Tokenized assets double in a year as Wall Street pushes into on-chain finance

Stablecoins still account for 90% of all RWAs, but other segments are growing quickly.

- RWA assets, excluding stablecoins, doubled on a yearly basis

- Private credit and tokenized treasuries are the fastest-growing RWA segment

- BlackRock’s BUIDL fund leads in the tokenized Treasury segment

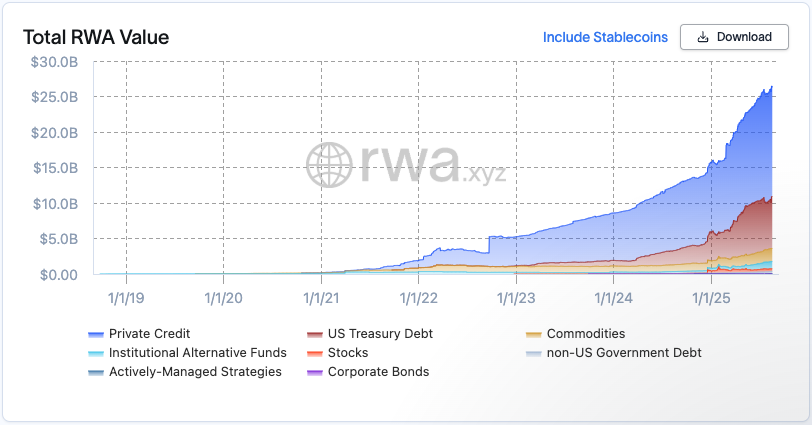

Real-world assets have seen significant growth in the past year. On August 18, the total value of tokenized assets rose to $26,30 billion, up from $12.4 billion in the same time of year, according to the data from rwa.xyz.

Tokenized private credit was by far the biggest segment, accounting for more than half of all RWA value, at $15.3 billion. At the same time, tokenized treasuries were the segment that saw the biggest growth, rising 80% year to date to $7.31 billion.

BlackRock’s BUIDL fund, which offers tokenized U.S. Treasuries, leads among all RWA issuers, with $2.397 billion in value. Tether Gold (XAUT) tokenized gold is in second place, with $1.252 billion in value.

Why Wall Street is betting on RWAs

Tokenized assets offer investors an easier way to get exposure to traditional assets. For instance, private credit was typically available only to select banks and institutional investors. With RWAs, companies can look for funding from a broader range of investors.

The same goes for tokenized U.S. Treasuries, which offer an easy way for foreign investors to access this market. This enables Wall Street to grow the markets for its services, which is why many companies are jumping in.

Interestingly, stablecoins could be considered the biggest RWA segment. Technically tokenized cash, the total value of all stablecoins is currently $266.74 billion. This would make stablecoins over 90% of the RWA market if they were counted as RWA assets. Still, due to their different utility, they are usually not.

You May Also Like

PENGU Token Gains 0.81% as Pudgy Penguins Cultural Momentum Drives Market Interest

‘Caught lying’: Outrage mounts after ICE exposed for killing US citizen 11 months ago