Oil Prices Fall Over 4% as US-Iran Negotiations Reduce Supply Concerns

TLDR

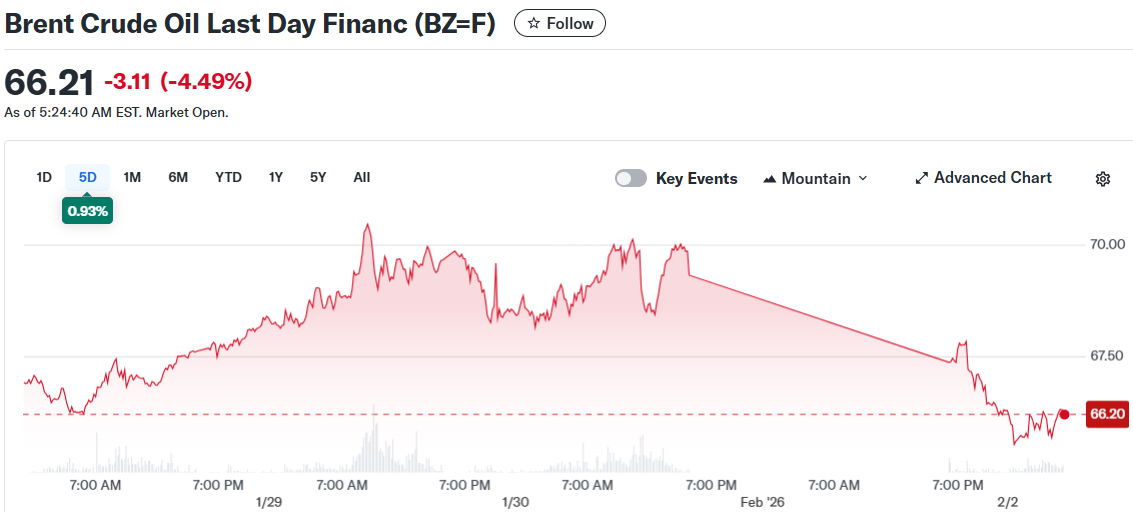

- Oil prices dropped over 3% on Monday as reports emerged of serious negotiations between the US and Iran, reducing risk premium in crude markets.

- Brent crude fell 4.6% to $66.10 per barrel while WTI declined 4.7% to $60.92 per barrel during Asian trading hours.

- President Trump stated Iran is “seriously talking” with his administration, easing concerns about potential military strikes that could disrupt Middle East oil supplies.

- OPEC+ kept oil production levels unchanged for March at their Sunday meeting, following their November decision to pause output increases.

- A stronger US dollar and profit-taking after oil reached six-month highs last week added pressure to crude prices.

Oil markets experienced sharp declines on Monday as diplomatic developments between Washington and Tehran reduced concerns about supply disruptions in the Middle East. The pullback came after crude reached six-month highs last week.

Brent Crude Oil Last Day Financ (BZ=F)

Brent Crude Oil Last Day Financ (BZ=F)

Brent crude futures for April delivery fell 4.6% to $66.10 per barrel during Asian trading hours. West Texas Intermediate crude dropped 4.7% to $60.92 per barrel. The declines reflected changing market sentiment about geopolitical risks in the oil-rich Middle East region.

President Donald Trump told reporters over the weekend that Iran was “seriously talking” with his administration. Iranian officials had previously confirmed they were arranging negotiations with the United States. Trump’s comments came after weeks of heightened tensions and threats of military action.

The US president had deployed a naval fleet to the Middle East and repeatedly threatened Iran over nuclear issues. These actions had pushed oil prices higher as markets priced in potential supply disruptions. Last week, crude reached levels not seen since August 2025.

ANZ analysts noted the diplomatic progress removed some risk premium from the market. However, they emphasized that US military presence in the region continues to build. Tensions remain elevated despite the talks.

OPEC+ Maintains Production Levels

The Organization of Petroleum Exporting Countries and its allies held their regular meeting on Sunday. The group decided to keep oil production unchanged for March. This decision followed their November announcement to pause further output increases indefinitely.

OPEC+ had increased production by approximately 2.9 million barrels per day throughout 2025. The cartel stopped additional hikes despite recent price increases. Oil prices had fallen about 20% over the previous year before last week’s rally.

The group provided no forward guidance on future production plans. Analysts attributed this to uncertainty about global economic conditions and ongoing geopolitical issues.

Market Pressures Mount

A stronger US dollar added downward pressure on crude prices. The greenback surged after President Trump nominated Kevin Warsh as the next Chairman of the Federal Reserve. Dollar-denominated commodities become more expensive for overseas buyers when the currency strengthens.

Traders also engaged in profit-taking after the recent rally. Oil prices had climbed on concerns about extreme cold weather disrupting North American supplies. A major production outage in Kazakhstan had also supported prices.

Ryan McKay, senior commodity strategist at TD Securities, suggested additional downside could emerge. He noted this would be possible if easing geopolitical risk premium coincides with weakening market fundamentals. The broader commodities complex also saw selling pressure on Monday.

Oil markets had previously overcome concerns about weak global demand and potential oversupply in 2026. Weather-related disruptions and geopolitical tensions had provided support. The diplomatic developments between the US and Iran now shift the focus back to fundamental supply and demand factors.

The post Oil Prices Fall Over 4% as US-Iran Negotiations Reduce Supply Concerns appeared first on CoinCentral.

You May Also Like

DBS lists Franklin Templeton’s sgBENJI token and Ripple’s RLUSD stablecoin on its exchange

Kalshi Launches Blockchain Ecosystem Hub with Solana and Base Partnership