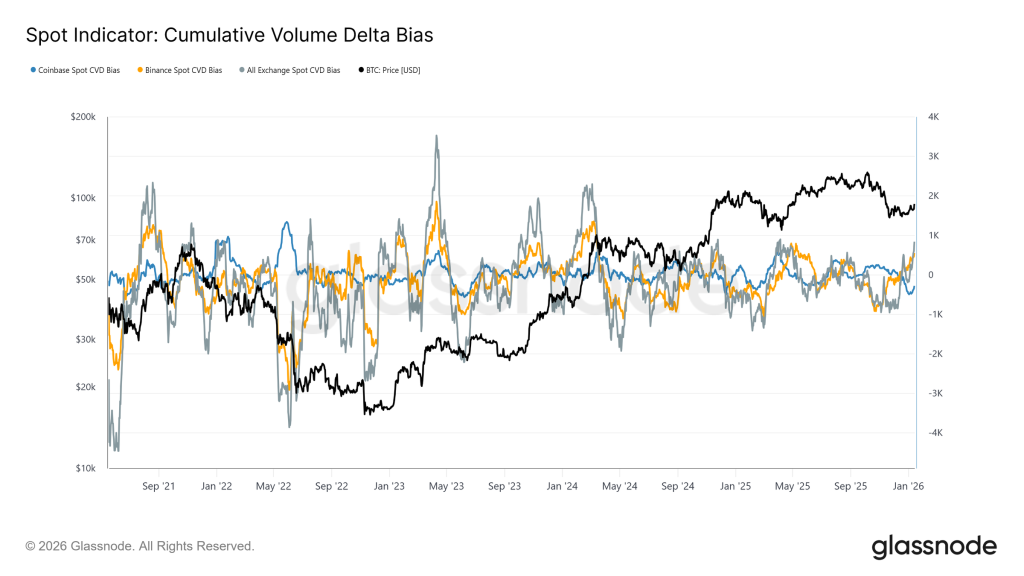

At the venue level, Glassnode points to improving spot behavior. Binance and aggregate exchange flow measures have shifted back into buy-dominant regimes, and Coinbase, described as a consistent source of sell-side aggression during the consolidation, has “meaningfully slowed its selling activity.” The report calls this a constructive structural shift, while stressing it still falls short of the persistent, aggressive accumulation typically associated with full trend expansions.

The most pointed caution in the report is that the move into the $96K region was “mechanically reinforced” by short liquidations in a relatively thin liquidity environment. Futures turnover remains well below the elevated activity seen across most of 2025, implying it took comparatively little capital to force shorts out and push price through resistance.

“This indicates that the breakout occurred in a comparatively light liquidity environment, where modest positioning shifts were able to drive disproportionately large price responses,” Glassnode said. “In practical terms, it did not take significant new capital to force shorts out of the market and lift price through resistance.” The implication is that continuation now depends on whether spot demand and sustained volume can replace forced covering once the squeeze impulse fades.

Options markets add a second layer of tension. Glassnode describes implied volatility as low but “deferred,” while skew continues to price downside asymmetry, with 25-delta skew biased toward puts in mid and longer maturities. In short: participants appear comfortable holding exposure, but remain unwilling to do so without insurance.

Positioning also matters at the microstructure level. The report flags dealers as short gamma around spot, with a zone roughly from $94K to $104K. In that setup, hedging flows can amplify moves rather than dampen them, buying into rallies and selling into dips, raising the odds of faster travel toward high-interest strikes such as $100K if momentum takes hold.

At press time, BTC traded at $96,334.

You May Also Like

Ozak AI Crosses $3.2 Million Raised—How Early Investors Are Now Sitting On 100x Returns And Triple-Digit Profit Percentages

Utah Man Receives 3-Year Sentence For $3M Deceptive Exchange Scheme