Crypto Liquidations Reach $5B as Market Volatility Surges

This article was first published on The Bit Journal.

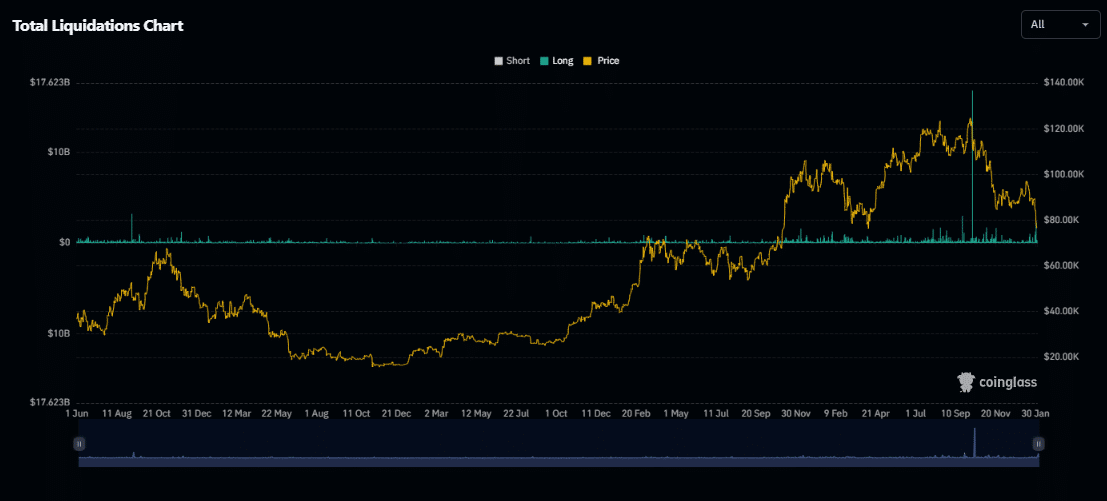

The crypto market has been shaken by a powerful liquidation wave that erased more than $5 billion in leveraged positions within just four days. The scale and speed of the event make it the largest round of crypto liquidations since October 10, 2023.

What began as a sharp price pullback quickly turned into a market-wide reset, exposing how fragile heavily leveraged trading can be during periods of rising market volatility.

According to the source, the sell-off intensified as major assets slipped below key technical levels. Once those levels failed, automated liquidation systems took control, forcing positions to close faster than traders could react. The result was a cascade of sell orders that rippled across the entire market.

Source: Coinglass

Source: Coinglass

Bitcoin and Ethereum Sparked a Chain Reaction

Most crypto liquidations were concentrated in Bitcoin and Ethereum, the two largest and most liquid assets in the market. As prices dropped, long positions were hit first. These traders had positioned for further upside and were forced out as margin requirements were breached.

The impact did not stop there. As Bitcoin and Ethereum fell, altcoins followed with sharper declines. Lower liquidity in smaller tokens amplified price swings, turning modest drops into steep losses. This domino effect is typical during liquidation-driven moves, where market volatility spreads outward from major assets to the broader market.

Cascading Liquidations Across Exchanges

The liquidation wave unfolded across both centralized and decentralized platforms. Centralized exchanges such as Binance, OKX, and Bybit recorded some of their highest daily liquidation volumes in months. Automated risk engines on these platforms closed positions instantly to prevent further losses, adding continuous sell pressure.

At the same time, decentralized protocols were not immune. Smart contract-based liquidations executed without discretion, reinforcing the downward momentum. Together, these mechanisms created a self-feeding loop, where each forced sale increased market volatility and triggered the next wave of closures.

What Triggered the $5B Liquidation Wave

Several factors converged to create this perfect storm. Elevated leverage left traders with little room for error. Even small price movements were enough to trigger margin calls. At the same time, broader macroeconomic uncertainty weighed on sentiment. Ongoing concerns around interest rates, regulatory clarity, and uneven capital inflows kept risk appetite fragile.

When prices dipped, confidence vanished quickly. Liquidations surged not because of a single headline, but because positioning was already stretched. Once selling began, automated systems ensured it accelerated.

Market Sentiment After the Shakeout

Events of this size tend to change behavior, at least temporarily. Following the wave of crypto liquidations, open interest across derivatives markets declined as traders reduced leverage or stepped aside. Short-term sentiment turned cautious, with many participants reassessing risk management strategies.

Historically, such events often mark cooling-off periods rather than outright trend reversals. Market volatility usually declines once forced sellers exit and leverage resets. However, recovery depends on discipline. If speculative behavior returns too quickly, instability can follow.

What Comes Next for Crypto Markets

For long-term investors, liquidation waves are often viewed as structural resets. Excess risk is flushed out, and price discovery becomes healthier. If network fundamentals remain strong, these periods can attract patient capital looking beyond short-term noise.

Still, uncertainty remains. All eyes are now on whether Bitcoin and Ethereum can stabilize at current levels. Continued weakness could invite further volatility, while stabilization may signal that the worst of the forced selling has passed.

Conclusion

The $5 billion liquidation wave serves as a sharp reminder of how quickly leverage can turn against traders. Crypto liquidations did not appear out of nowhere. They emerged from stretched positioning, automated systems, and a sudden rise in market volatility.

While painful, such events are part of crypto’s maturation process. The lesson is clear. In fast-moving markets, survival depends less on bold predictions and more on disciplined risk control.

Glossary of Key Terms

Crypto liquidations: Forced closure of leveraged positions when margin requirements are no longer met.

Market volatility: Rapid and significant price changes within a short period.

Leverage: Borrowed capital used to increase the size of a trading position.

Open interest: The total number of active derivative contracts in the market.

FAQs About Crypto Liquidations

What caused the recent crypto liquidations?

High leverage combined with sudden price drops triggered automated margin closures.

Which assets were most affected?

Bitcoin and Ethereum led liquidations, followed by sharp declines in altcoins.

Why did market volatility increase so quickly?

Forced selling created a feedback loop that pushed prices lower in rapid succession.

Do liquidation waves signal a bear market?

Not necessarily. They often reset leverage and precede periods of stabilization.

References

Bitget

Coinglass

bloomingbit

Decrypt

Binance

Read More: Crypto Liquidations Reach $5B as Market Volatility Surges">Crypto Liquidations Reach $5B as Market Volatility Surges

You May Also Like

Tropical Storm Basyang expected to drench Caraga, Northern Mindanao

Crypto execs met with US lawmakers to discuss Bitcoin reserve, market structure bills

Lawmakers in the US House of Representatives and Senate met with cryptocurrency industry leaders in three separate roundtable events this week. Members of the US Congress met with key figures in the cryptocurrency industry to discuss issues and potential laws related to the establishment of a strategic Bitcoin reserve and a market structure.On Tuesday, a group of lawmakers that included Alaska Representative Nick Begich and Ohio Senator Bernie Moreno met with Strategy co-founder Michael Saylor and others in a roundtable event regarding the BITCOIN Act, a bill to establish a strategic Bitcoin (BTC) reserve. The discussion was hosted by the advocacy organization Digital Chamber and its affiliates, the Digital Power Network and Bitcoin Treasury Council.“Legislators and the executives at yesterday’s roundtable agree, there is a need [for] a Strategic Bitcoin Reserve law to ensure its longevity for America’s financial future,” Hailey Miller, director of government affairs and public policy at Digital Power Network, told Cointelegraph. “Most attendees are looking for next steps, which may mean including the SBR within the broader policy frameworks already advancing.“Read more