Crypto crash: why are altcoins going down today? (08/01)

Bitcoin and most altcoins are declining today, August 1, as the recent crypto crash continues.

- Bitcoin price continued its strong downtrend on Friday.

- Top altcoins like SPX6900, Virtuals Protocol, and Pendle were the top laggards.

- The decline is mostly because of the ongoing trade jitters.

Bitcoin (BTC) price dropped briefly below $115,000, continuing a downtrend that started on July 14 when it peaked at $123,000. Some of the top laggards during the ongoing crash were SPX6900 (SPX), Pendle (PENDLE), and Virtuals Protocol (VIRTUAL) fell by over 10%.

Crypto crash is happening amid Trump tariff blitz

Bitcoin and altcoins are under pressure as market participants react to the escalating trade war between the U.S. and other countries. President Donald Trump imposed a 25% tariff on India, 30% on South Africa, and 39% on most goods imported from Switzerland.

While the U.S. has signed trade deals with countries like Japan, the European Union, and the U.K., steep tariffs remain in place. The implication is that U.S. inflation may stay elevated for longer, complicating the Federal Reserve’s path to cutting interest rates.

The Fed held interest rates steady between 2.25% and 2.50% this week, with officials reaffirming their data-dependent stance. This suggests the central bank may not cut rates this year, contrary to many analysts’ expectations.

August is historically a down month for cryptocurrencies

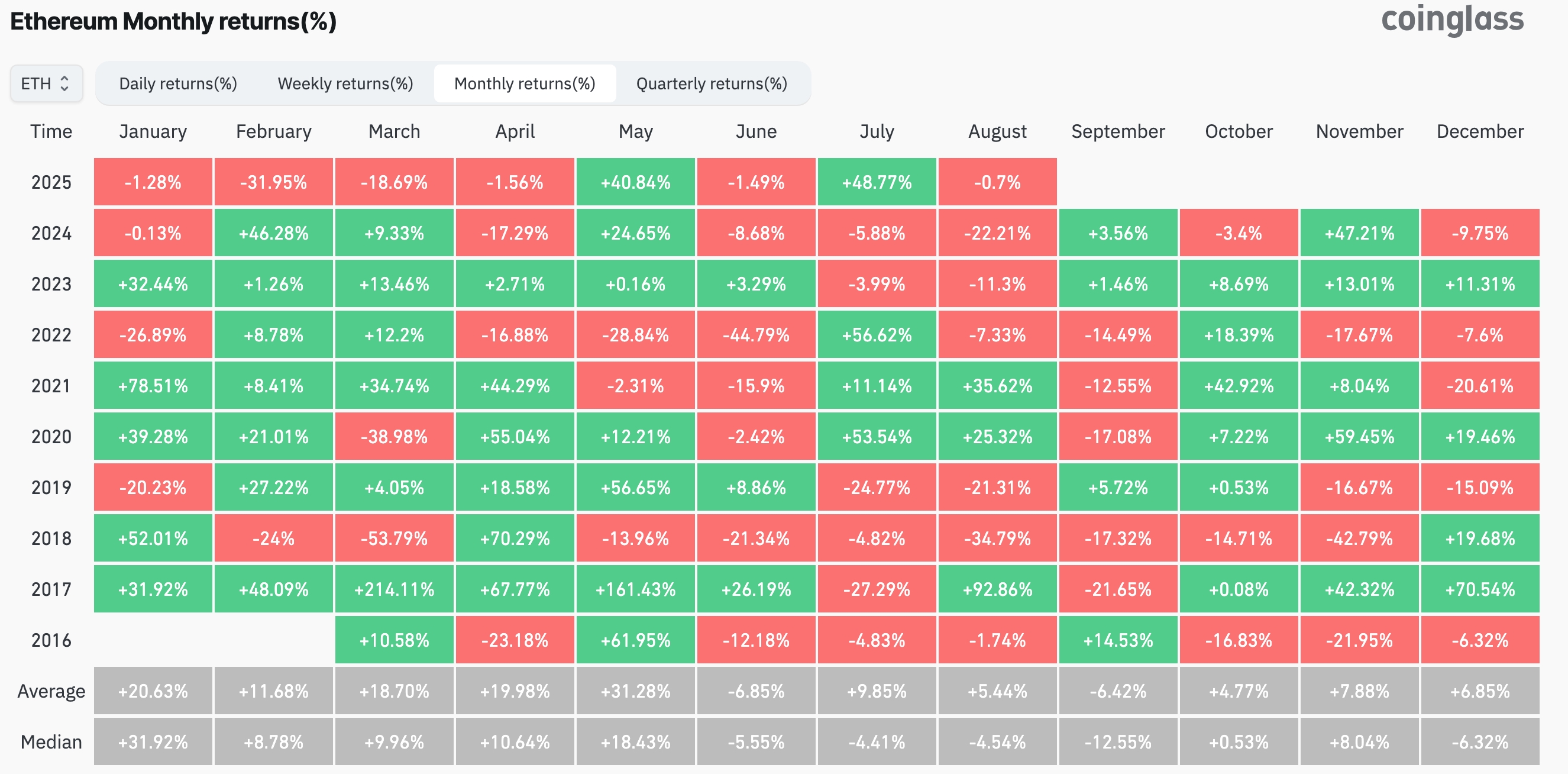

Meanwhile, the crypto market is declining in part due to seasonal trends. Ethereum’s price dropped by 22% in August last year, 11% in 2023, and 7.3% in 2022. The average return for August since 2015 stands at 5.14%.

Ethereum performance seasonality | Source: CoinGlass

Ethereum performance seasonality | Source: CoinGlass

Bitcoin has also dropped in August of the past three years. It dropped by 8.6% in 2024, 11.2% in 2023, and 13.8% in the previous year.

However, seasonality is not always a reliable predictor of performance. For example, Bitcoin declined by 2.3% in March despite gains during the same month over the previous four years.

Slowing US economy

Bitcoin and other altcoins are also under pressure following data showing that the U.S. economy is slowing. According to a Bureau of Labor Statistics report, the economy added a mere 73,000 jobs, while the unemployment rate rose to 4.3%.

These figures align with projections shared by Federal Reserve officials during Wednesday’s meeting. They expect economic growth to slow as the impact of tariffs spreads.

Slowing Bitcoin and Ethereum ETF inflows

The crypto market is falling amid signs of waning institutional demand. Data from SoSoValue showed that spot Bitcoin ETFs recorded a net outflow of $114 million on Thursday. These funds have seen $169 million in inflows so far this month, down from a peak of $2.7 billion in the second week of July.

Ethereum ETFs added $306 million this week, down from $1.85 billion last week and $2.1 billion the week before. The data suggests weakening institutional interest in cryptocurrencies.

The broader market is also retreating as investors continue to book profits following a strong rally in the first half of May. A pullback following a surge is not uncommon.

You May Also Like

XRP Enters ‘Washout Zone,’ Then Targets $30, Crypto Analyst Says

Republicans are 'very concerned about Texas' turning blue: GOP senator