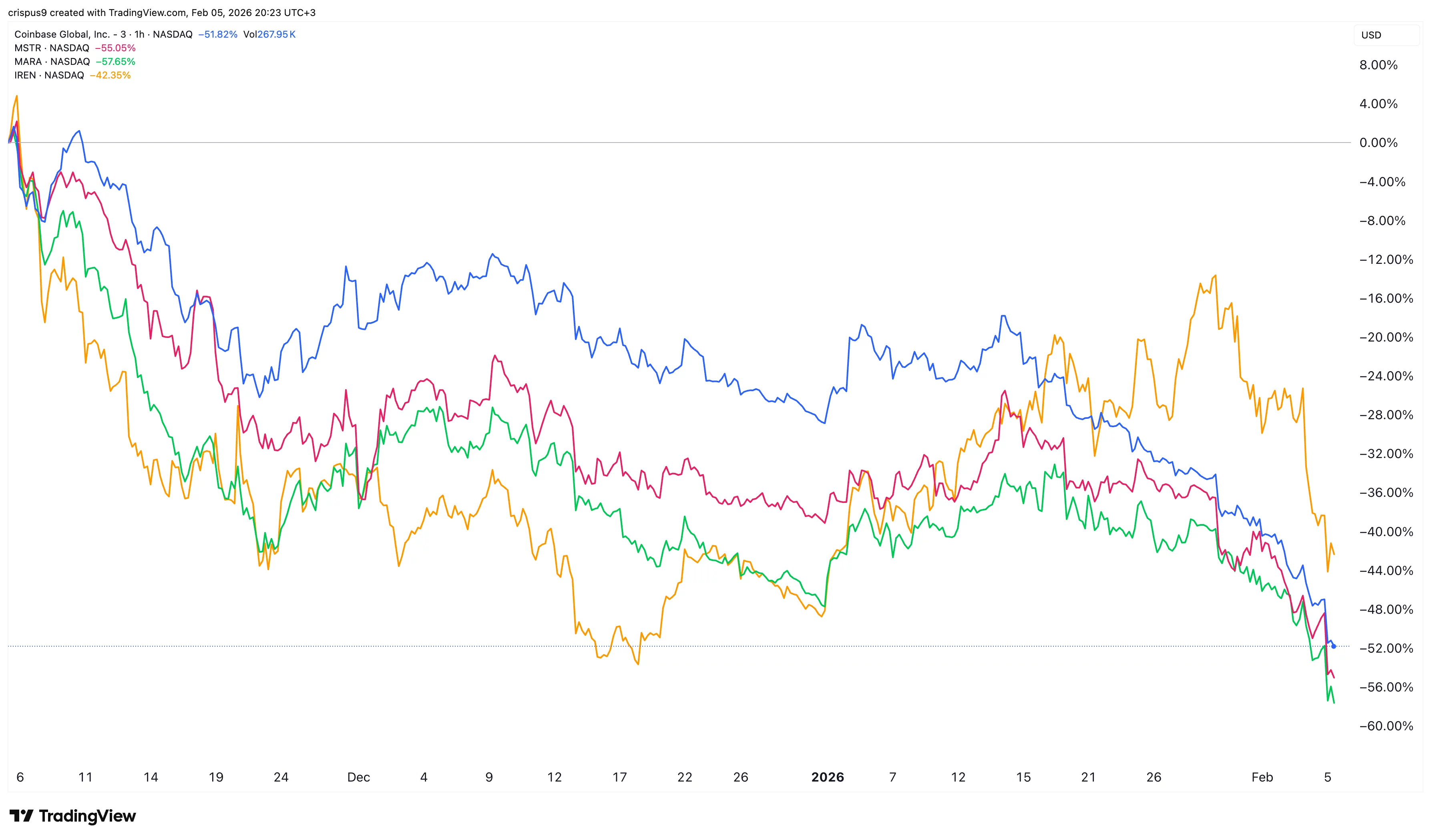

Crypto stocks MSTR, COIN, IREN, and MARA slump as liquidations jump

Crypto stocks continued their strong downward momentum, erasing billions of dollars, as Bitcoin and other altcoins slumped.

- Most crypto stocks are in a strong freefall this year.

- Coinbase, IREN, MARA, and Strategy have fallen by over 40% from their all-time highs.

- The decline happened as the crypto market crashed and liquidations rose.

IREN, a Bitcoin (BTC) mining company that has expanded to AI data centers, dropped by 6.5%, reaching a low of $42. It has dropped by over 47% from its all-time high as investors focus on its upcoming earnings. Other mining companies like MARA and Bitfarms also dived.

Top crypto stocks have slumped this year

Michael Saylors’ MSTR stock slumped to $110, down sharply from its all-time high of $550. This crash has brought its market cap to $38 billion, down from over $130 billion.

Crypto exchanges were not spared either. Coinbase stock tumbled to $150 from a record high of $443. Other similar companies, like Bullish and Gemini, which went public last year, dropped to their record lows.

These stocks plunged due to the ongoing crypto market crash, which hurt Bitcoin and most coins. This decline led to a surge in liquidations, which jumped by 74% to $1.4 billion.

All these crypto companies do well when Bitcoin and altcoins are rising and vice versa. For example, Bitcoin mining companies like IREN and MARA do well when BTC is rising, as that leads to higher revenues when they sell their holdings.

Exchanges like Coinbase, Gemini, and Bullish struggle in bear markets as activity tends to drop. Most of Coinbase’s revenue comes from transactions, while the rest comes from subscriptions and services. Gemini and Bullish make more than 90% of their revenue in transactions.

Crypto crash nearing an end?

Data shows that the Crypto Fear and Greed Index has slumped to the extreme fear zone of 10. In most cases, a move to these lows is usually a key indicator of a reversal.

Additionally, Bitcoin, Ethereum, and other altcoins have become highly oversold on the daily and weekly charts. Rebounds typically occur when these assets reach these levels.

Another potential catalyst for cryptocurrencies and associated stocks is a Trump strike on Iran. Fears of this attack are one reason why the crypto market is falling.

As a result, there is a likelihood that these coins and their stocks will drop after the attack happens and then rebound. This is what happened in June last year during the 12-day war.

You May Also Like

United States Building Permits Change dipped from previous -2.8% to -3.7% in August

Tether Advances Gold Strategy With $150 Million Stake in Gold.com