Major changes! Trump signs crypto executive order, plans to establish digital asset reserves, SEC revokes SAB 121

Author: Weilin, PANews

On January 23rd, local time, the third day after Trump took office, he signed the executive order " Strengthening American Leadership in Digital Financial Technology " . The order proposed the establishment of a "Presidential Digital Asset Market Working Group" to explore federal regulatory measures for stablecoins and related plans for national digital asset reserves, and explicitly prohibited the "establishment, issuance, circulation or use" of central bank digital currencies (CBDCs).

At the same time, the U.S. Securities and Exchange Commission (SEC) announced the withdrawal of Staff Accounting Bulletin No. 121 (SAB 121), which has been criticized for the crypto industry.

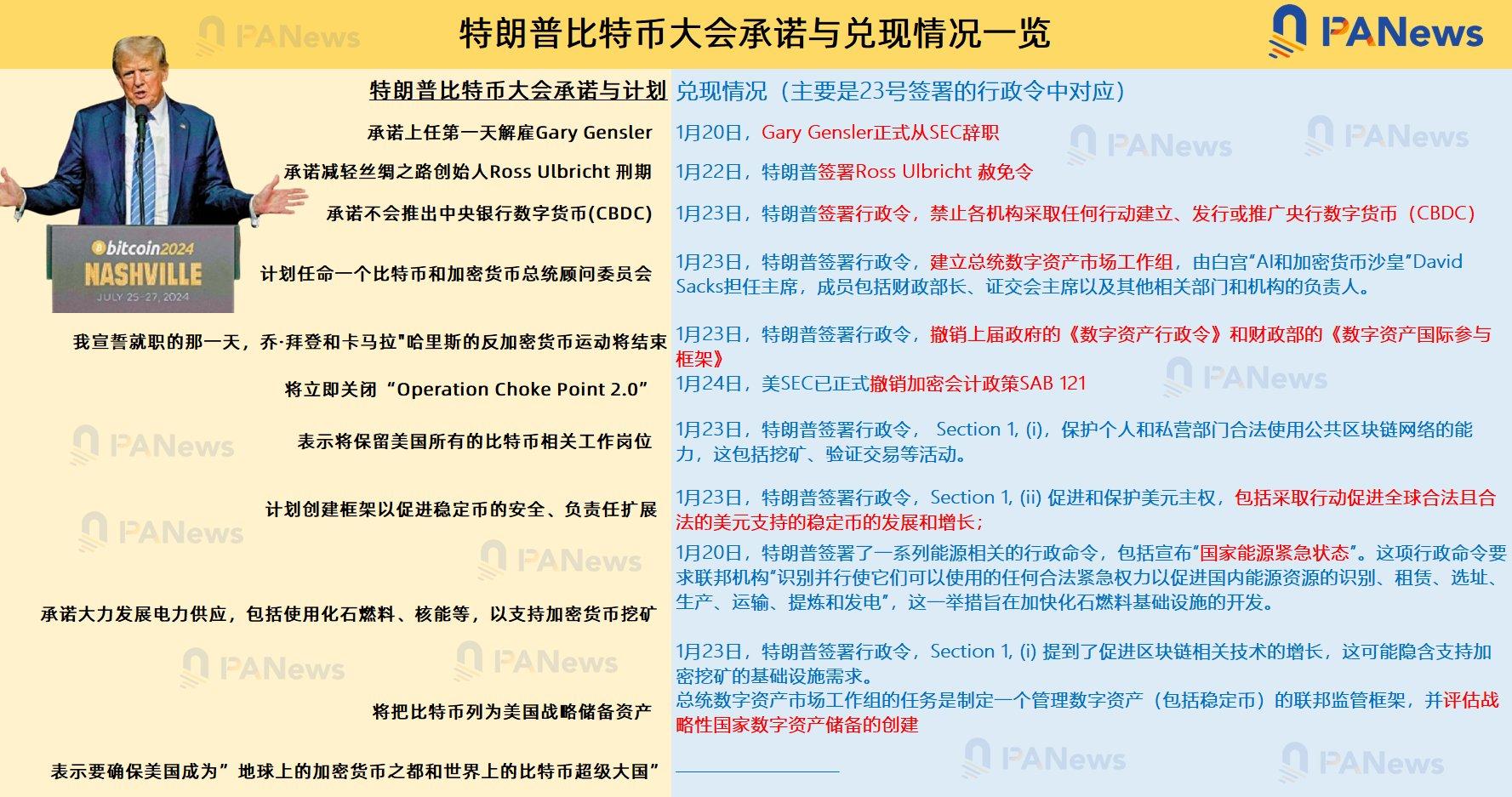

Although it is unclear whether the implementation of certain laws and policies by executive orders by the US President will be rejected by the courts, Trump has fulfilled many of his promises at the Bitcoin Conference last July, which is expected to almost completely overturn the previous crypto regulatory model.

Crypto Executive Order: Establishment of a Presidential Task Force to Assess the Nation’s Digital Asset Reserves

The executive order begins with a statement of purpose and policy, stating that “the digital asset industry plays a critical role in U.S. innovation and economic development and is critical to U.S. international leadership. Therefore, it is the policy of this Administration to support the responsible growth and application of digital assets, blockchain technology, and related technologies across all sectors of the economy.”

