A week after the stablecoin regulation came into effect, Hong Kong's over-the-counter market size dropped by 33%.

The Hong Kong Stablecoin Ordinance (hereinafter referred to as the Ordinance) officially came into effect on August 1, 2025. The Ordinance has established strict rules for the issuance and operation of stablecoins, explicitly prohibiting the offer, promotion and sale of stablecoins without a license, and does not provide a transition period.

As institutions whose main business is exchanging stablecoins and fiat currencies, Hong Kong's local cryptocurrency money changers are the first to be affected. After the regulations came into effect, many over-the-counter trading service providers announced the suspension of stablecoin-related businesses while waiting to apply for licenses.

This article aims to provide regulators with an on-chain perspective on the impact of the regulations by disclosing TRC20-USDT outflow data from Hong Kong Over-the-Counter Trading Service Providers (HKVAOTC) addresses over the past 70 days.

Data Description

Bitrace has been monitoring the business address traffic of VAOTC entities located in Hong Kong or primarily serving Hong Kong customers. The latter are classified as store-type service providers that primarily serve offline customers or real-name customers, and non-store-type service providers that primarily serve online customers or anonymous customers.

The data disclosed in this survey will include the TRC20-USDT transfer data of all service providers in the two time periods of June 1 to July 31 and August 1 to August 8, 2025, Beijing time.

The following data have excluded non-operational transit activities between business addresses.

The volume of stablecoin transactions in the over-the-counter market fell by 32.94%.

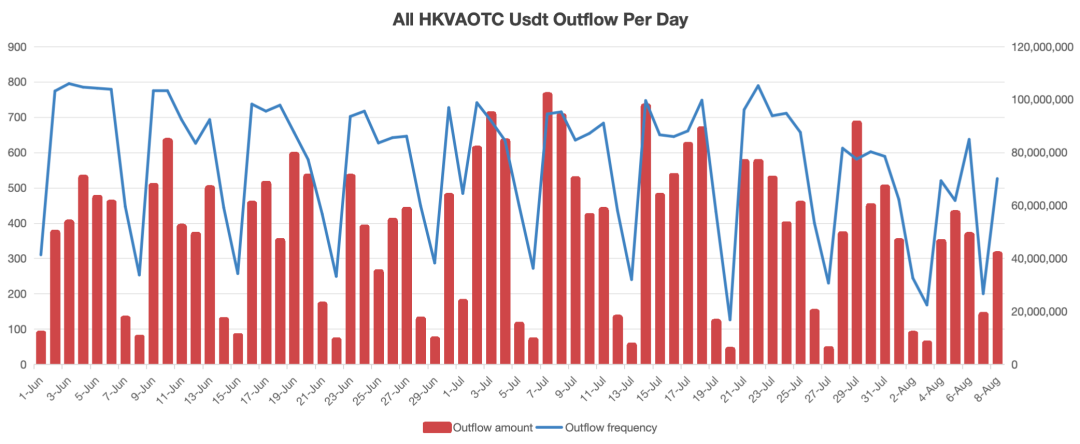

Between June 1 and July 31, all business addresses transferred out a total of 3.17B USDT, with an average daily amount of 52.04M USDT; between August 1 and August 8, all business addresses transferred out a total of 279M USDT, with an average daily amount of 34.90M USDT.

Compared with before the regulations came into effect, the overall size of the stablecoin exchange market decreased by 32.94% after August 1. This sensitivity shows the profound impact of the regulations on Hong Kong's local crypto industry.

Store type service providers reduce the scale to a larger

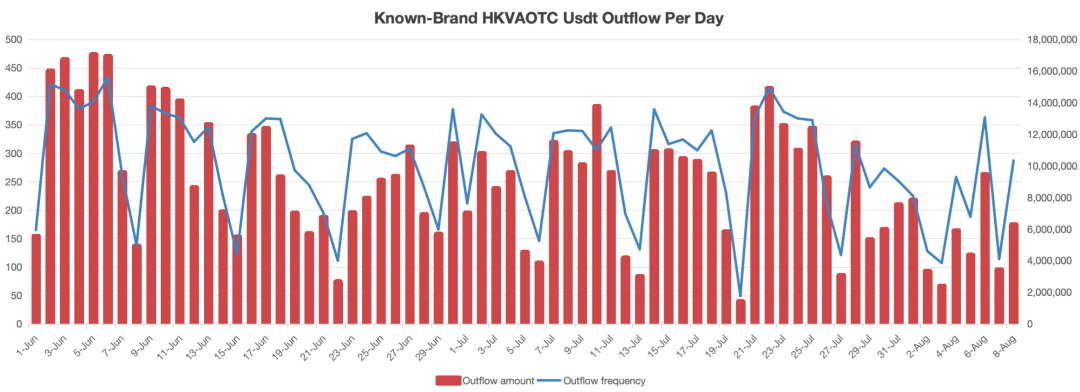

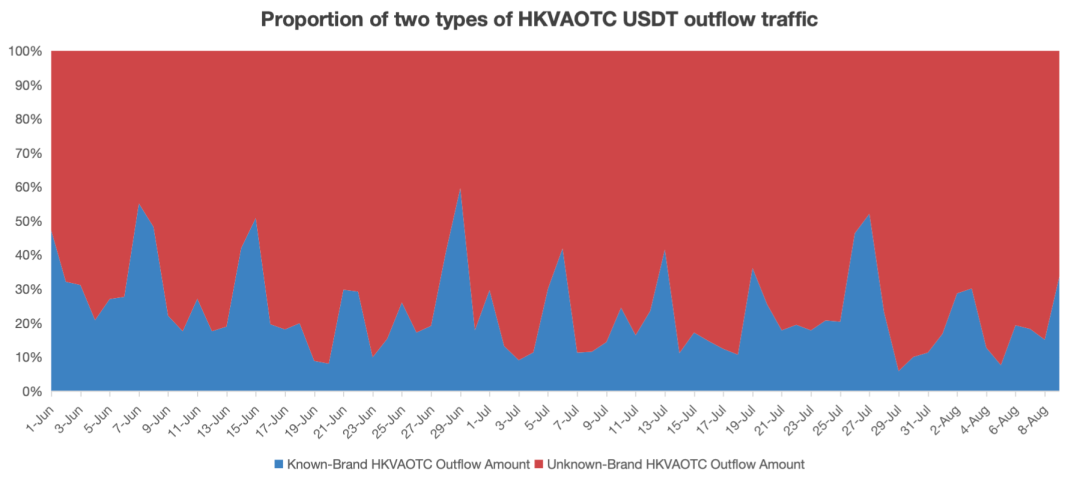

Traffic statistics are collected separately for store-type and non-store-type service provider business addresses.

After the regulations came into effect, the average daily USDT outflow volume of store-type service providers decreased by 43.20% (9.47M -> 5.38M), while the business addresses of non-store-type service providers decreased by 30.65% (42.57M -> 29.52M).

The impact on store-type service providers is significantly greater than that on non-store-type services, indicating that after the regulations came into effect, some businesses in Hong Kong's over-the-counter trading service industry tended to go underground in a short period of time.

Final Thoughts

The introduction of the Stablecoin Ordinance marks a significant step forward in regulatory compliance for Hong Kong's crypto industry, and will have a significant impact on the local over-the-counter (OTC) trading services sector in the short term. Among relevant practitioners, some are choosing to comply with regulations and apply for licenses, while others are turning to underground operations, presenting a diverse range of choices.

You May Also Like

Kalshi Partners with Solana & Base to Launch KalshiEco Hub for Onchain Prediction Markets