Ethereum (ETH) Price: ETH Drops to $1,750 as Vitalik Buterin Sells $6.6 Million

TLDR

- Ethereum (ETH) dropped to $1,750 before recovering to $1,962, marking its lowest price point since May 2025

- Mid-sized holders (100-10,000 ETH) sold off their positions while large holders (10,000+ ETH) accumulated during the decline

- Ethereum Coinbase Premium Index fell to 2022 bear market levels, showing weak institutional demand from US investors

- Vitalik Buterin sold 2,961 ETH worth $6.6 million recently, though he still holds 227,000 ETH valued at $470 million

- Exchange inflows on Binance surged to 1.63 million ETH, the highest since 2022, indicating potential selling pressure

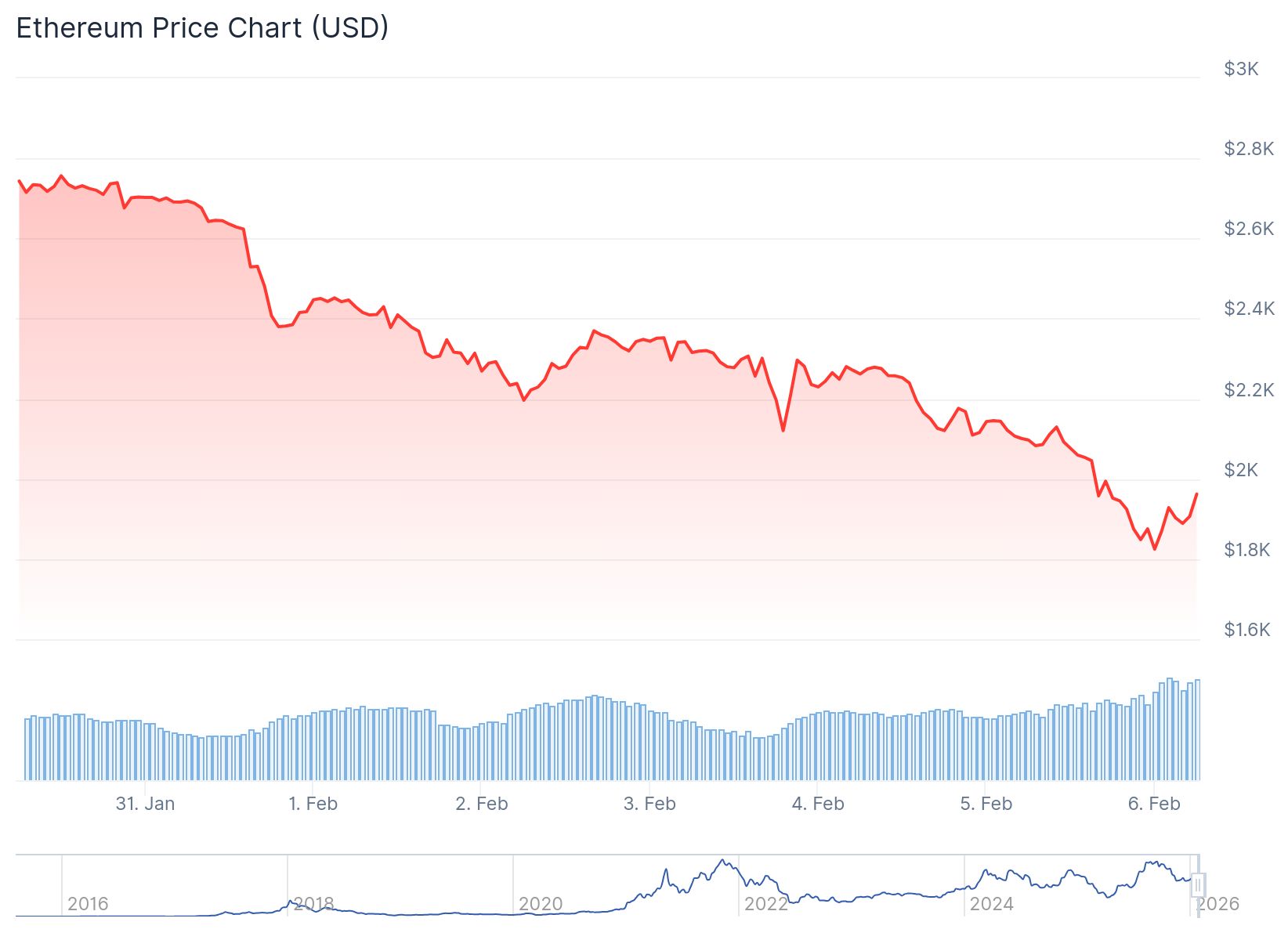

Ethereum’s price dropped to $1,750 on Thursday before recovering to $1,962. The decline represents a more than 60% drop from its all-time high of $4,950.

Ethereum (ETH) Price

Ethereum (ETH) Price

The selloff has tested holder conviction across different wallet sizes. Onchain data reveals a clear divide between investor groups during the downturn.

Mid-sized holders appear to be capitulating under pressure. Wallets holding 100-1,000 ETH decreased their balances from 9.79 million ETH in August to 8.32 million ETH this week. Holders with 1,000-10,000 ETH reduced their positions from 14.51 million to 12.26 million ETH.

