Trump Threatens 100% Tariffs On Canada As Bitcoin Falls To $88K

Bitcoin’s price has extended its weekly drop to 6.7%, amid Trump’s threats of a 100% tariff on Canadian imports, as pressure pushed BTC below the key $89,000 level.

BTC is down 1% over the last 24 hours, trading at $88,858 as of 12:34 a.m. EST, with trading volume down 58% to $17.1 billion, according to Coingecko data. The drop in trading volume indicates reduced activity, which supports the current bearish sentiment.

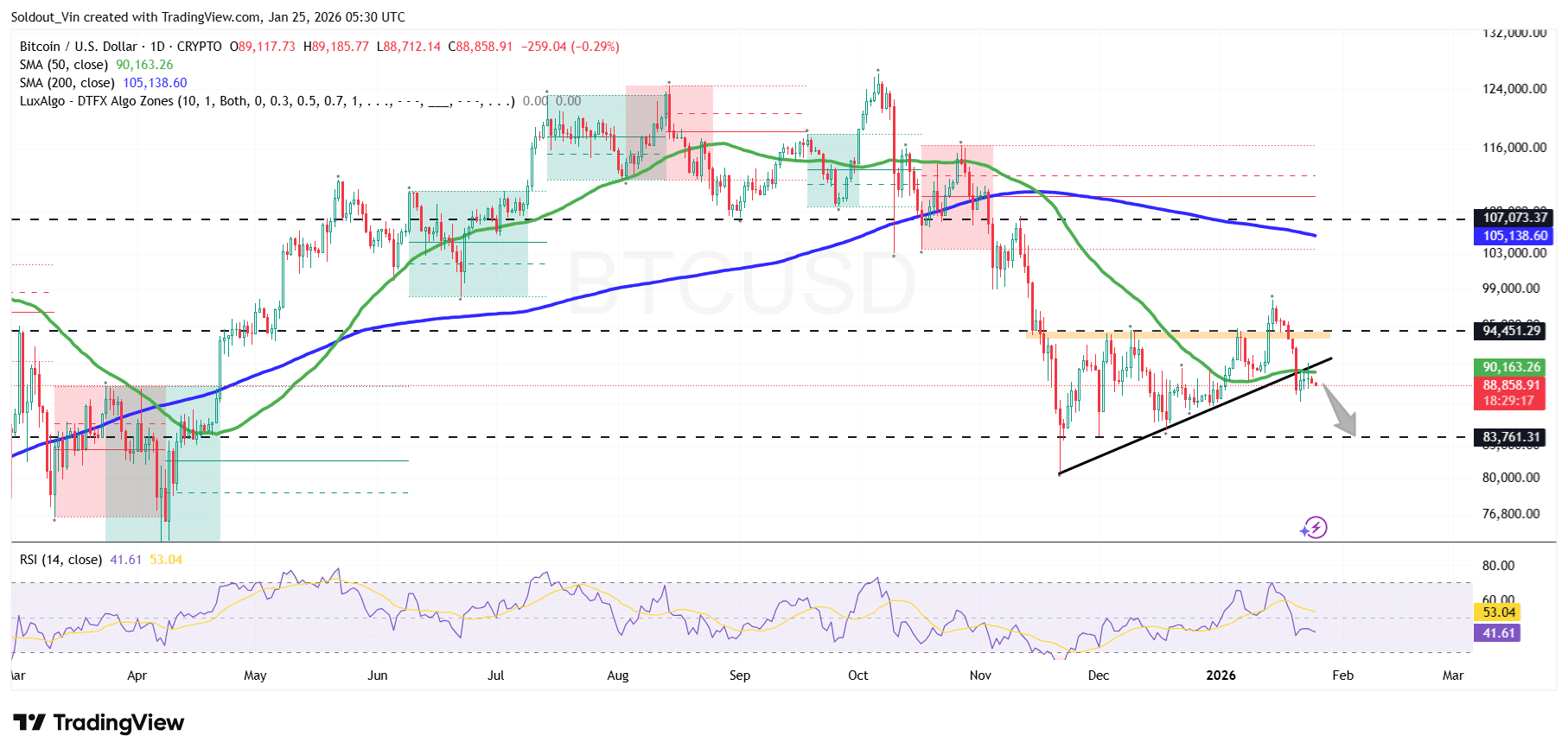

After BTC dropped below the ascending triangle pattern, selling pressure has picked up, signaling that sellers are still in control of the $90,000 area, which was the previous support, following a sustained drop from the $97,000-$98,000 level.

Trump Threatens Canada With 100% Tariff Over Pending Trade Deal With China

US President Donald Trump said on Saturday that he would impose a 100% tariff on Canada if it goes through with a trade deal with China and warned Canadian Prime Minister Mark Carney that such a deal would endanger his country.

“China will eat Canada alive, completely devour it, including the destruction of their businesses, social fabric, and general way of life,” Trump wrote on Truth Social. “If Canada makes a deal with China, it will immediately be hit with a 100% Tariff against all Canadian goods and products coming into the U.S.A.”

Carney had traveled to China this month to reset the countries’ strained relationship and reached a trade deal with Canada’s second-biggest trading partner after the US.

The Chinese embassy in Canada said that China was ready to work with Canada to implement the important consensus reached by the leaders of the two countries.

US-Canada tensions have grown in recent days following Carney’s criticism of Trump’s pursuit of Greenland.

Trump is now suggesting that China would try to use Canada to evade US tariffs.

The continuous threat of Trump imposing tariffs has kept markets jittery this month, even after they surged at the beginning of the year.

US Bitcoin ETFs On A Five-Day Outflow Streak

As the BTC price continues to drop, US-based Bitcoin exchange-traded funds have extended their outflow streak to five days.

