Internet Computer Price Outlook: ICP Targets $5 as the 50-day SMA Holds Firm as Support

Highlights:

- The ICP price is showing strength after rallying 39% in a week to exchange hands at $4.40.

- The derivatives market shows mixed signals, with open interest slipping and the long-to-short ratio falling below 1.

- The technical outlook shows a potential surge to $5 if the $3.33 support remains intact.

The Internet Computer (ICP) price is trading at $4.40, 39% higher than it was in the past week. However, daily trading volume has declined 57%, indicating a sharp drop in trading activity. Technically, the ICP price could target $5 if bullish sentiment holds.

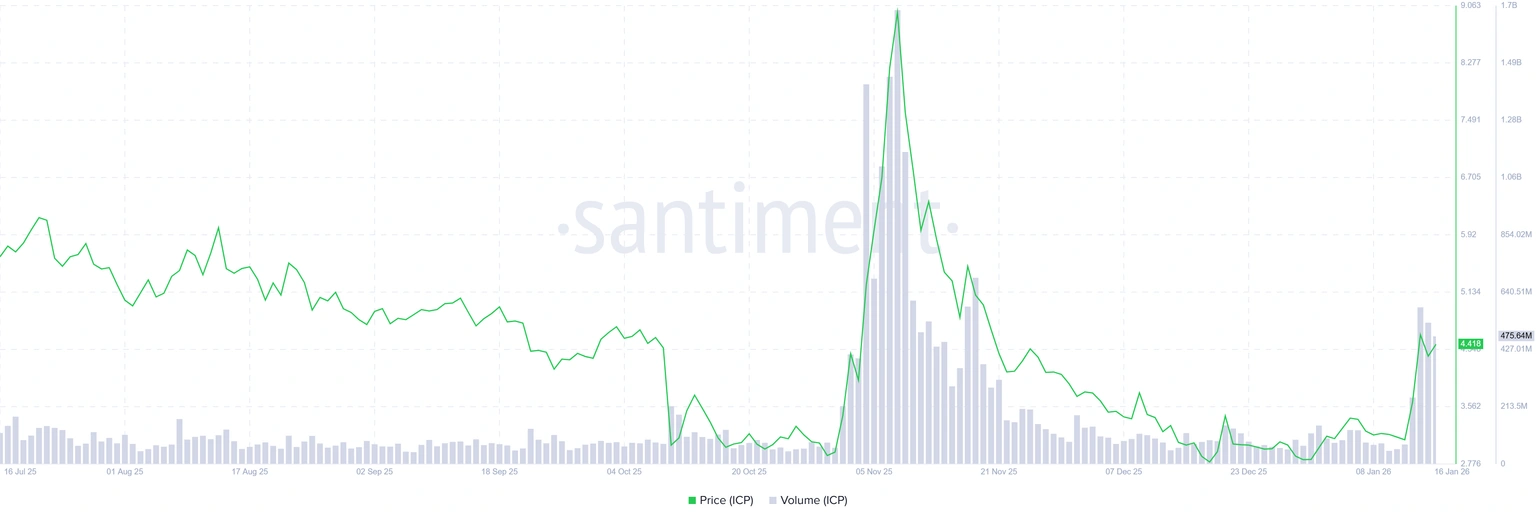

Santiment data indicate that the trading volume (the total trading volume across all exchange applications on the chain) for the ICP ecosystem was $583.84 million on Wednesday. It had stabilized at around $475.64 million on Friday. This increase in volume reflects a surge in trader interest and liquidity in ICP and aligns with our bullish view.

