Looking for potential Alpha: 10 early un-coined projects

By Stacy Muur

Compiled by: Tim, PANews

I’ve hand-picked 10 early-stage protocols from AI-driven social analytics platform Moni that are 100% worth your attention:

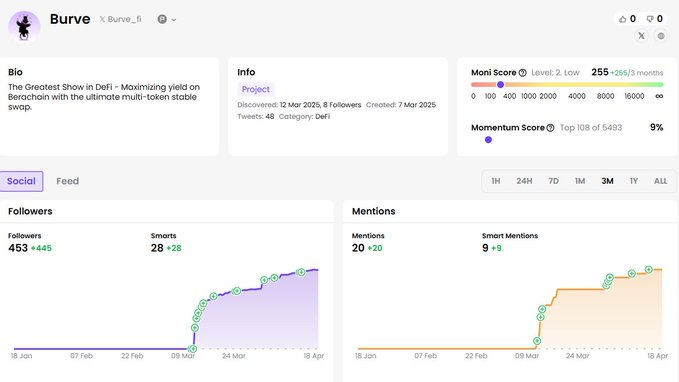

1.Burve

Category: DeFi yield aggregator based on Berachain

Introduction: Maximize the

Berachain on-chain revenue.

Airdrop potential: medium-high (the project is in a very early stage, few followers, no tokens issued yet, classic airdrop model)

Tokens: Not issued

Highlights: Building an ecosystem around liquidity provider optimization + risk management tools (insurance, leverage). It is expected that the liquidity mining phase will be launched later.

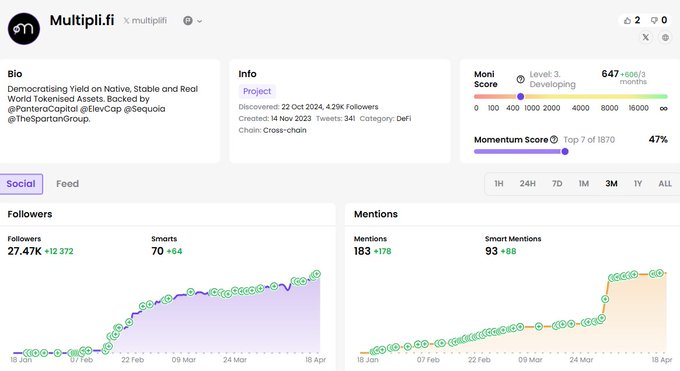

2.Multipli.fi

Category: DeFi income aggregation

Introduction: Democratize the benefits of native assets, stablecoins, and real-world tokenized assets

Airdrop Potential: High (ORB rewards available in both testnet and mainnet; token issuance confirmed)

Token: Not yet issued

Highlights: ORB (on-chain reward bonds) can be obtained by participating in the testnet and mainnet staking, and will be redeemed at TGE

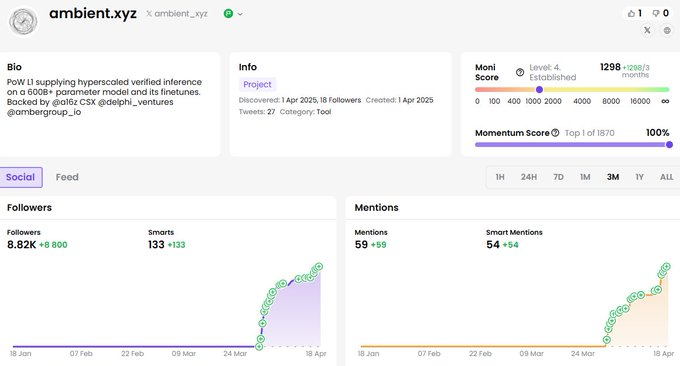

3.ambient.xyz

Category: Web3+AI Infrastructure

Introduction: A PoW (proof of work) blockchain that transforms AI model training into a secure, rewarded on-chain activity

Airdrop Potential: No official airdrop plan has been announced yet

Token: Not yet issued

Highlights: Currently there is no point mining or airdrop mechanism. Investors include a16z, Delphi Ventures and Amber Group.

