Aster Testnet Launch Signals Push Toward Custom Layer-1 Growth

The decentralized crypto exchange and perpetual futures platform Aster has announced that its layer-1 blockchain testnet is now available to all users. The company has indicated that this milestone represents an important step toward the eventual rollout of the Aster layer-1 mainnet, which is currently targeted for the first quarter of 2026. By opening the testnet to the public, Aster is enabling developers and users to explore its infrastructure while preparing for a broader production launch.

According to the Aster roadmap, several additional features are scheduled to be introduced in the first quarter of the coming year. These planned upgrades include fiat currency on-ramps designed to simplify access for new users, the release of Aster’s core codebase for builders, and further progress toward the mainnet launch. Together, these developments are expected to strengthen the platform’s technical foundation and attract greater participation from both developers and traders.

Strategic Focus on Infrastructure and Ecosystem Building

Aster has outlined a longer-term strategy that places infrastructure development, token utility, and ecosystem expansion at the center of its priorities for 2026. The roadmap suggests that the project aims to invest heavily in community growth and developer engagement as it transitions from early-stage development to a more mature network. By emphasizing these areas, Aster appears to be positioning itself for sustained growth rather than short-term adoption.

The platform’s current direction builds on a rebranding effort completed in March 2025, when Aster repositioned itself as a perpetual futures decentralized exchange. This shift placed the project in direct competition with established players such as Hyperliquid, another perpetual futures DEX that operates on its own application-specific layer-1 blockchain. The competitive landscape has increasingly favored platforms that control their underlying infrastructure.

Move Toward Application-Specific Blockchains

The decision to launch a dedicated layer-1 blockchain reflects a broader trend across the Web3 sector. Many projects are moving away from general-purpose networks such as Ethereum or Solana, which process a wide variety of transactions, toward custom-built blockchains optimized for specific use cases. For platforms like Aster, this approach is intended to support higher transaction throughput and reduce congestion that can arise on shared networks.

By developing its own layer-1 chain, Aster aims to tailor performance, security, and scalability to the needs of perpetual futures trading. This strategy aligns with the growing demand for specialized infrastructure as decentralized finance applications become more complex and transaction volumes continue to rise.

Rising Momentum for Perpetual DEXs

The growing interest in perpetual decentralized exchanges has been a defining trend in the crypto market. The strong performance of Hyperliquid during 2025 helped draw attention to the potential of perpetual futures platforms, encouraging the emergence of competitors such as Aster. Perpetual futures differ from traditional futures contracts in that they do not have an expiration date, eliminating the need for traders to roll over positions.

Instead, traders maintain open positions by paying a funding rate, which allows markets to operate continuously around the clock. This structure has contributed to the appeal of perpetual futures, particularly in the always-on crypto economy.

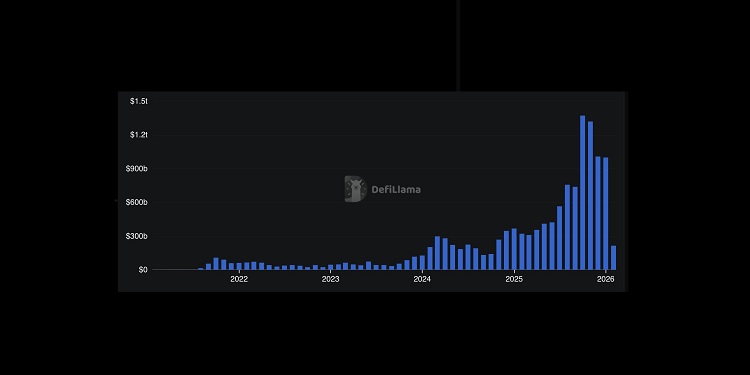

Trading Volume Highlights Growing Demand

Data from DeFi analytics platforms indicates that cumulative trading volume on perpetual DEXs nearly tripled during 2025, rising from roughly $4 trillion to more than $12 trillion by year-end. A significant portion of that activity, approximately $7.9 trillion, was recorded within 2025 alone. Monthly trading volumes also reached a notable milestone, surpassing $1 trillion in each of the final three months of the year.

This sharp increase in activity suggests rising investor demand for crypto derivatives and on-chain trading platforms. As more financial activity migrates to blockchain-based systems, platforms like Aster are seeking to capture a share of this expanding market by offering purpose-built infrastructure and continuous trading capabilities.

The post Aster Testnet Launch Signals Push Toward Custom Layer-1 Growth appeared first on CoinTrust.

You May Also Like

Microsoft Corp. $MSFT blue box area offers a buying opportunity

Marathon Digital BTC Transfers Highlight Miner Stress