ICP Trading Volume: Santiment

ICP Trading Volume: Santiment

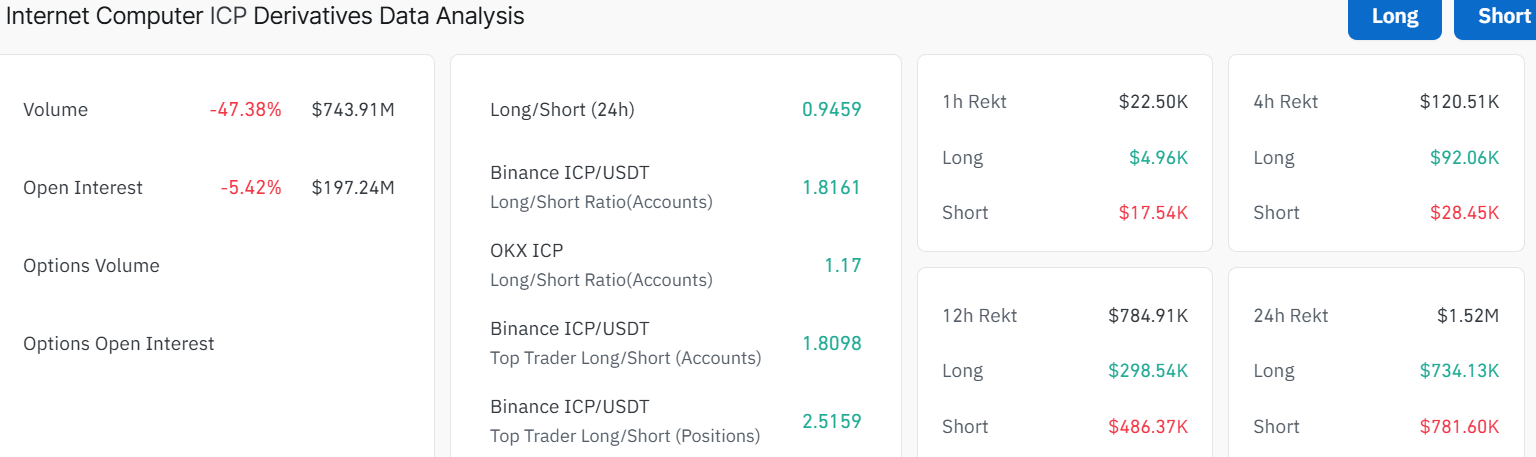

According to CoinGlass data, Internet Computer futures OI has declined by 5% to $197 million. The volume has notably plunged 47% to $743, indicating reduced market activity in ICP. A drop in OI indicates that money is flowing out of the market, which may lead to a price decline in the coming days.

ICP Derivatives Data: CoinGlass

ICP Derivatives Data: CoinGlass

The long-to-short ratio sits at 0.9459 on Friday. This ratio is below 1, indicating that bearish sentiment is creeping into the market as more traders bet on a decline in the ICP price.

ICP Price Targets $5 If Support at $50-day SMA Holds

ICP/USDT price action shows a clear bullish structure on the 1-day chart, supported by strong momentum. Internet Computer is trading around $4.40, continuing a steady recovery after several weeks of consolidation.

The chart highlights a major support zone between $3.07 and $2.84, which is labelled as a consolidation area. This zone served as a strong base, with bulls repeatedly stepping in to prevent further downside. From this area, ICP began forming higher lows, signalling a shift from bearish pressure to bullish control. This is evident as the bulls flipped the 50-day SMA at $3.33 into immediate support, giving the buyers strength for further upside.

ICP/USD 1-day chart: TradingView

ICP/USD 1-day chart: TradingView

ICP has broken above the key psychological level at $3.33, which has been acting as short-term support. Holding above this level is important to maintain the bullish trend.

On the upside, the chart shows a clear resistance zone around $4.59. If the ICP token maintains momentum above $4.59 and volume remains strong, a retest of the $5 resistance zone is likely. A decisive close above this level could open the door for a stronger rally in the ICP market. The RSI is currently around 68.91, signalling intense buying pressure in the market. Traders are still at liberty to join the trend, unless the RSI hits the overbought zone. An overbought RSI does not mean an immediate reversal, but traders should expect brief pullbacks.

Overall, the Internet Computer price remains bullish, with the price long above the $3.33 support level. Any short-term dips toward support could attract buyers, keeping the broader upward movement to $5 intact.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

BlackRock boosts AI and US equity exposure in $185 billion models

The Daunting Challenge Of A $50 Target