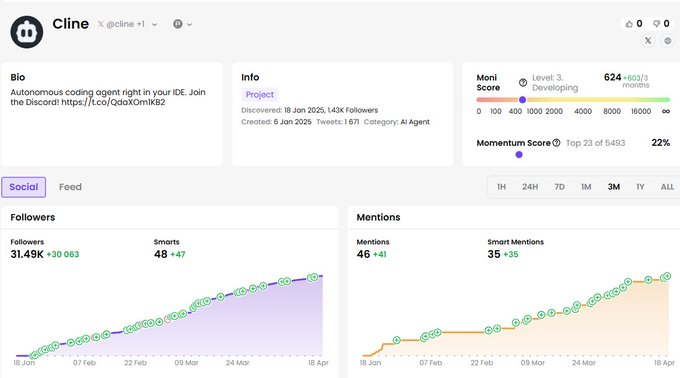

4. Cline

Category: AI developer tools, autonomous programming agents

Introduction: An open source AI programming agent that supports collaborative writing, debugging and delivery of full-stack code

Airdrop potential: Low (no token model, focus on SaaS and open source, no reward mechanism announced)

Token: None (no plans or signs of issuing native tokens)

Highlights: 1.3 million+ installed base, over 31,000 community fans, active developer ecosystem; high popularity on GitHub (over 40,000 stars), more focused on open source infrastructure rather than on-chain protocols

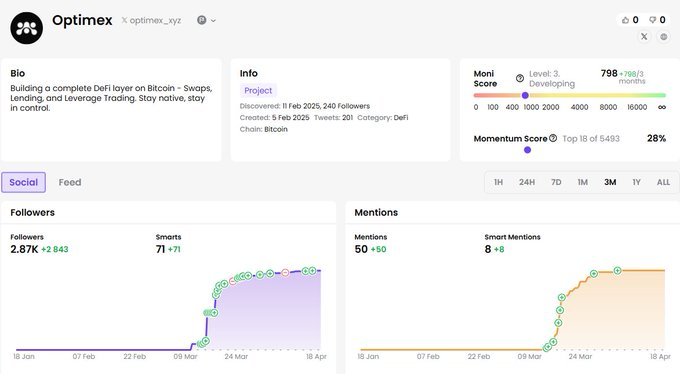

5. Optimex

Category: BTCFi

Introduction: A non-custodial DeFi protocol layer for native Bitcoin, supporting flash exchange, lending and margin trading

Airdrop Potential: Moderate (no official plan yet, but early adopters + alpha testers may be eligible)

Tokens: Not yet launched (no public information on TGE or token economics)

Highlights: No points system, no tokens. The project may be building a retroactive reward mechanism (rewards will be issued based on early contributions in the future)

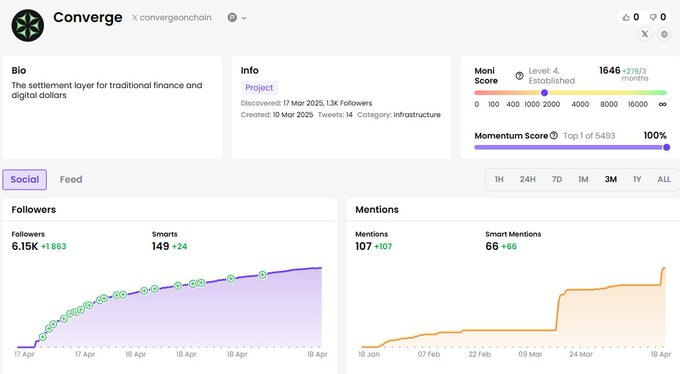

6. Converge

Category: Institutional DeFi protocols, asset tokenization settlement layer

Introduction: Layer1 public chain compatible with EVM, integrating traditional finance and decentralized finance, realizing compliant asset tokenization and stablecoin settlement

Airdrop Expectations: Low (no airdrop announced; focus on institutional adoption and compliance)

Token: No native token; USDe and $ENA used for settlement

Highlights: Powered by Ethena and Securitize. Designed for both institutional and permissionless use cases. Early partners include AAVE, Pendle, Morpho, and Maple Finance.

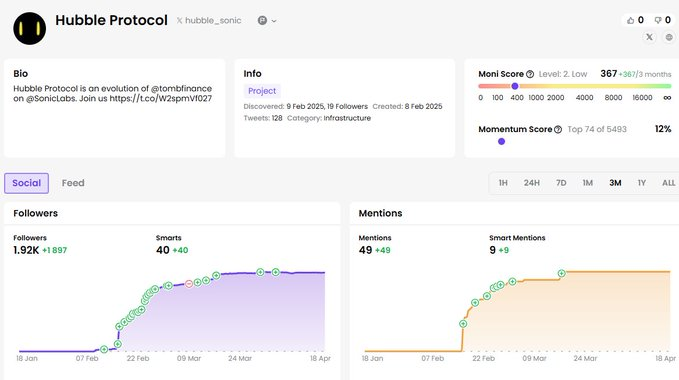

7. Hubble Protocol

Categories: DeFi, Yield Strategy Forks

Introduction: An evolution of Tomb Finance, reimagined on Sonic to optimize DeFi yield strategies.

