WLFI Backlash as 9 ‘Team Wallets’ Swing 59% Vote on USD1 Growth Proposal

World Liberty Financial is facing mounting criticism from its community after a governance vote approving a USD1 growth proposal passed with decisive support from a small cluster of large wallets.

The vote saw objections from the community over the lack of voting access for locked WLFI holders, reigniting concerns about control, dilution, and the limits of WLFI’s on-chain governance.

Source: WLFI

Source: WLFI

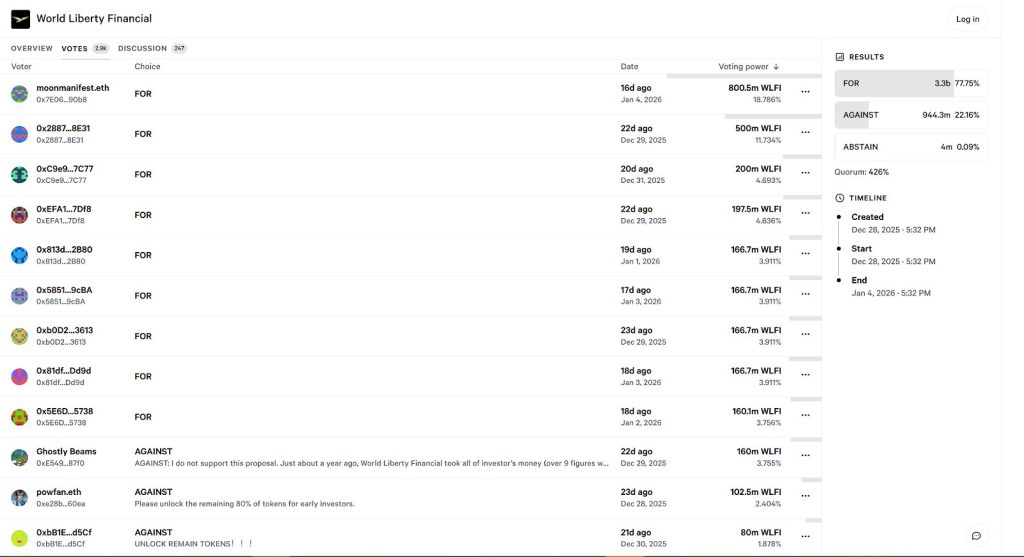

On-chain voting data reviewed by market participants shows that the top nine wallets backing the proposal accounted for roughly 59% of the total voting power.

The single largest wallet alone represented 18.786% of votes cast in the snapshot.

WLFI Vote Passes 78%, but Access Dispute Overshadows Outcome

Analysis shared by pseudonymous trader and researcher DeFi^2 showed that several of these addresses are flagged by on-chain mapping tools as team-linked or strategic partner wallets, effectively allowing a narrow group of insiders to determine the outcome.

The proposal itself authorized World Liberty Financial to deploy less than 5% of its unlocked WLFI treasury holdings to support the adoption of USD1, the project’s dollar-backed stablecoin.

The vote, created on December 28 and closed on January 4, attracted 2,931 participants and passed comfortably, with 3.3 billion votes, or 77.75%, in favor.

Votes against totaled 944.3 million, while abstentions were negligible. The quorum level reached 426%, far exceeding the threshold required for validity.

The backlash has centered less on the mechanics of the proposal and more on who was able to participate.

Many WLFI holders remain locked out of their tokens following the project’s token generation event and cannot vote on governance matters until unlock conditions are changed.

Several community members pointed out that while these holders are unable to influence decisions, team and partner wallets appear to have had full voting access.

DeFi^2 described the episode as an “alarming governance vote,” arguing that a measure unrelated to token unlocks was pushed through despite repeated calls from holders to address access restrictions first.

Tokenholders opposing the proposal have also questioned its economic logic.

WLFI holders are not entitled to protocol revenue, according to the project’s own documentation, which allocates 75% of revenue to the Trump family and 25% to the Witkoff family.

WLFI Holders Voice Frustration Over Incentives and Locked Supply

Against that backdrop, critics argue that using WLFI tokens to incentivize USD1 growth increases dilution without offering a direct upside to tokenholders.

One tokenholder who voted against the proposal said the project had previously deployed more than nine figures of investor capital to accumulate assets such as Bitcoin, Ether, and Chainlink, yet WLFI holders saw no tangible benefit from those holdings.

Tensions increased further after on-chain data showed a transfer of 500 million WLFI tokens to Jump Trading shortly after the vote concluded, while early investor allocations remain locked.

Community members have described the situation as asymmetric, with emissions rising and liquidity becoming available to select counterparties while long-term holders wait for unlocks.

Calls to release the remaining 80% of tokens for early investors have grown louder across social channels.

The governance dispute is unfolding as World Liberty Financial accelerates its broader expansion.

On January 8, the group disclosed that World Liberty Trust had filed a de novo application for a U.S. national banking charter with the Office of the Comptroller of the Currency.

If approved, the charter would allow the trust to issue and safeguard USD1 directly within the U.S. banking system.

Days later, on January 12, World Liberty Financial announced the launch of World Liberty Markets, a lending and borrowing platform built around USD1 and WLFI.

You May Also Like

Wealthfront Corporation (WLTH) Shareholders Who Lost Money – Contact Law Offices of Howard G. Smith About Securities Fraud Investigation

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!