Bitcoin Price Forecast: BTC consolidates as Trump tariffs go into effect

- Bitcoin price has been consolidating below the $116,000 resistance level so far this week, indicating indecisiveness among traders.

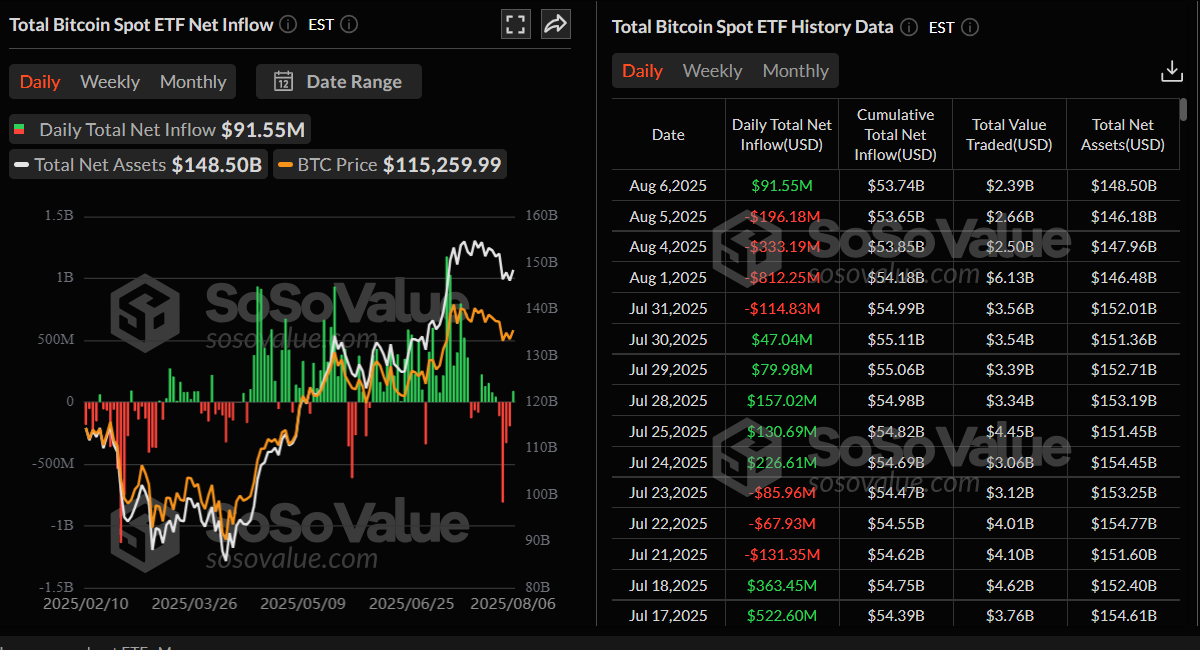

- Trump’s sweeping tariffs take effect, while new trade-related announcements could potentially inject fresh volatility.