Highlights of the executive order include:

- Protect and promote the ability of citizens and private sector entities to lawfully access and use open public blockchain networks, including the ability to develop and deploy software, participate in mining and validating, transact with others without unlawful censorship, and maintain self-custody of digital assets.

- Promote the development of legal and compliant US dollar-backed stablecoins around the world.

- Protect and promote the right of all law-abiding citizens and private sector entities to fair and open access to banking services.

- Provide regulatory clarity and certainty based on the principle of technology neutrality, build a framework that adapts to emerging technologies, a transparent decision-making process and clear boundaries of regulatory authority.

- Except as required by law, any institution is prohibited from taking actions to establish, issue, or promote a CBDC within or outside the United States. Any institution’s existing plans or actions related to the creation of a CBDC are immediately terminated.

- Rescind the Executive Order “Ensuring the Responsible Development of Digital Assets” issued on March 9, 2022; and instruct the Secretary of the Treasury to immediately revoke the “Framework for International Engagement in Digital Assets” issued by the Treasury Department on July 7, 2022.

- Establish a Presidential Digital Asset Markets Working Group within the National Economic Council. The working group is led by a special advisor in the field of artificial intelligence and encryption. In addition to the special advisor, members include the Secretary of the Treasury, the Attorney General, the Secretary of Commerce, the Chairman of the Securities and Exchange Commission, the Chairman of the Commodity Futures Trading Commission (CFTC), etc.

In addition, the order requires that within 30 days of issuance, the Treasury Department, the Department of Justice, the Securities and Exchange Commission, and other relevant agencies should identify all regulations, guidance documents, etc. that affect the digital asset industry. Within 60 days, each agency shall submit modification recommendations to the special adviser. The working group shall submit a report to the President within 180 days, proposing regulatory and legislative recommendations to advance the policies of this order, including: (i) recommending a federal regulatory framework for the issuance and operation of digital assets (including stablecoins) in the United States; (ii) assessing the potential for creating a national digital asset reserve and proposing standards for establishing such a reserve.

Trump has delivered on most of his encryption promises

At present, Trump has fulfilled most of his crypto promises. Ordering federal agencies to stop any possible CBDC development was one of Trump's promises to the crypto industry during his presidential campaign. Recently, Trump also fulfilled his promise to pardon Ross Ulbricht, the founder of Silk Road. On January 20, Gary Gensler officially stepped down, which actually fulfilled Trump's promise to "fire Gary Gensler on the first day of his presidency."

But since taking office, Trump has yet to comment on fulfilling his promise that all Bitcoin should be 'Made in the USA.'

Although Trump has been advancing policies through executive orders, their effectiveness may also face some procedural impacts. For example, on January 20, Trump signed an executive order that essentially abolished birthright citizenship under the 14th Amendment to the U.S. Constitution, but the move was subsequently blocked by a federal judge as "clearly unconstitutional."

US SEC officially revokes crypto accounting policy SAB 121

At the same time as the White House issued the executive order, the SEC is also working to reverse its previous crypto regulatory model.

On January 24, the U.S. Securities and Exchange Commission (SEC) issued a new Staff Accounting Bulletin, announcing the withdrawal of the controversial SAB 121. “Staff reminds entities that they are still required to comply with existing disclosure requirements to keep investors informed of the entity’s obligations to custody crypto assets for others,” the announcement read.

SAB 121 requires banks and other public companies to include their customers’ crypto assets on their own balance sheets, while SAB 122 “withdraws previous interpretive guidance” and instead instructs companies to follow the rules of the Financial Accounting Standards Board (FASB) or the relevant provisions of International Accounting Standards.

SAB 121 has been controversial since its introduction in March 2022. It was supported by former SEC Chairman Gary Gensler, who said the rule could protect investors in bankruptcy events. "We actually found out many times in bankruptcy courts that bankruptcy courts have repeatedly ruled that crypto assets are not assets that are safe from bankruptcy risk," he told Reuters in an interview in 2023.

SAB 121, issued in late March 2022, is intended to better protect investors and details how companies should account for custody services for crypto assets. Due to the risks unique to crypto assets, the staff believes that companies should record a liability and a corresponding asset on their balance sheets at fair value.

In simple terms, if a bank custody $1 billion worth of Bitcoin for a client, they must hold $1 billion in cash to offset this "liability" on their balance sheet. There are widespread concerns in the cryptocurrency industry that it could prevent banks from safekeeping digital assets and exclude banks from the crypto market.

Last year, SAB 121 became the subject of a Congressional Review Act resolution, which was passed by Congress but vetoed by then-President Biden. Now, the SEC’s revocation of SAB 121 policy marks a major change in the regulation of the crypto industry.

At present, after Trump signed the crypto executive order and the SEC announced the revocation of SAB 121, the US crypto regulatory landscape has reached a milestone. This series of measures has brought more regulatory clarity to the industry and filled the market with new expectations for the future. The transformation still takes time. In addition, whether the Trump administration can continue to make its promises come true and how to further promote the digital asset reserve plan still deserves close attention from the industry.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

Weekly Highlights | Gold, US Stocks, and Cryptocurrencies All Fall; Walsh and Epstein are the Celebrities of the Week.