Bitcoin ETFs witness $330 million in inflow as BTC price dumps again

Bitcoin ETFs recorded $330.67 million in net inflows on February 6, ending a three-day outflow streak that drained $1.25 billion from products.

- Bitcoin ETFs recorded $330.7M in inflows on Feb. 6, ending a $1.25B outflow streak.

- BlackRock’s IBIT led with $231.6M as BTC rallied 6.6% above $70,000.

- Ethereum ETFs diverged with $21.4M in outflows, led by BlackRock’s ETHA.

BlackRock’s IBIT led with $231.62 million in inflows. At the same time, Ark & 21Shares’ ARKB has brought in $43.25 million and Bitwise’s BITB posted $28.70 million in inflows.

The reversal came as Bitcoin (BTC) price climbed 6.6% over 24 hours and quickly fell to the $67,000 level.

Total net assets under management rose to approximately $105 billion from $80.76 billion on February 5, while cumulative total net inflow reached $54.65 billion. VanEck’s HODL and Fidelity’s FBTC showed no updated data for the trading session.

February 2-5 posted $1.25B in Bitcoin ETFs redemption

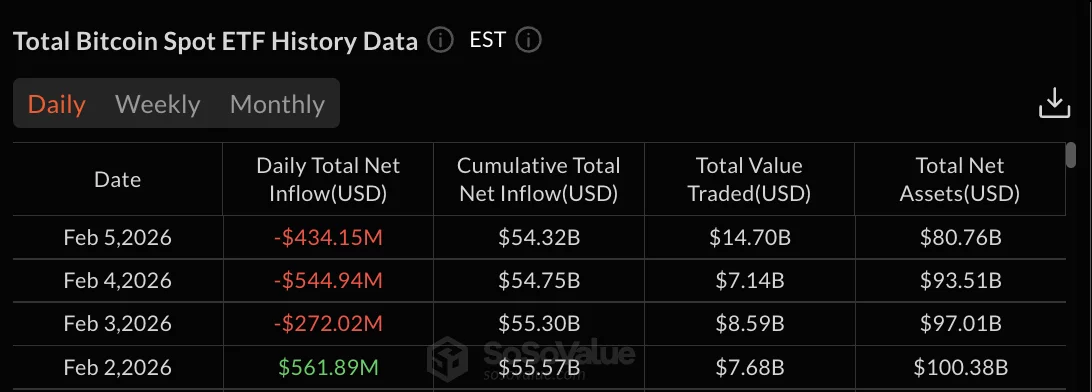

The three-day selling wave began February 3 with $272.02 million in outflows, followed by the streak’s largest single-day withdrawal of $544.94 million on February 4.

February 5 recorded $434.15 million in Bitcoin ETFs redemptions before buying pressure resumed.

February 2 briefly interrupted the selling with $561.89 million in inflows, but failed to establish sustained surge.

Total net assets fell from $100.38 billion on February 2 to a low of $80.76 billion on February 5 before recovering with February 6’s inflows.

Grayscale’s mini BTC trust attracted $20.13 million while the primary GBTC product recorded zero flows. Invesco’s BTCO posted $6.97 million in inflows. Valkyrie’s BRRR, Franklin’s EZBC, WisdomTree’s BTCW, and Hashdex’s DEFI all recorded zero activity.

BlackRock’s IBIT maintains $61.84 billion in cumulative net inflows. Grayscale’s GBTC holds -$25.88 billion in net outflows since converting from a trust structure.

Fidelity’s FBTC has accumulated approximately $11.08 billion in cumulative inflows based on available data.

Ethereum posts $21 million in outflows as BlackRock withdraws

Ethereum spot ETFs recorded $21.37 million in net outflows on February 6 despite Bitcoin’s reversal to positive flows.

BlackRock’s ETHA accounted for $45.44 million in redemptions, offsetting positive flows from four other products.

Bitwise’s ETHW led Ethereum inflows with $11.80 million, followed by Grayscale’s mini ETH trust at $6.80 million, VanEck’s ETHV at $3.01 million, and Invesco’s QETH at $2.45 million. Grayscale’s ETHE, Franklin’s EZET, and 21Shares’ TETH recorded zero flows.

Total net assets for Ethereum products fell to $10.90 billion from $13.69 billion on February 2. Cumulative total net inflow dropped to $11.80 billion.

Ethereum has posted outflows in three of the past four trading days, with February 4 and 5 recording $79.48 million and $80.79 million in withdrawals respectively.

February 3 provided brief relief with $14.06 million in inflows before redemptions resumed.

You May Also Like

‘Mysteriously disappeared’: DOJ Epstein prosecution memo vanishes after press inquiry

Mike Belshe: Stablecoins are a safer alternative to banks, BitGo’s operational controls are key for crypto market structure, and the future of finance is in asset tokenization