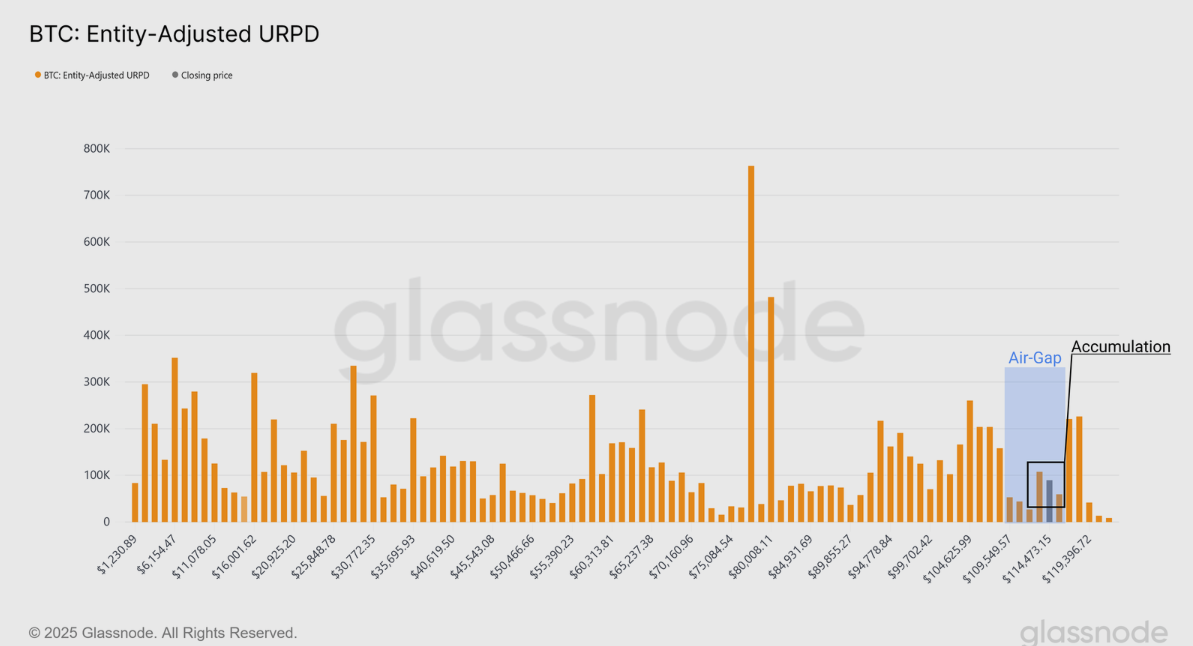

- BTC is trading within a low-liquidity “air gap” between $110,000 and $116,000, a zone that has historically attracted opportunistic accumulation.

Bitcoin (BTC) has been trading sideways below the $116,000 mark so far this week, reflecting a cautious tone among traders amid growing macroeconomic uncertainty. US President Donald Trump’s reciprocal tariffs are already in force, while new trade-related announcements could potentially inject fresh volatility into the crypto markets.

Trump’s constant tariff threats could hit BTC

US President Donald Trump’s reciprocal tariffs went into effect on Thursday. So far this week, Bitcoin prices have been consolidating between the $113,000 and $116,000 ranges, highlighting market participants' indeciveness and awaiting a key catalyst. In this sense, any new trade-related announcements could potentially bring fresh volatility in crypto markets.

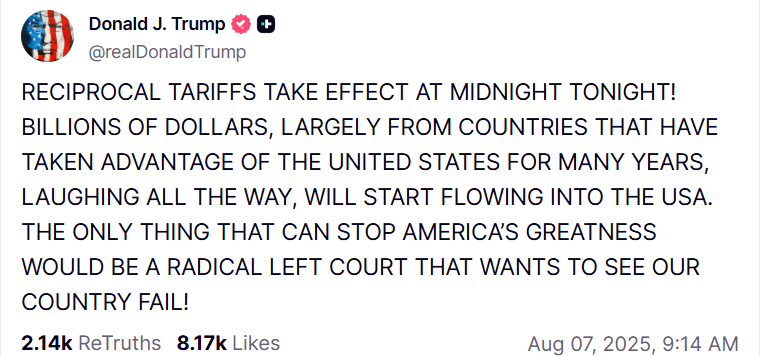

According to K33 Research BTC 30-day volatility stays at one-year lows at 1.33% and seven-day volatility hovers at a modest 1.2% after hitting a near two-year low of 0.76% on July 30, the lowest volatility recorded since September 2023.

BTC-USD Volatility chart. Source: K33 Research

Despite no directional bias and low volatility, the growing acceptance that the US Federal Reserve (Fed) will resume its rate-cutting cycle in September adds some optimism to riskier assets such as Bitcoin.

According to the CME Group's FedWatch Tool, market participants see a more than 90% chance that the US central bank will lower borrowing costs at the next monetary policy meeting in September. Moreover, the Fed is expected to deliver at least two 25-basis-point rate cuts by the end of this year.

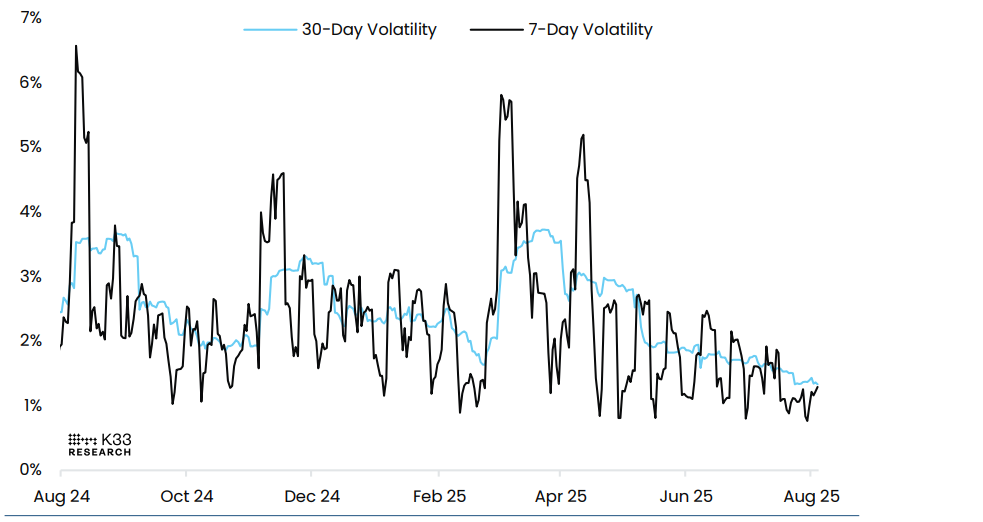

Moreover, a recent $58 billion US debt auction saw foreign demand fall to a one-year low, forcing domestic banks and investors to absorb the excess—an early warning that, if this trend continues, the Federal Reserve may be pressured to resume money printing, which could further support Bitcoin’s appeal as a hedge.

