This new XRP rival continues to go vertical while other coins struggle in August

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Shiba Inu and Pepe Coin face pressure this August, but Remittix is climbing steadily toward milestones that could spark explosive growth.

Table of Contents

- Shiba Inu fights to hold critical support

- Pepe Coin price faces seller pressure

- Remittix: The XRP rival that’s still climbing

- Why RTX might go vertical

- Remittix rises as SHIB, PEPE stall, and analysts see 100x gains after first CEX listing.

- Remittix presale is heating up fast because of a Certik audit, $250k giveaway, and 40% bonus.

- Dubbed the XRP rival, Remittix could parabolically surge from its $0.0944 presale price.

The memecoin market looks wobbly this August, with Shiba Inu and Pepe Coin prices under pressure despite pockets of whale activity. Both tokens await market momentum for their next moves.

In contrast, a fundamentally different project, Remittix (RTX), dubbed by some as the “XRP rival,” is climbing steadily toward major milestones that could send it parabolic once it hits exchanges.

Shiba Inu fights to hold critical support

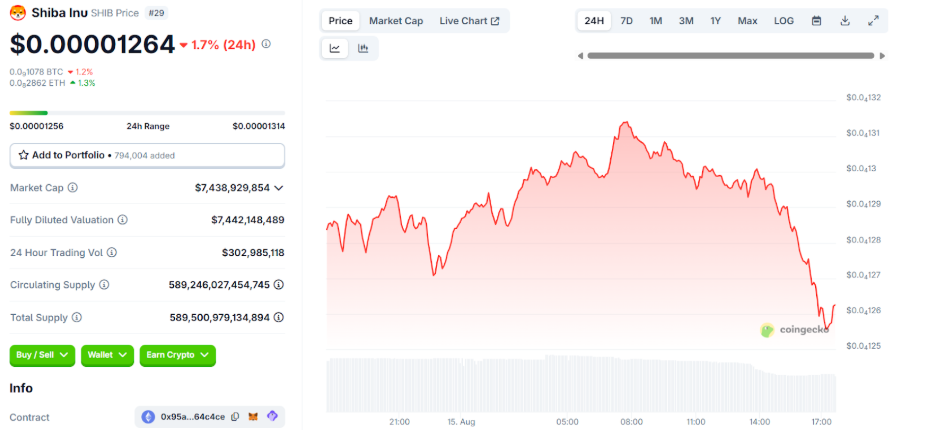

After a sharp drop from $0.00001419, Shiba Inu held onto $0.00001260, a solid support zone that traditionally spurred rebound rallies. Traders are watching SHIB’s capacity to recover $0.00001330 with volume, which might lead to $0.00001380.

Although there may be brief recoveries, SHIB is still susceptible to additional declines if selling pressure continues. Market sentiment shows that only a decisive breakout above $0.00001400 could rekindle the momentum that characterized previous meme coin surges.

Pepe Coin price faces seller pressure

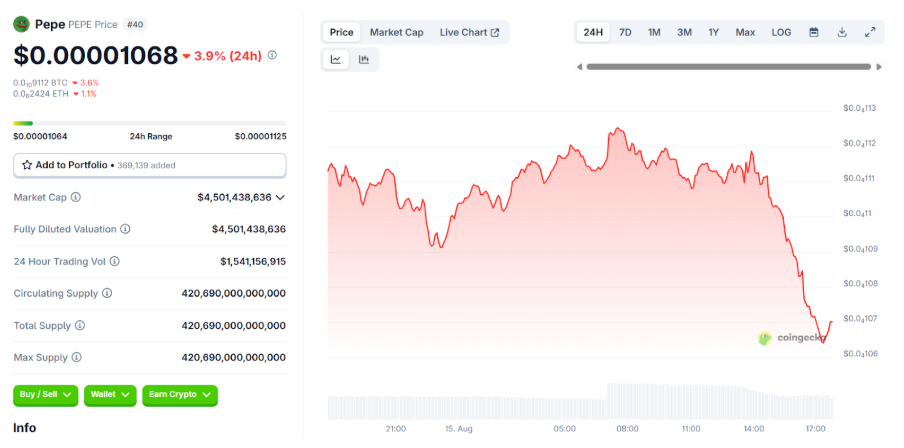

Pepe Coin price slipped around 4% over the past 24 hours, underperforming the broader crypto market. Despite the drop, whales have quietly increased their holdings by 1.5% over the last month, a sign of longer-term confidence.

Technical charts show PEPE struggling to break above $0.000012, with repeated rejection at that level. If buyers fail to reclaim it, the token could revisit lower supports around $0.00001180.

For SHIB and PEPE, the path forward likely depends on a renewed surge in memecoin trading activity, something that’s cooled noticeably in August.

Remittix: The XRP rival that’s still climbing

While memecoin favorites are struggling, Remittix continues its vertical climb in presale. It is designed as a next-gen cross-border payments solution.

Remittix combines multi-chain interoperability, real-time FX conversion, and direct bank payouts in over 30 countries, giving it real-world utility beyond memecoin speculation.

Key highlights from RTX’s ongoing momentum:

- $19.5 million+ raised and 599m tokens sold so far in presale

- Beta web3 Wallet launching Q3 2025 with multi-chain support and gas fee optimization.

- CEX listing announcement imminent once the $20m milestone is reached.

- Early buyers still get a 40% presale bonus before public trading.

Investor demand has surged because of the centralized exchange listing, luring early-stage cryptocurrency funds and ordinary purchases.

Why RTX might go vertical

Unlike SHIB and PEPE, whose rallies depend on sentiment swings, RTX’s growth is anchored in a clear use case and upcoming adoption catalysts.

The project already has a cult-like community of followers, enhanced by the $250,000 giveaway and 40% presale bonus. Meanwhile, its ecosystem is safe for transactions, with a completed Certik audit.

Analysts expect a liquidity surge once its first CEX listing goes live, which could push prices 100x from the current $0.0944 presale level. The microcap advantage and relatively untapped niches are potential catalysts for parabolic runs.

With whales chasing utility tokens in 2025 and payments-focused cryptos seeing renewed institutional interest, Remittix may be setting up for one of the fastest post-listing climbs in the market this year.

To learn more about Remittix, visit the website, socials, and $250k giveaway.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

18.07 Trillion Shiba Inu Surge Pushes Price Explosion

SON DAKİKA: Kara Gecede Sürpriz Altcoin İçin Spot ETF Başvurusu Geldi!