| Disclosure: This content is promotional in nature and provided by a third-party sponsor. It does not form part of the site’s editorial output or professional financial advice. |

The crypto market opened 2026 above $3 trillion in total value, with daily volume hovering near $150 billion as volatility returned. The Monero (XMR) price update shows renewed strength, while the latest Solana (SOL) price prediction points to steady upside. Yet with both assets already mature and widely held, how much room is really left for explosive profits?

That question directs attention to Zero Knowledge Proof (ZKP). Analysts describe a system where demand resets every day, forcing prices higher through record participation. Researchers say yesterday’s entry looked cheap, today feels reasonable, and tomorrow may lock out late buyers entirely.

Experts label this the Green Staircase for returns, and compared with Monero and Solana, Zero Knowledge Proof fits the top trending crypto profile for outsized gains.

Zero Knowledge Proof and the Rising Entry Curve

Zero Knowledge Proof is built as a full-scale blockchain network, backed by over $100 million in self-funded infrastructure, live testnets, and physical hardware. Analysts note that few projects enter the market with this level of completion and financial commitment already in place today now.

Attention is turning to its auction structure, where a fixed daily supply meets rising demand. Researchers tracking wallet data report thousands of new participants every day, pushing valuation higher in steps and earning Zero Knowledge Proof early recognition as a top trending crypto globally.

Market commentators describe a stair-step pattern driven by constant repricing, not speculation. Each daily reset recalculates value upward as capital flows in, meaning buyers secure fewer tokens over time even when investing the same amount as participation expands relentlessly across regions and platforms worldwide.

That shift has serious consequences for timing. Analysts warn that earlier buyers locked lower cost bases, while later entrants face shrinking allocations. Models suggest the auction is approaching a permanent floor that may never be revisited once demand peaks under current participation growth rates.

This structure explains why experts again label Zero Knowledge Proof a top trending crypto. With daily price pressure, capped participation, and projections reaching 5000x, analysts argue the risk-reward profile favors action now before affordability disappears from the open market entirely for late buyers permanently.

Monero (XMR) Price Update: Privacy Coin Performance Check

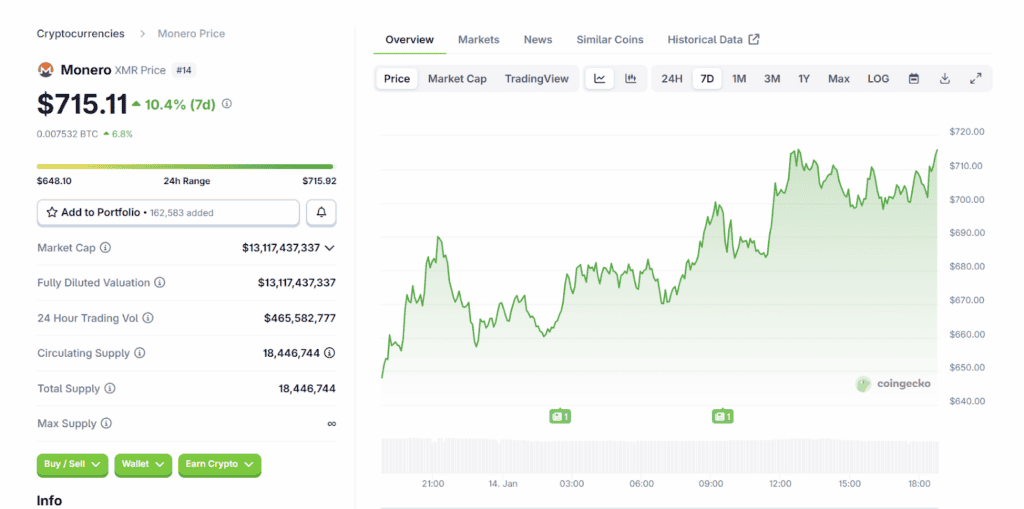

The Monero (XMR) price update shows strong momentum in mid January 2026 as XMR trades between $698 and $715 after a sharp breakout above $600. The privacy focused coin now holds a market cap near $13 billion, with daily trading volume around $450 million. Circulating supply sits close to 18.4 million XMR, keeping scarcity intact. This move follows weeks of steady buying as privacy demand returns across global markets.

Source- CoinGecko

Source- CoinGecko

Another Monero (XMR) price update highlights how far XMR has already climbed. Price data shows gains of more than 40 percent since early January, pushing Monero into the top 15 cryptocurrencies by value. Analysts note strength, but also point out that large upside now requires heavy capital. Compared to newer projects, Monero offers stability and utility, yet its mature size limits the chance for extreme returns. This makes timing and expectations important for investors watching current price action closely today now.

Solana (SOL) Price Prediction: Network Outlook and Limits

The Solana (SOL) price prediction remains a key focus in January 2026 as SOL trades in the $140 to $150 range after a volatile start to the year. Market models suggest near term resistance around $160, with some analysts projecting moves toward $180 if volume holds. Longer range forecasts for 2026 place potential averages near $170, supported by strong network usage and steady developer activity across DeFi and NFT sectors.

A second Solana (SOL) price prediction angle highlights limits tied to size. With a market cap already above $70 billion, large gains now need massive capital inflows. Analysts see SOL as reliable, but note that returns may be slower compared to smaller networks. For investors seeking stability with moderate upside, Solana remains relevant, yet expectations must align with its mature position in the market. This context shapes realistic outlooks for 2026 buyers today and ahead.

How Zero Knowledge Proof Fits the Top Trending Crypto Narrative

Recent data from the Monero (XMR) price update shows strong gains, but its large market size now limits extreme upside. At the same time, the latest Solana (SOL) price prediction points to steady growth rather than explosive returns. Both assets offer stability and proven use, yet their maturity means major profits now require significant capital and patience.

This contrast sharpens focus on Zero Knowledge Proof, which analysts describe as structured around constant demand pressure. Researchers point to its daily pricing resets and rising wallet activity as signals that timing matters more than headlines, especially as each new entry locks in fewer tokens.

Experts now call it a top trending crypto, arguing this structure favors early action before affordability tightens further ahead now.

Find Out More about Zero Knowledge Proof:

Website: https://zkp.com/

| Disclaimer: The text above is an advertorial article that is not part of coinlive.me editorial content. |