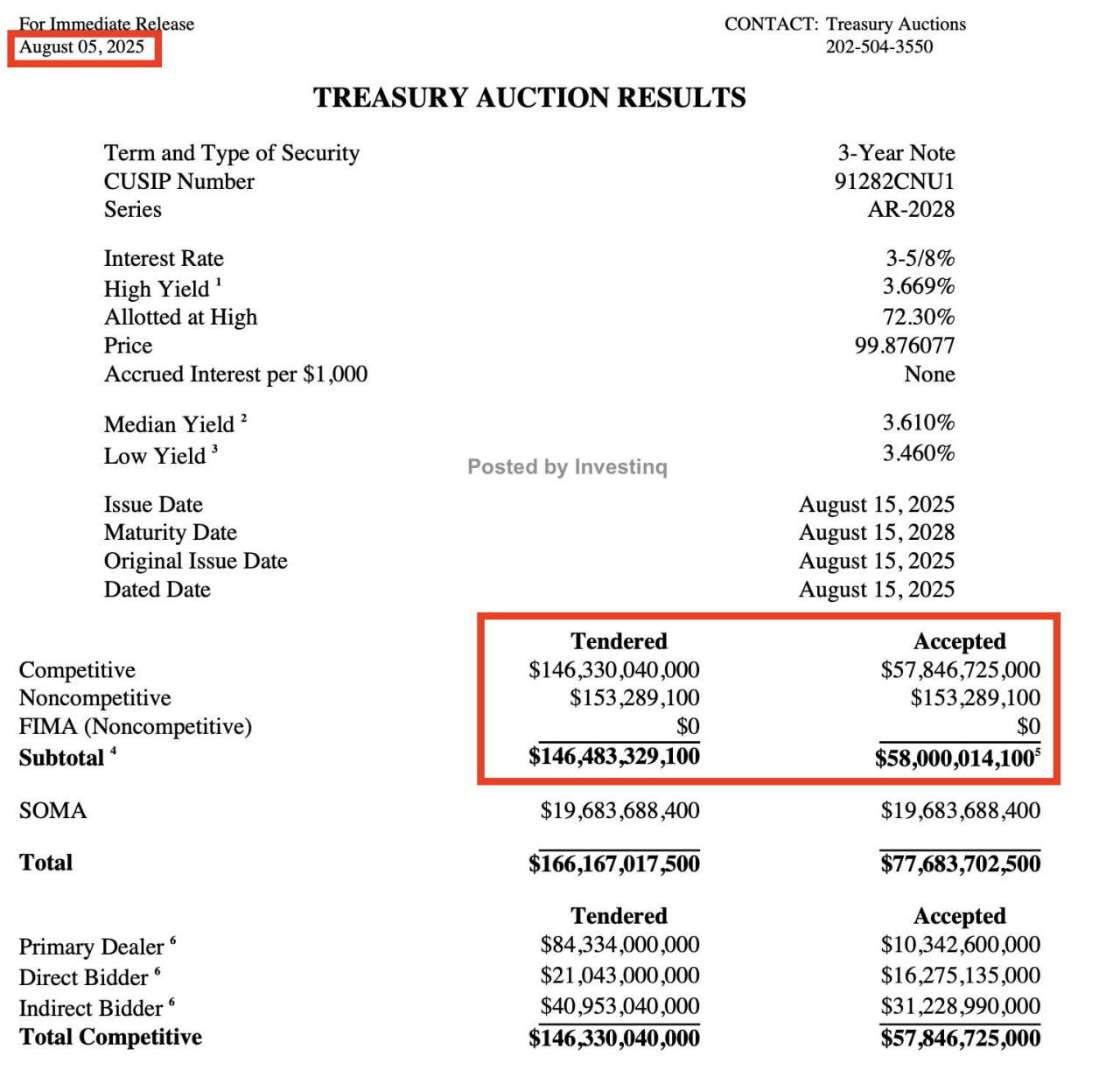

Institutional demand recovers somewhat

Institutional demand shows some signs of relief. According to the SoSoValue data, US spot Bitcoin ETFs recorded a mild inflow of $91.55 million on Wednesday, breaking a four-day streak of outflows. However, the current inflow levels remain lower than those recorded around July 10, which preceded Bitcoin's surge to a new all-time high of $123,218 on July 14.

