Solana price prediction still strong after falling to $123 while analysts hint ZKP may be the next 100x crypto

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Solana stays strong into late January 2026 as investors weigh limited upside and growing interest in ZKP infrastructure plays.

- Zero Knowledge Proof (ZKP) targets privacy-preserving computation, not speed or fees, positioning itself as core infrastructure for AI and regulated data.

- Built with $100m+ of team capital before fundraising, ZKP reverses the typical crypto model and reshapes early-stage risk perception.

- Analysts see ZKP’s privacy-first AI focus and long presale as asymmetric upside, contrasting Solana’s more mature growth profile.

Solana enters late January 2026 in a position many large-cap altcoins envy. Price structure remains bullish, on-chain metrics continue to improve, and investor conviction appears intact despite recent consolidation. The question facing the market is not whether Solana is strong, but whether most of the easy upside is already reflected in the price.

At the same time, capital rotation is beginning to favor earlier-stage infrastructure plays. That is where Zero Knowledge Proof (ZKP) increasingly enters the conversation as a potential next-cycle outperformer.

Solana price prediction: Structure, not hype

From a technical perspective, Solana’s price action is constructive but extended. After breaking above the $132 level earlier this month, SOL has transitioned into a consolidation range beneath heavy resistance around $145–$147. This is a classic pause after a strong trend leg rather than a breakdown.

Momentum indicators support that view. RSI has held above 50 on key timeframes, while MACD remains positive, signaling that bullish control is intact even as price chops sideways. As long as SOL holds the $130–$135 region, the broader structure remains healthy.

A clean daily close above $147 would likely open the door to the $155–$165 zone, with $180 acting as a longer-term technical target. Conversely, a sustained break below $130 could invite a deeper test into the low $120s, particularly if macro conditions turn risk-off.

In short, Solana’s price prediction for early 2026 points to choppy upside, not a vertical move, a sign of maturity rather than weakness.

On-chain data confirms real usage

What separates Solana from many large-cap peers is that price strength is backed by usage.

