Buterin Bites Back At ‘Copy-Paste’ $ETH Clones: $HYPER Presale The Solution That’s Needed?

Quick Facts:

Buterin bites back that the market is oversaturated with ‘copy-paste’ EVM Layer 2s that fragment liquidity without adding technical novelty, prompting a search for genuine innovation.

Buterin bites back that the market is oversaturated with ‘copy-paste’ EVM Layer 2s that fragment liquidity without adding technical novelty, prompting a search for genuine innovation. As legacy L2 narratives stall, capital is rotating toward infrastructure that unlocks Bitcoin’s $1T+ liquidity for complex DeFi and gaming applications.

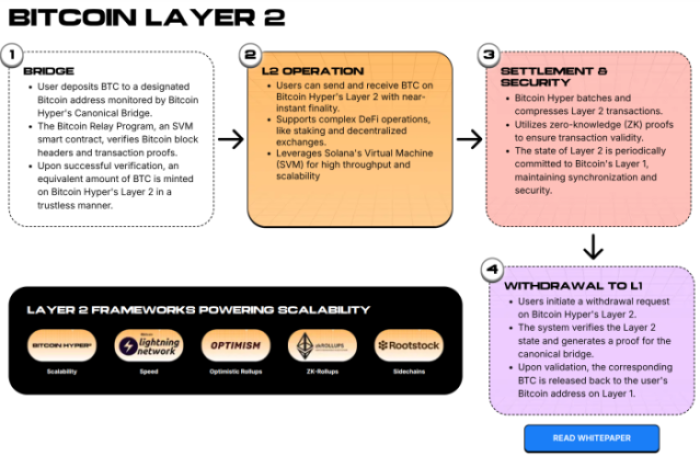

As legacy L2 narratives stall, capital is rotating toward infrastructure that unlocks Bitcoin’s $1T+ liquidity for complex DeFi and gaming applications. Instead of forking Ethereum, Bitcoin Hyper integrates the Solana Virtual Machine (SVM) to bring parallel processing and high-speed execution to the Bitcoin network.

Instead of forking Ethereum, Bitcoin Hyper integrates the Solana Virtual Machine (SVM) to bring parallel processing and high-speed execution to the Bitcoin network.

Ethereum co-founder Vitalik Buterin has never been one to mince words regarding blockchain scaling, but his recent commentary strikes a particularly sharp nerve.

The landscape is currently saturated with Layer 2 solutions that often amount to little more than ‘copy-paste’ forks of the Ethereum Virtual Machine (EVM). Buterin’s critique highlights a growing fatigue among developers and investors alike.

Frankly, the market is drowning in redundancy. We have dozens of chains offering the same throughput, the same limitations, and the same fragmentation of liquidity, often differing only by their marketing budgets rather than their technical architecture.

That matters because the ‘scalability wars’ have shifted. It’s no longer enough to simply offer lower fees than Ethereum Mainnet; that is now the baseline expectation, not a competitive advantage.

While Ethereum battles internal redundancy, Bitcoin faces the opposite problem: a desperate need for modernization.

The world’s largest asset remains technically isolated, holding over a trillion dollars in dormant capital that can’t easily access DeFi or complex smart contracts. This disconnect creates a massive arbitrage opportunity for infrastructure that can bridge the security of Bitcoin with the speed of modern execution layers.

Enter Bitcoin Hyper ($HYPER). By integrating the high-performance Solana Virtual Machine (SVM) directly as a Bitcoin Layer 2, the project isn’t positioning itself as another copy-paste iteration. It’s building the first technical bridge between Bitcoin’s liquidity and Solana’s speed.

GET YOUR $HYPER ON THE OFFICIAL PRESALE PAGE

Bitcoin Hyper Integrates SVM To Break The EVM Monotony

The core differentiation of Bitcoin Hyper lies in its refusal to follow the standard EVM rollup playbook.

Most Bitcoin Layer 2s currently in development are attempting to shoehorn Ethereum-style smart contracts onto Bitcoin’s stack. While functional, that approach often inherits the latency and sequential processing limitations of the EVM.

Bitcoin Hyper takes a radically different architectural path by using the Solana Virtual Machine (SVM) for its execution layer.

This distinction is technical, but the implications are purely financial. The SVM allows for parallel transaction processing, enabling Bitcoin Hyper to deliver throughput speeds that theoretically exceed Solana itself, all while anchoring state to the Bitcoin network.

This distinction is technical, but the implications are purely financial. The SVM allows for parallel transaction processing, enabling Bitcoin Hyper to deliver throughput speeds that theoretically exceed Solana itself, all while anchoring state to the Bitcoin network.

For developers, this opens the door to high-frequency trading, complex gaming dApps, and real-time payment infrastructure using wrapped BTC. These are use cases currently impossible on Bitcoin L1 and painfully sluggish on EVM-based L2s.

The architecture uses a modular approach: Bitcoin L1 handles settlement and security, while the real-time SVM L2 handles execution. A single trusted sequencer ensures immediate ordering, with periodic state anchoring back to Bitcoin to preserve trust.

By supporting Rust, Bitcoin Hyper is tapping into the Solana developer community, giving them a direct pipeline to build on Bitcoin. This isn’t just a scaling solution; it’s a liquidity funnel designed to move BTC into high-yield DeFi environments.

Want a full project rundown? Check out our ‘What is Bitcoin Hyper?‘ guide.

Whale Accumulation Signals Demand For High-Performance BTC Layers

Tech specs drive long-term value, but on-chain flows dictate immediate price action. The presale data for Bitcoin Hyper suggests that sophisticated capital is already positioning for this narrative shift.

$HYPER’s already raised over $31M, a significant figure that indicates institutional-grade interest rather than mere retail speculation. With tokens currently priced at $0.0136751, the entry point remains accessible, but the volume suggests the window is narrowing.

Traders watching the order books will notice specific patterns. Etherscan data reveals high-net-worth wallets are buying in bulk. The largest acquisition was around $500K. Whale activity of this magnitude during a presale phase is typically a leading indicator of high conviction.

These buyers are likely betting on the scarcity of the tokenomics and the high APY staking rewards available immediately after the Token Generation Event (TGE).

On the incentive side, the protocol’s staking structure is designed to mitigate post-launch volatility. Presale stakers are subject to a 7-day vesting period, a mechanism that prevents immediate dumping while rewarding early conviction. Rewards are distributed for community governance and participation, aligning the incentives of token holders with the network’s long-term health.

JOIN THE $HYPER PRESALE ON ITS OFFICIAL SITE

This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments, including presales and new Layer 2 protocols, carry inherent risks. Always perform your own due diligence before making investment decisions.

You May Also Like

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council

Breaking: CME Group Unveils Solana and XRP Options