Source: CryptoQuant

Source: CryptoQuant

Large holders took a different approach during the same period. Wallets with 10,000-100,000 ETH increased holdings from 17.18 million to 19.77 million ETH. The largest holders with 100,000+ ETH expanded their positions from 2.75 million to 3.68 million ETH.

The data shows whales and large entities accumulating while smaller holders distribute into price weakness. ETH is currently trading below the realized price for all investor cohorts.

Realized prices range between $2,120 for the largest holders and $2,690 for mid-sized holders. The aggregate realized price sits at $2,630, representing the average cost basis at which investors last moved their ETH.

Weak Institutional Demand Signals

The Ethereum Coinbase Premium Index dropped to its lowest level since July 2022. The metric measures ETH pricing on Coinbase against global exchanges like Binance.

A 30-day moving average shows the premium in negative territory. This indicates stronger selling pressure from US-based investors compared to the broader market.

Coinbase serves as a proxy for institutional flows in the United States. The negative premium suggests reduced exposure from institutional investors during current market conditions.

Exchange activity points to continued selling pressure. Binance saw ETH inflows surge to 1.63 million on Wednesday, the highest daily reading since 2022.

Large exchange inflows during weak price action typically signal preparation to sell or rebalance positions. The Binance taker buy/sell ratio sits at 0.94, below the neutral level of 1.

Source: CryptoQuant

Source: CryptoQuant

Both the 30-day and 50-day averages remain under 1. This pattern suggests selling pressure is the dominant trend rather than a temporary phase.

Vitalik Buterin Sales Continue

Ethereum founder Vitalik Buterin sold 2,961 ETH worth $6.6 million in recent days. He previously sold 16,384 ETH, stating the proceeds would fund privacy projects on the network.

Buterin still holds 227,000 ETH valued at approximately $470 million. His continued holdings indicate long-term confidence despite recent sales.

Spot Ethereum ETFs recorded $68 million in outflows during February. The funds have experienced three consecutive months of losses.

Since November, investors have withdrawn over $2.5 billion from these products. The ETFs currently hold $12.7 billion in assets after receiving $11.9 billion in cumulative inflows.

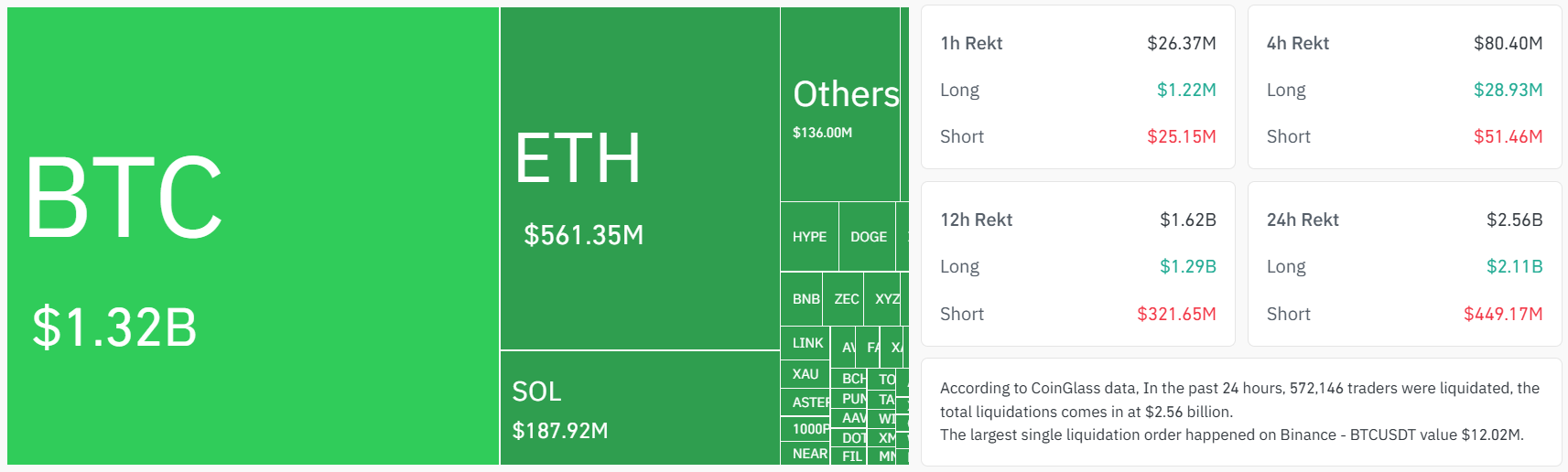

Source: Coinglass

Source: Coinglass

Leveraged traders faced liquidations totaling $237 million in the past 24 hours. The liquidations affected bulls holding long positions on the altcoin.

ETH dropped below $2,125, which served as support during August and September 2024. The Relative Strength Index fell to 31 while the Stochastic Oscillator entered oversold territory.

Exchange inflows remain elevated as the taker buy/sell ratio stays below neutral levels on major platforms.

The post Ethereum (ETH) Price: ETH Drops to $1,750 as Vitalik Buterin Sells $6.6 Million appeared first on CoinCentral.

You May Also Like

The Next Bitcoin Story Of 2025

Strategy Defines Its Bitcoin Stress Point After Q4 Volatility