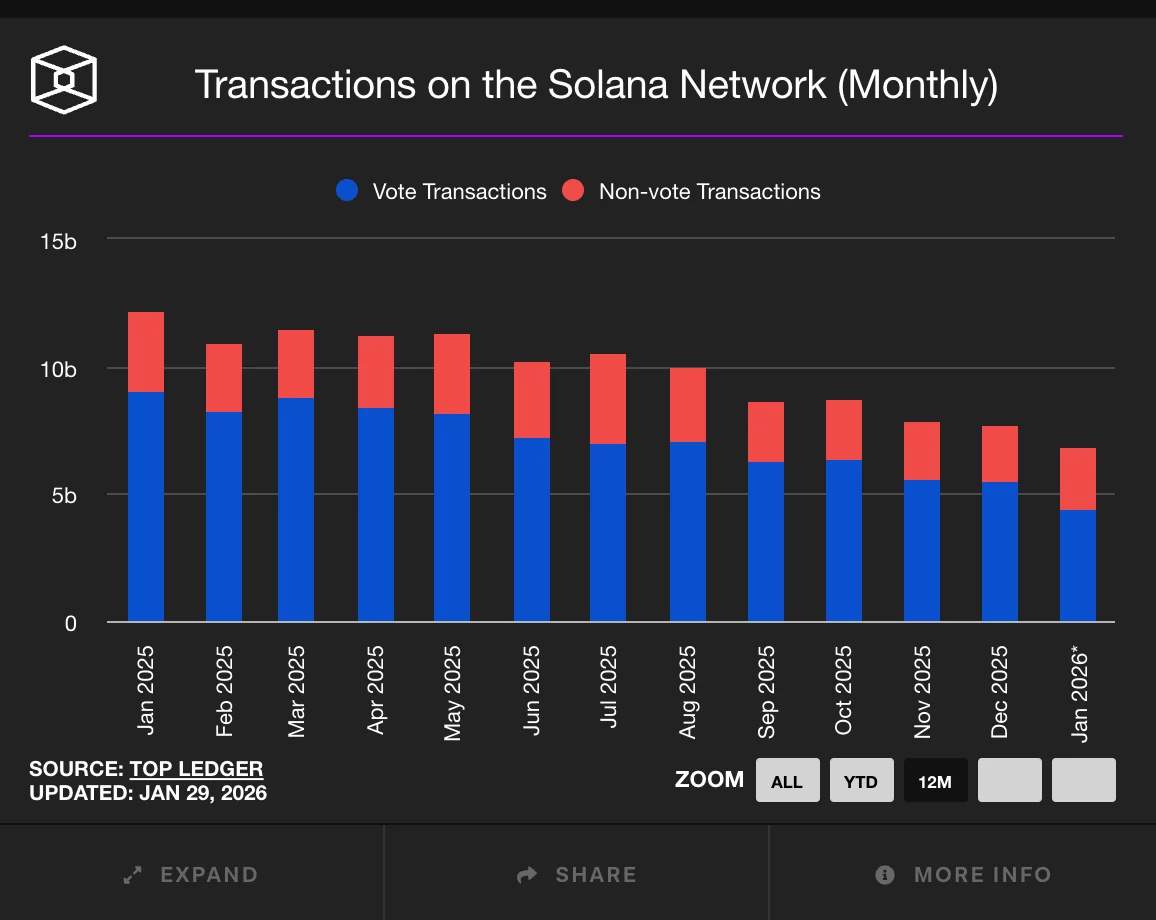

Active addresses have surged meaningfully in January, with multiple data sources showing millions of daily active users and sharp week-over-week growth. Transaction counts recently pushed above 500 million in a short window, reinforcing Solana’s position as one of the most-used blockchains in the market.

DeFi activity adds another layer of support. Total value locked has climbed above $9 billion, and stablecoin supply on Solana continues to grow, a signal that liquidity is staying on-chain rather than rotating out. These metrics typically precede higher valuations over multi-month horizons.

Zero Knowledge Proof: A different bet entirely

Zero Knowledge Proof is not competing with Solana on speed, fees, or consumer apps. It is addressing a different layer of the stack: privacy-preserving computation.

ZKP is a privacy-first Layer 1 designed to allow advanced computation, including AI workloads, to run on encrypted data. Results can be verified cryptographically without exposing the underlying information. As regulation tightens and AI adoption accelerates, this capability moves from “nice to have” to essential infrastructure.

Unlike many early-stage projects, ZKP did not raise capital first and build later. The team deployed over $100 million of its own capital to build the network, testnet, and hardware infrastructure before launching its presale auctions. That reversal of the traditional crypto funding model materially changes risk perception.

ZKP is also expected to raise more than $1.7 billion through its presale auctions, signaling ambition at a scale typically associated with institutional-grade platforms rather than short-lived token launches.

ZKP includes streak incentives for consecutive participation, with bonuses increasing from 5 percent on Day 1 to 10 percent by Day 5, paid in additional ZKP tokens. This favors sustained engagement over one-off speculation.

Why some analysts see ZKP as the next 100x crypto

The case for ZKP as a potential next 100x crypto is not based on hype, but on asymmetry.

Solana’s upside from here is likely measured in multiples of 2–3x over time if adoption continues. ZKP, by contrast, is still in price discovery, with a long presale horizon and a gradual distribution model that allows the network to evolve publicly.

If privacy-first AI infrastructure becomes a core requirement across finance, healthcare, and enterprise analytics, ZKP’s addressable market is orders of magnitude larger than typical DeFi or payments use cases. That is why it increasingly appears on lists of the best crypto to buy now for investors willing to tolerate early-stage risk in exchange for outsized upside.

The bottom line

Solana price prediction for 2026 remains constructive. Strong on-chain metrics, whale accumulation, and improving infrastructure support a bullish medium-term outlook, even if price action remains choppy in the near term.

ZKP represents a different opportunity altogether. It is earlier, riskier, and far less proven, but it also targets a problem Solana does not aim to solve. For investors balancing exposure between established leaders and emerging infrastructure, that contrast explains why Solana remains the best crypto to watch, while ZKP is increasingly discussed as the best crypto to buy before the next narrative fully matures.

To learn more about Zero Knowledge Proof, visit the website, buy, Twitter (X), and Telegram.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

Trump-backed stablecoin hits $5 billion as first family cashes in

Will Ripple be publicly traded? — Will Ripple be publicly traded?