Spot BTC ETFs posted $103.5 million in net outflows on Friday, continuing an outflow streak that began the previous Friday.

As a result, total outflows reached approximately $1.72 billion, including the shortened four-day trading week in the US due to Martin Luther King Jr. Day on Monday, according to Farside data.

The outflows come as the Crypto Fear and Greed Index, which measures the overall crypto sentiment, posted an “Extreme Fear” score in its update.

Crypto sentiment platform Santiment said in a report on Saturday that the crypto market is in “a phase of uncertainty.”

Will the BTC price continue to drop?

Bitcoin Price Faces Growing Downside Pressure

Bitcoin has struggled to maintain recent gains, slipping back toward monthly lows after a brief relief rally earlier in the week. The short-lived upside move failed to attract strong follow-through, which shows continued weakness in the BTC market.

From a technical perspective, the BTC price has broken down below its ascending triangle, a pattern that previously suggested potential upside continuation.

This drop below the pattern signals a loss of bullish momentum and increases the risk of further downside.

Bitcoin price is now trading below the 50-day Simple Moving Average (SMA) ($90,163), which adds to its bearish outlook. This level had acted as dynamic support in prior weeks but has now flipped into resistance.

The longer-term 200-day SMA at $105,138 remains well above and continues to cap any meaningful recovery attempts. This area also aligns with a prior supply zone.

BTC/USD Chart Analysis Source: TradingView

BTC/USD Chart Analysis Source: TradingView

Bitcoin price action is range-bound, moving in between roughly $83,500 and $94,400, a sideways structure that has persisted since late November.

Momentum indicators echo this indecision, with the RSI hovering near 43, suggesting weak buying strength but not yet oversold conditions.

If Bitcoin fails to reclaim $90,000, a move toward the $85,000 demand zone is possible. A confirmed breakdown below that area could expose the $83,500 support level as the next key downside target for BTC.

Related News:

You May Also Like

Anchorage Digital applies for a Fed master account; what is it?

Could Ripple’s XRP Replace SWIFT? New Signals Hint at Potential Financial Power Shift