Total Bitcoin spot ETF net inflow daily chart. Source: SoSoValue

BTC’s low-liquidity price ranges highlight new accumulation zones

Glassnode reported on Wednesday that the Bitcoin price has slipped below the $116,000 accumulation range low and entered a low-liquidity “air gap” ranging between $110,000 and $116,000, as shown in the graph below. Historically, such low-liquidity price ranges often evolve into new accumulation zones where opportunistic buyers step in to acquire BTC at a perceived discount to the latest ATH.

BTC: Entity-Adjusted URPD chart. Source: Glassnode

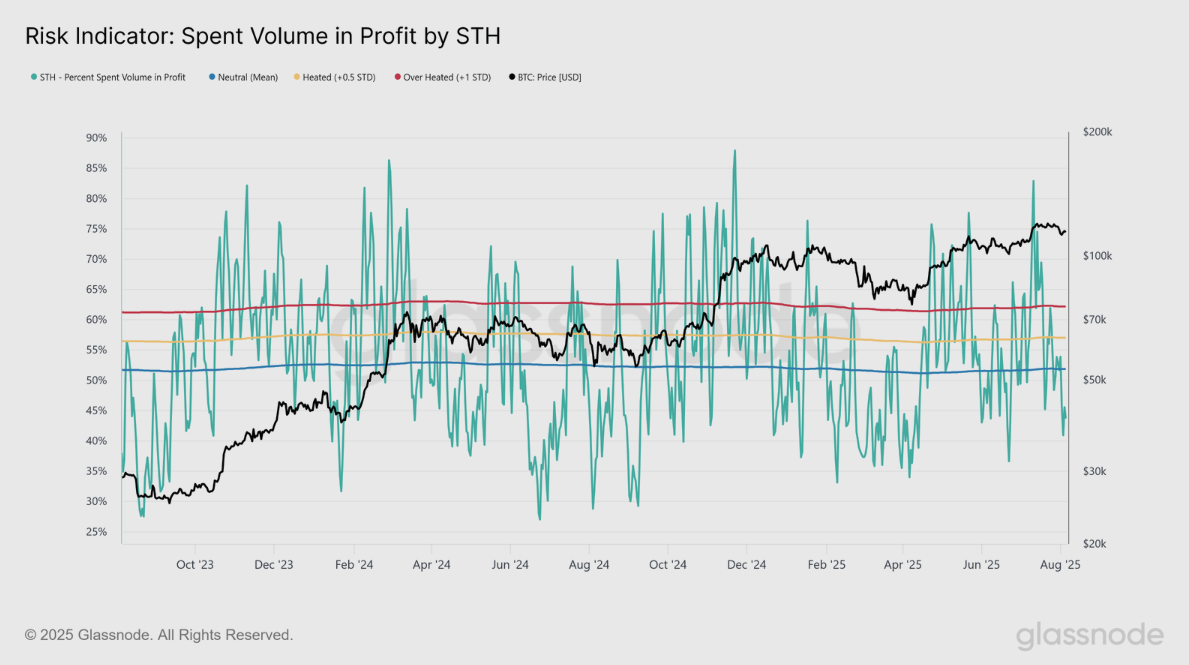

The report also highlighted that the proportion of Short-Term-Holder (STH) spent coins that are taking profit has cooled off, and trading at 45%, which is below the neutral threshold. Overall, this suggests the market is in a relatively balanced position, with 70% of STH supply still held in profit, and an almost even split of profit and loss taking in coins which are on the move.

Risk Indicator: Spent Volume in profit by STH chart. Source: Glassnode

Bitcoin Price Forecast: Consolidation persists

Bitcoin price closed below its lower consolidation level at $116,000 at the end of July and declined nearly 3% in the next two days, retesting its 50-day Exponential Moving Average at around $113,182. This 50-day EMA roughly coincides with the previous all-time high of $111,980, making it a key support zone. BTC has recovered slightly and currently hovers around $114,900 as of Thursday.

If BTC closes above $116,000 on a daily basis, it could extend the rally toward its key psychological level at $120,000.

The Relative Strength Index (RSI) on the daily chart is flattening around its neutral level of 50, indicating indecisiveness among traders. However, the Moving Average Convergence Divergence (MACD) continues to tilt bearish after showing a bearish crossover on July 23 that still holds.

BTC/USDT daily chart

If BTC closes below its 50-day EMA at $113,182, it could extend the decline to retest its previous all-time high of $111,980 from May 22.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

You May Also Like

Pi Network Rolls Out Palm Print Authentication Ahead of Massive Unlock

Pi Network Growth and Mainnet Migration: Real Utility and Community Expansion