Bitcoin Enters Bear Market Territory as Institutional Demand Reverses: CryptoQuant

Bitcoin may be entering a renewed bear market phase, according to new research from CryptoQuant, as on-chain indicators, weakening institutional flows and tightening liquidity conditions point to broad structural downside risk.

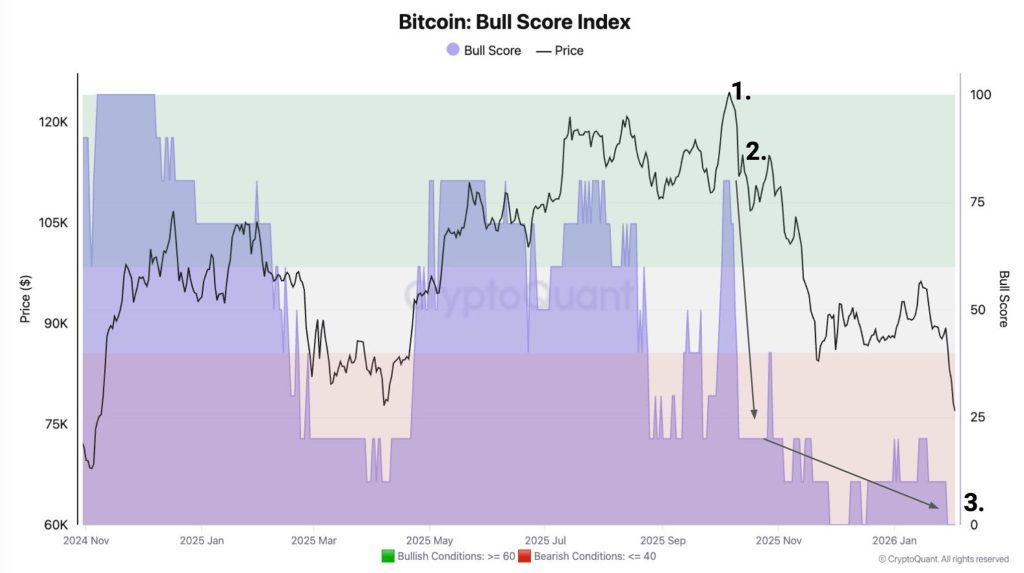

In its latest Crypto Weekly Report, CryptoQuant said multiple on-chain metrics now confirm a bear market regime. The firm noted that Bitcoin peaked near $126,000 in early October, when its Bull Score Index stood at 80, signaling a strong bullish environment.

However, following the October 10 liquidation event, the index flipped bearish and has since fallen to zero, while BTC trades closer to $75,000. “This signals broad structural weakness,” CryptoQuant wrote.

ETF Flows Turn From Tailwind to Headwind

CryptoQuant highlighted a material reversal in institutional demand, particularly through U.S. spot Bitcoin ETFs. At the same point last year, ETFs had purchased roughly 46,000 BTC, but in 2026 they have instead become net sellers, offloading around 10,600 BTC.

That shift represents a 56,000 BTC demand gap compared with 2025, contributing to persistent selling pressure across the market.

U.S. Spot Demand Remains Subdued

Despite lower prices, CryptoQuant said U.S. investor participation remains weak. The Coinbase Premium — often used as a proxy for American spot demand — has stayed negative since mid-October.

Historically, sustained bull markets have coincided with a positive Coinbase Premium driven by strong U.S. buying. CryptoQuant noted that this pattern has not returned, suggesting retail and institutional dip-buying remains limited.

Stablecoin Liquidity Shows First Contraction Since 2023

Liquidity conditions are also tightening, according to the report. CryptoQuant pointed to USDT’s 60-day market cap growth turning negative by $133 million, marking the first contraction since October 2023.

Stablecoin expansion peaked at $15.9 billion in late October 2025, and the reversal is consistent with liquidity drawdowns typically seen in bear markets.

The firm added that one-year apparent spot demand growth has collapsed 93%, falling from 1.1 million BTC to just 77,000 BTC, reinforcing the slowdown in new capital entering the market.

Technical Breakdown Raises Downside Risk

CryptoQuant also warned that Bitcoin has broken below its 365-day moving average for the first time since March 2022. BTC has already declined 23% in the 83 days since that breakdown — a sharper move than the early stages of the 2022 bear market.

With key on-chain support levels now lost, CryptoQuant suggests Bitcoin could face further downside toward the $70,000–$60,000 range unless a new catalyst restores demand and liquidity.

You May Also Like

Recovery extends to $88.20, momentum improves

Fed Decides On Interest Rates Today—Here’s What To Watch For