Airdrop Potential: Moderate (early stages with no token confirmed, but mention of user onboarding mechanism hints at possible incentives in the future)

Token: Not yet launched

Highlights: The project claims to be derived from Tomb Finance and may be building an elastic supply or algorithmic yield structure.

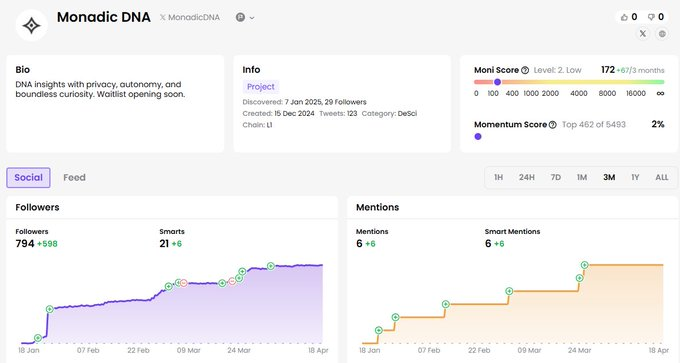

8. Monadic DNA

Categories: Decentralized Science, Privacy-Preserving Genomics

Brief: Gain health and lifestyle insights from DNA without giving up control of your data

Airdrop Potential: Moderate (waitlist opening soon, good early momentum, no token announced yet but likely to adopt typical DeSci incentive model)

Token: Not yet launched (token or governance mechanism not confirmed yet)

Highlights: Positioned as an alternative to 23andMe’s user ownership, 23andMe is the winning project of ETHGlobal 2024

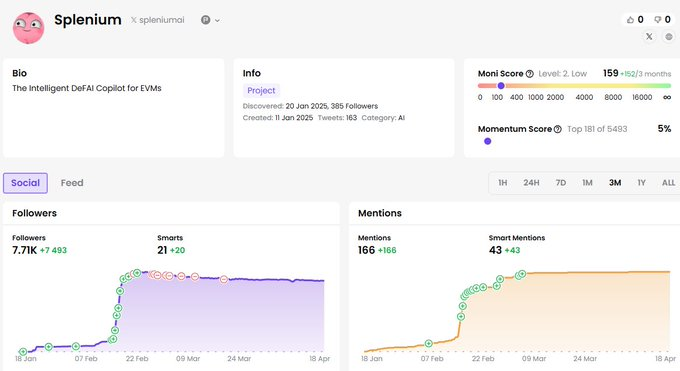

9. Splenium

Category: Decentralized Artificial Intelligence (DeAI)

Introduction: An AI co-pilot tool based on a chat interface that supports users to conduct NFT transactions, asset management and market tracking across EVM chains in real time

Airdrop potential: Medium (13,000 users, early growth stage, high interaction frequency indicates that a reward mechanism may be introduced in the future)

Tokens: Not yet issued (token plans not yet confirmed)

Highlights: It is expected to develop into a personal DeFi application layer or be integrated into the existing wallet ecosystem. It is necessary to build a long-term growth flywheel through the token economy or protocol layer.

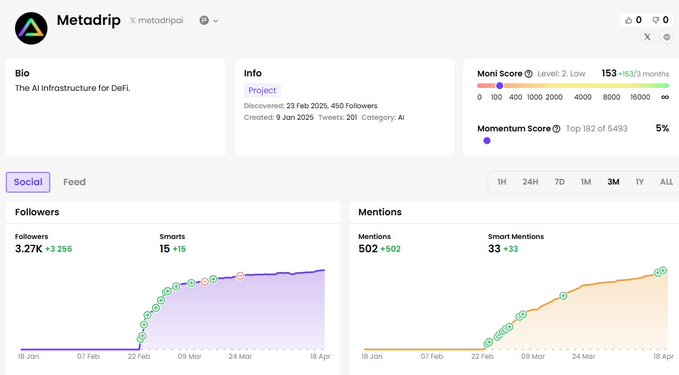

10. Metadrip

• Categories: AI Agents, DeFi UX Layer

• Introduction: A one-stop platform for cryptocurrency trading, staking, tracking and token issuance through a conversational AI assistant

• Airdrop Potential: High (staking mechanism, DAO governance and DRIP token design hint at future rewards or early user incentives)

• Tokens: Planned (DRIP tokens will be used for voting governance)

• Highlights: Focusing on retail investors, creating an "All-in-One" DeFi assistant experience, integrating multiple Web3 functions in the interface

Time always rewards those who wake up early.

This list is not a prediction, but a snapshot. Please use it at your own discretion.

Not every early-stage project can become a breakout, but every breakout has the same growth trajectory.

You May Also Like

‘Huge’ investor demand for apartment buildings

Trump has 'collapsed' with 'core voters' on 3 key issues